Benchmark Electronics (BHE) Margin Compression Reinforces Bearish Narratives Despite Revenue Progress

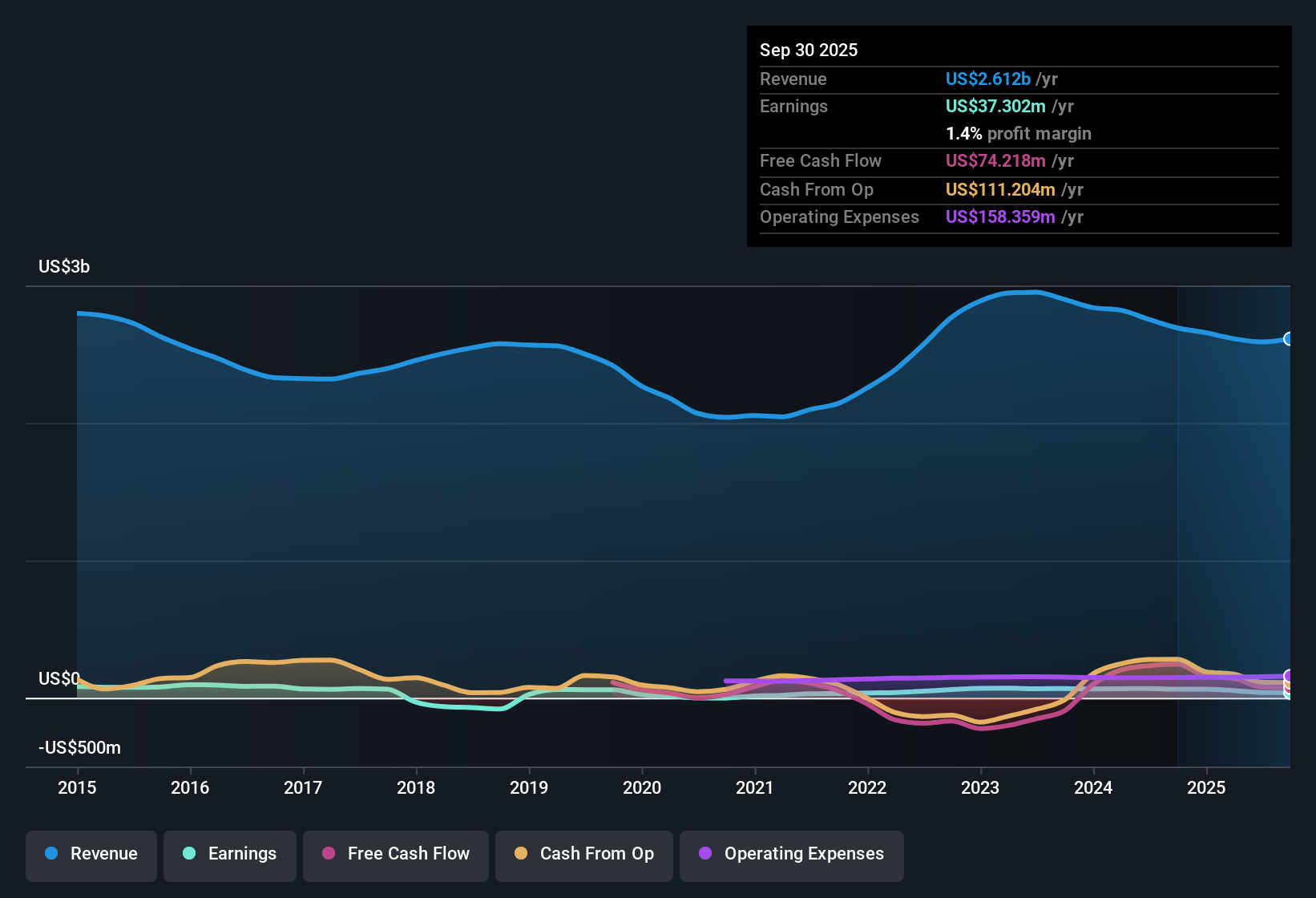

Benchmark Electronics (NYSE:BHE) has wrapped up FY 2025 with fourth quarter revenue of US$704.3 million and basic EPS of US$0.17, alongside net income excluding extra items of US$6.0 million, putting the spotlight firmly on how efficiently that top line is translating into profit. The company has seen quarterly revenue move from US$656.9 million and EPS of US$0.51 in Q4 2024 to US$704.3 million and EPS of US$0.17 in Q4 2025, with trailing twelve month EPS at US$0.69, which sets up a close look at how much of that revenue is sticking as earnings. With margins under the microscope, this set of results leaves investors focused on how resilient profitability really is.

See our full analysis for Benchmark Electronics.With the numbers on the table, the next step is to see how this earnings profile lines up with the widely followed narratives around Benchmark Electronics and where those stories might need updating.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM net margin sits at 0.9% after one off loss

- On a trailing twelve month basis, Benchmark Electronics earned US$24.9 million of net income on US$2.7b of revenue. This works out to a 0.9% net margin compared with 2.4% in the prior period.

- Bears point to this margin compression and the US$31.6 million one off loss as pressure points, yet the data also shows:

- Trailing twelve month basic EPS moved from 1.76 US$ in Q4 2024 to 0.69 US$ by Q4 2025, which heavily supports the bearish view that recent profitability has been weak.

- At the same time, five year EPS growth averaged 9.4% annually, which challenges an overly pessimistic take that the business cannot return to stronger earnings once one off items are excluded.

P/E of 80.4x against a richer price tag

- With the share price at US$55.98, Benchmark Electronics is trading on a trailing P/E of 80.4x, compared with 27.5x for the US Electronic industry and 62.8x for peers.

- What stands out for bullish investors is how much of the upbeat thesis is already reflected here:

- The stock also sits well above an indicated DCF fair value of US$9.85, which leans against the bullish case that current pricing is fully supported by recent cash flow based metrics.

- However, analysts in the data set expect earnings to grow around 48.7% per year, a figure that strongly supports the bullish argument that future profit growth, rather than current margins, is what the market is paying up for.

Revenue at about US$2.7b with modest 5.7% growth

- Over the last five years, revenue growth is reported at 5.7% per year compared with an expected 10.1% for the broader US market, while trailing twelve month revenue sits at about US$2.7b.

- Consensus style expectations in the data lean on earnings rather than sales to carry the story, which creates an interesting tension:

- Revenue growth of 5.7% per year is described as slower than the wider US market, so any bullish view that Benchmark Electronics is a rapid top line growth story does not line up with these figures.

- Yet those same forecasts call for roughly 48.7% annual earnings growth, suggesting the thesis is more about better profitability on roughly steady mid single digit revenue growth than about outsized sales expansion.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Benchmark Electronics's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Benchmark Electronics is working with thin 0.9% net margins, weaker recent EPS, and a P/E of 80.4x that sits well above an indicated DCF fair value.

If that mix of tight profitability and a richer valuation makes you uneasy, consider shifting your focus toward these 863 undervalued stocks based on cash flows to look for companies where pricing and fundamentals are more closely aligned.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Benchmark Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHE

Benchmark Electronics

Offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion