Arrow Electronics, Inc. (NYSE:ARW) Doing What It Can To Lift Shares

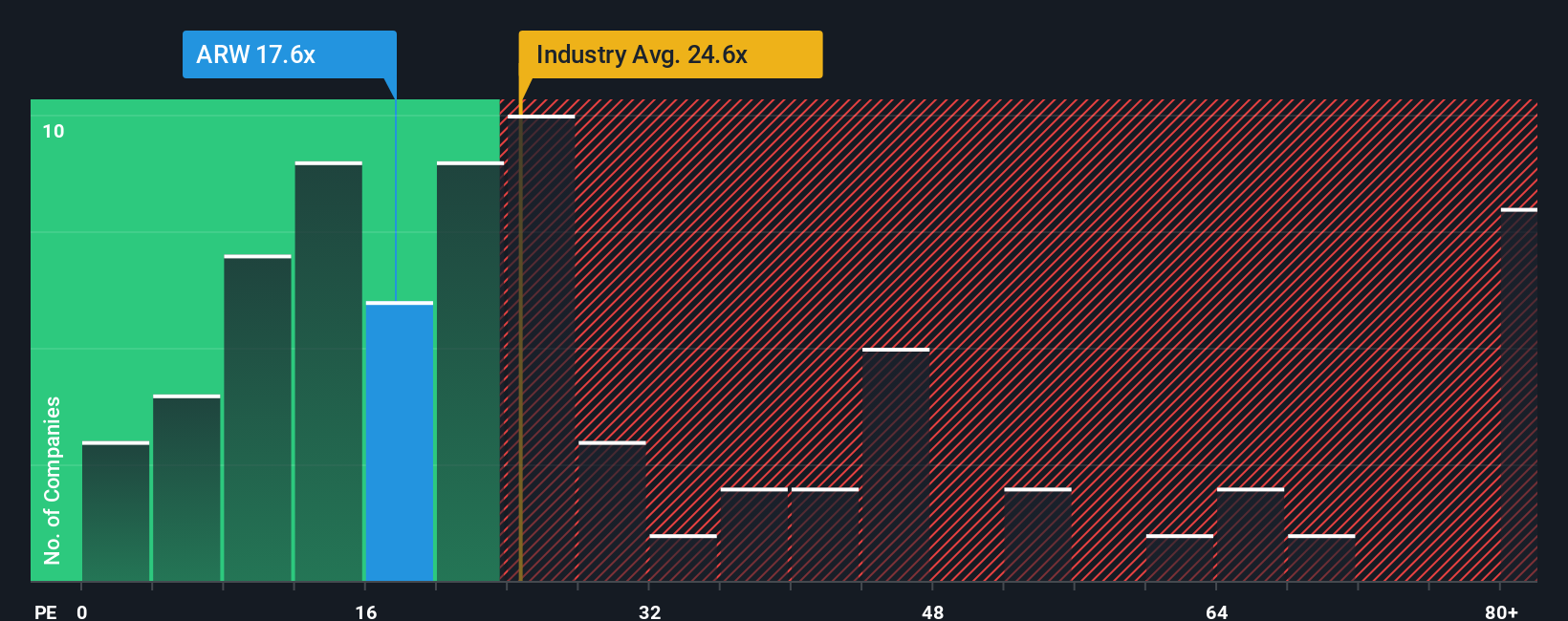

With a median price-to-earnings (or "P/E") ratio of close to 19x in the United States, you could be forgiven for feeling indifferent about Arrow Electronics, Inc.'s (NYSE:ARW) P/E ratio of 17.6x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Arrow Electronics hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Arrow Electronics

Is There Some Growth For Arrow Electronics?

In order to justify its P/E ratio, Arrow Electronics would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 43%. As a result, earnings from three years ago have also fallen 58% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 31% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 10% per annum, which is noticeably less attractive.

In light of this, it's curious that Arrow Electronics' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Arrow Electronics' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Arrow Electronics currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with Arrow Electronics.

If these risks are making you reconsider your opinion on Arrow Electronics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ARW

Arrow Electronics

Provides products, services, and solutions to industrial and commercial users of electronic components and enterprise computing solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026