Will Analyst Optimism and Earnings Momentum Redefine Amphenol's (APH) Growth Narrative?

Reviewed by Sasha Jovanovic

- In the past week, analysts and industry commentators have highlighted Amphenol's strong earnings momentum, upward revisions to earnings estimates, and expansion in sectors such as IT datacom and aerospace. This growing optimism follows Amphenol's continued record of surpassing expectations, enhanced product diversification, and positive revisions to future cash flow and margin projections.

- A key insight is that Amphenol's appeal is not only rooted in robust recent results but also in its ability to generate rising analyst confidence and maintain favorable ratings even amid sector-specific volatility, signaling confidence in both the company's execution and its market opportunities.

- To assess how this wave of analyst optimism and earnings strength shapes Amphenol's future prospects, we'll explore its effect on the company's investment narrative and growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Amphenol Investment Narrative Recap

For shareholders, the central investment thesis in Amphenol rests on its ability to capitalize on strong, sustained demand in high-growth markets like AI-driven data centers and advanced electronics, while effectively managing exposure to volatile technology cycles. The recent streak of analyst upgrades and earnings momentum reinforces the company’s near-term growth outlook but, based on current information, does not materially alter the most immediate catalysts or the ongoing risk that demand shifts could cause revenue to flatten after a period of “pulled-forward” growth.

Among recent announcements, Amphenol’s guidance for 34% to 36% year-over-year sales growth in Q3 2025 stands out as a key data point for assessing whether recent upward analyst revisions are supported by fundamentals. This guidance provides direct context for investor optimism and will serve as a crucial checkpoint for the strength and sustainability of the current growth pace.

By contrast, investors should pay close attention to signs that customer demand in fast-evolving end markets may soften unexpectedly...

Read the full narrative on Amphenol (it's free!)

Amphenol's outlook anticipates revenues reaching $26.9 billion and earnings of $5.1 billion by 2028. This scenario is based on forecasted annual revenue growth of 12.7% and an earnings increase of $1.9 billion from the current $3.2 billion.

Uncover how Amphenol's forecasts yield a $117.44 fair value, a 4% downside to its current price.

Exploring Other Perspectives

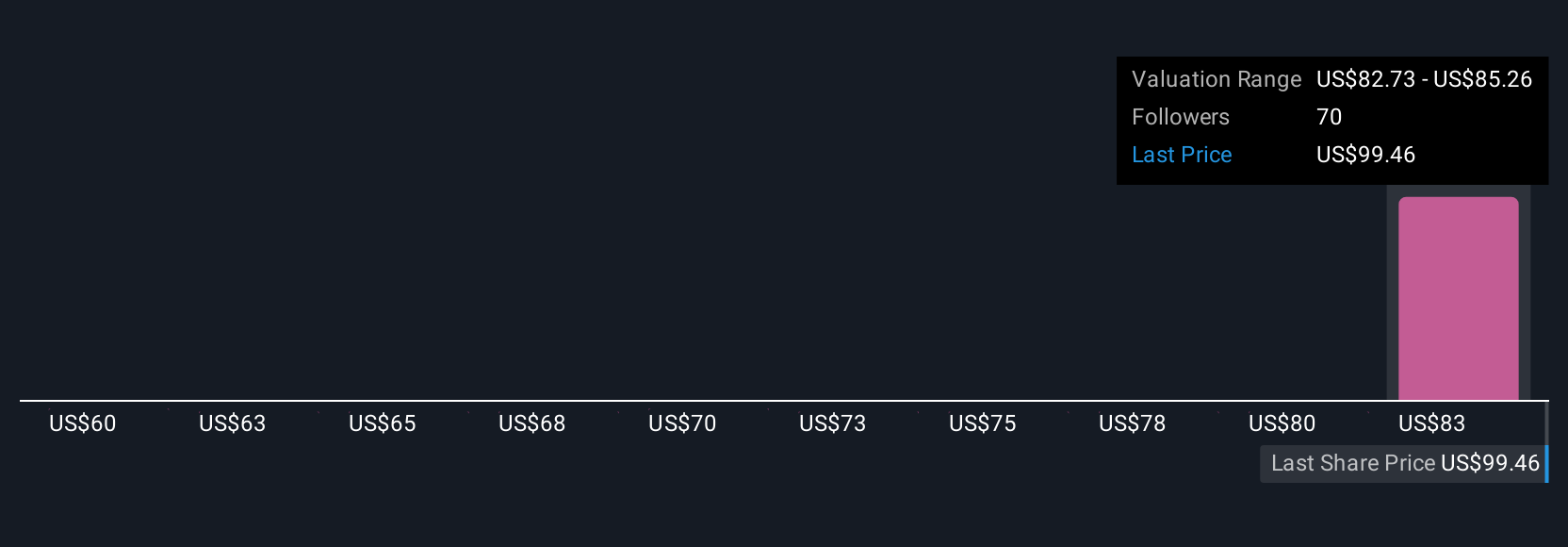

Fair value estimates from five Simply Wall St Community members for Amphenol range from US$60 to US$117.44, reflecting a wide spectrum of investor outlooks. With analysts highlighting accelerating demand in AI datacenter products, it is clear that perspectives on Amphenol's future can differ significantly, worth reviewing if you want to see the full picture.

Explore 5 other fair value estimates on Amphenol - why the stock might be worth less than half the current price!

Build Your Own Amphenol Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amphenol research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amphenol research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amphenol's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives