How Investors May Respond To Amphenol (APH) AI-Driven Design Wins and Datacenter Infrastructure Momentum

Reviewed by Sasha Jovanovic

- Amphenol Corporation reported strong second-quarter results earlier this year and delivered an optimistic outlook for the third quarter, crediting AI-driven product design wins and growing contributions to NVIDIA’s Blackwell NVL platform.

- The company’s order growth and outlook are further bolstered by its broad diversification across connectivity and intelligence-focused end markets, solidifying its position as a leading global connector supplier.

- We’ll explore how Amphenol’s AI-related design wins and increasing role in datacenter infrastructure now influence the company’s investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Amphenol Investment Narrative Recap

To be a shareholder in Amphenol today, you need to believe in the company's ability to maintain strong growth in AI-related and connectivity-driven sectors, while effectively managing volatility in demand and integration risks from major acquisitions. The recent news of robust AI-driven order growth and optimism around contributions to NVIDIA’s Blackwell NVL platform further supports this near-term catalyst, while supply chain risks and integration challenges remain, but have not become materially more acute as a result of this news.

One of the most relevant announcements is Amphenol's near-completed $10 billion acquisition of CommScope's connectivity and cable business, backed by recent $4 billion in new credit lines. This acquisition, closely tied to current demand in high-growth end markets, could amplify both the positives of diversification and the short-term risk of acquisition integration, especially if customer spending cycles turn or operational challenges emerge.

However, investors should be aware that, even in a period of strong sector growth, Amphenol’s increasing exposure to cyclical technology markets introduces…

Read the full narrative on Amphenol (it's free!)

Amphenol's narrative projects $26.9 billion in revenue and $5.1 billion in earnings by 2028. This requires a 12.7% yearly revenue growth and a $1.9 billion increase in earnings from the current $3.2 billion level.

Uncover how Amphenol's forecasts yield a $122.88 fair value, in line with its current price.

Exploring Other Perspectives

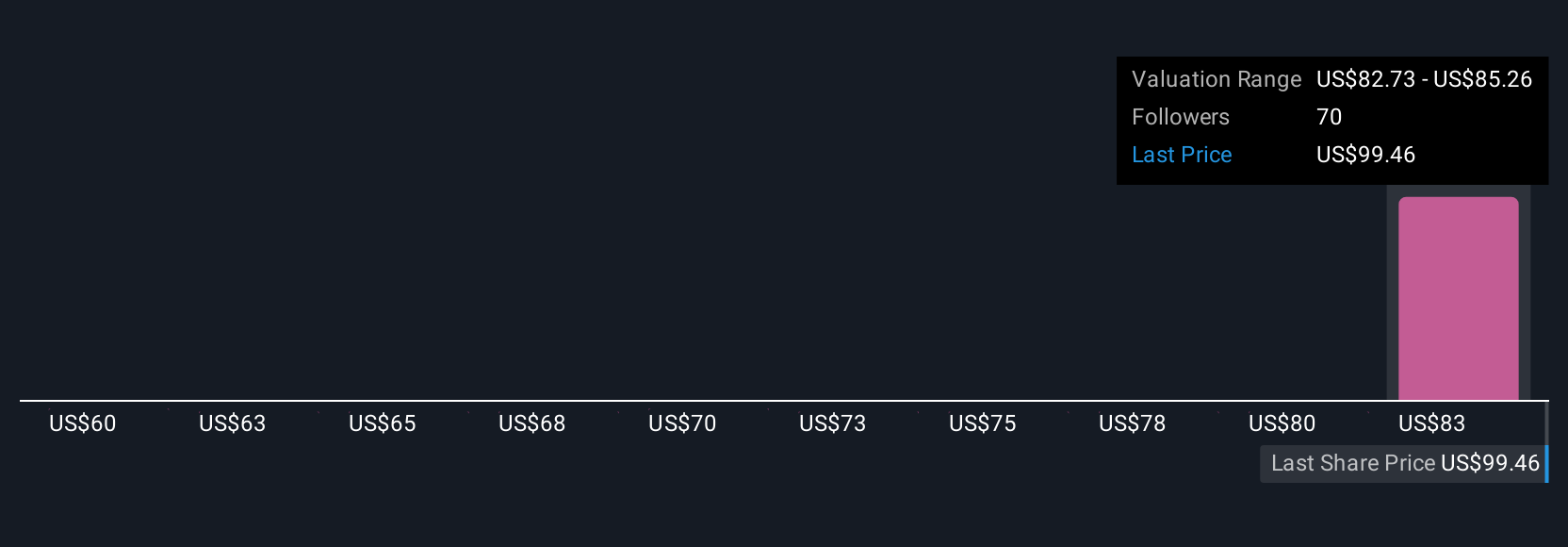

Fair value estimates from five Simply Wall St Community members range widely from US$60 to US$122.88 per share. With acquisition integration risk now front and center, your view may differ significantly from the consensus outlooks, explore the range of perspectives before making up your mind.

Explore 5 other fair value estimates on Amphenol - why the stock might be worth as much as $122.88!

Build Your Own Amphenol Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amphenol research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amphenol research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amphenol's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.