- United States

- /

- Communications

- /

- NYSE:ANET

Insider-Owned Growth Leaders To Watch In November 2025

Reviewed by Simply Wall St

As the United States stock markets experience a notable upswing, with major indices like the Dow surging by over 650 points, investors are keenly observing potential opportunities in growth companies. In such a buoyant market environment, stocks with high insider ownership can be particularly appealing as they often signal confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 22.6% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.5% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 133.7% |

| Astera Labs (ALAB) | 11.9% | 29.1% |

| AppLovin (APP) | 27.5% | 26.5% |

We'll examine a selection from our screener results.

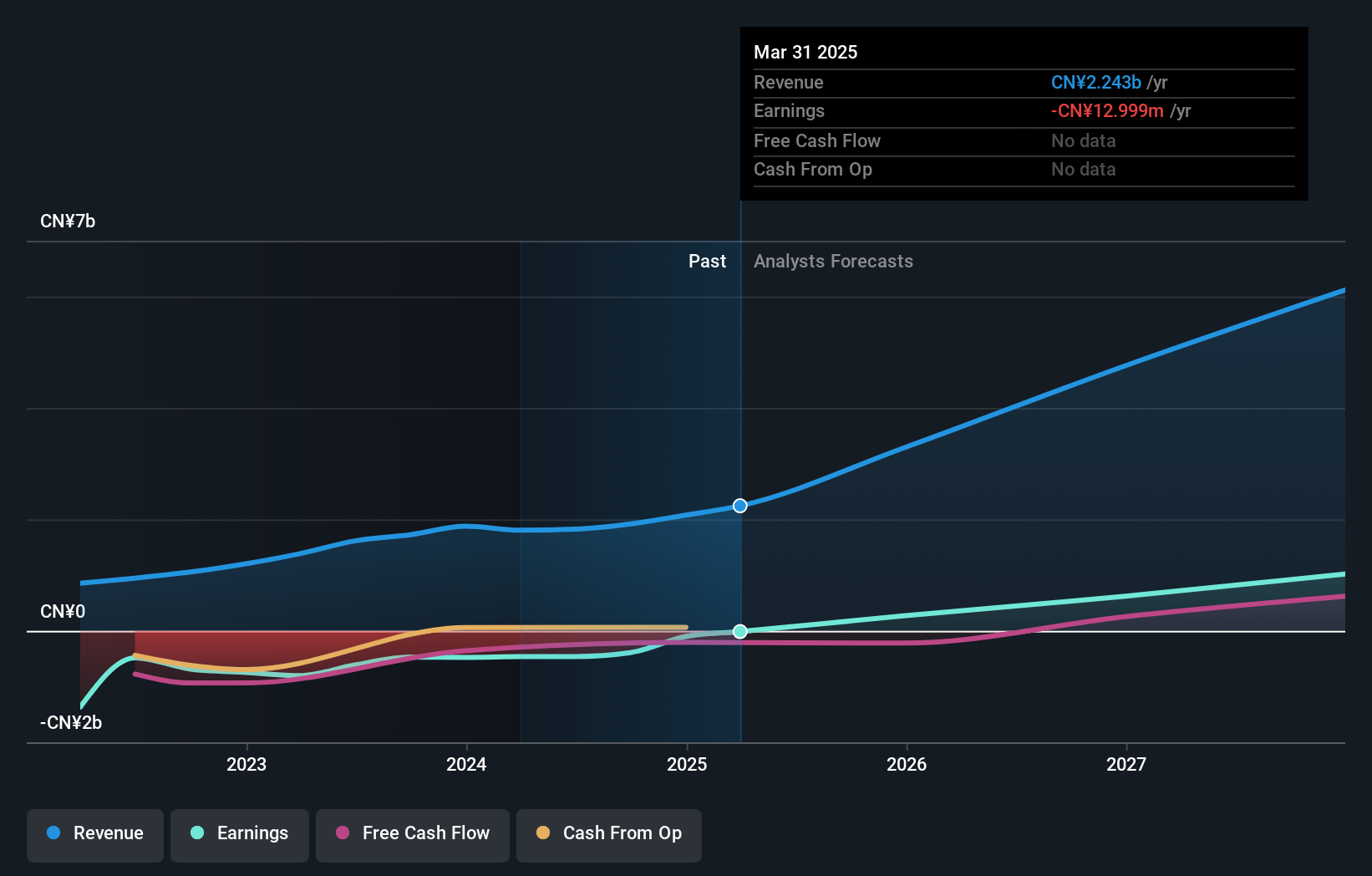

Hesai Group (HSAI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hesai Group develops, manufactures, and sells three-dimensional LiDAR solutions across Mainland China, Europe, North America, and internationally with a market cap of $2.84 billion.

Operations: Hesai Group's revenue primarily comes from the development, manufacturing, and delivery of LiDAR products, totaling CN¥2.75 billion.

Insider Ownership: 17.5%

Earnings Growth Forecast: 30.4% p.a.

Hesai Group, a lidar technology leader, is experiencing robust growth with revenue and earnings forecasted to grow significantly above market averages. Despite recent shareholder dilution, the company trades below its estimated fair value and has raised its full-year earnings guidance. Recent partnerships with Li Auto and a major U.S. robotaxi firm underscore Hesai's strategic positioning in autonomous driving markets. However, its share price has been volatile recently without significant insider trading activity noted.

- Get an in-depth perspective on Hesai Group's performance by reading our analyst estimates report here.

- The analysis detailed in our Hesai Group valuation report hints at an deflated share price compared to its estimated value.

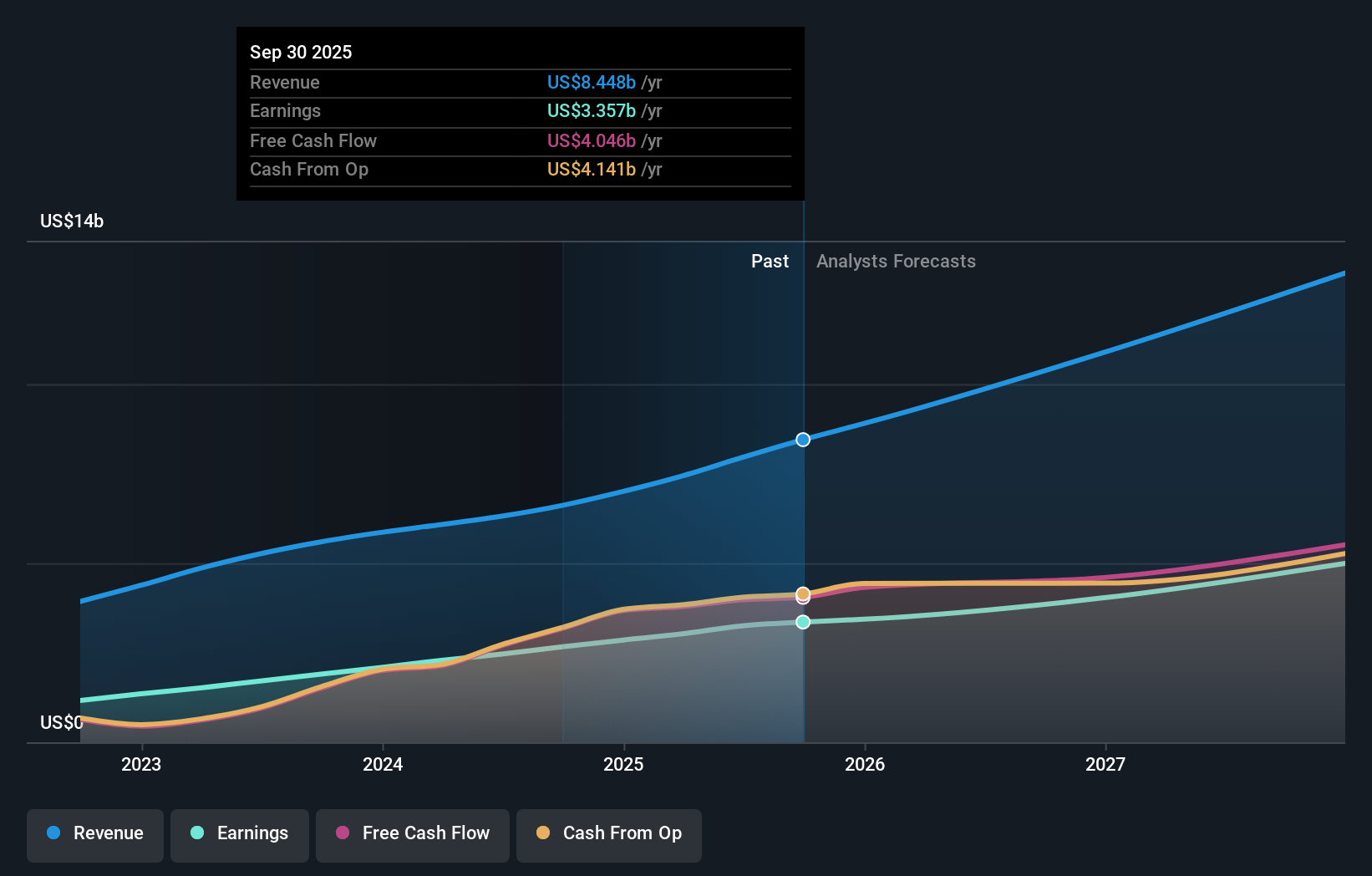

Arista Networks (ANET)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arista Networks Inc develops, markets, and sells data-driven networking solutions for AI, data centers, campuses, and routing environments across the Americas, Europe, the Middle East, Africa, and the Asia-Pacific with a market cap of $153.85 billion.

Operations: The company generates revenue primarily from its computer networks segment, totaling $8.45 billion.

Insider Ownership: 17.2%

Earnings Growth Forecast: 16.6% p.a.

Arista Networks, with substantial insider ownership, is experiencing strong growth, as evidenced by its recent revenue increase to US$2.31 billion in Q3 2025. The company’s earnings are forecasted to grow faster than the US market average at 16.6% annually. Despite no significant insider buying recently, Arista's innovative R4 Series platforms for AI and data centers highlight its strategic position in high-performance networking solutions, supporting continued expansion and competitive advantage in the tech sector.

- Click to explore a detailed breakdown of our findings in Arista Networks' earnings growth report.

- Our valuation report here indicates Arista Networks may be overvalued.

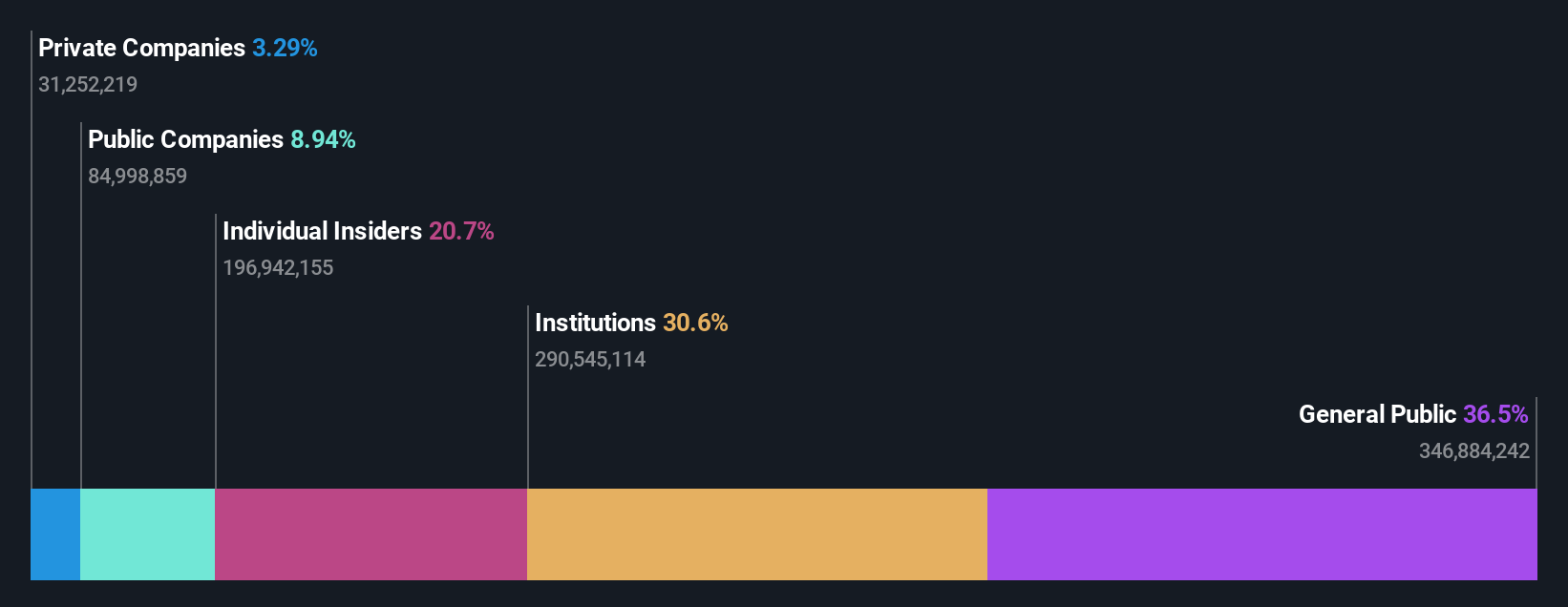

XPeng (XPEV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: XPeng Inc. designs, develops, manufactures, and markets smart electric vehicles in China with a market cap of approximately $20.62 billion.

Operations: The company's primary revenue segment is from Auto Manufacturers, generating CN¥70.57 billion.

Insider Ownership: 20.8%

Earnings Growth Forecast: 66.9% p.a.

XPeng, with significant insider ownership, is on a robust growth trajectory. Its revenue is forecasted to grow at 22% annually, outpacing the US market. The company reported a substantial reduction in net loss for the first nine months of 2025 and anticipates becoming profitable within three years. Recent vehicle deliveries have surged, reflecting strong brand momentum. Despite trading slightly below estimated fair value, XPeng's strategic board appointment signals confidence in its future direction.

- Navigate through the intricacies of XPeng with our comprehensive analyst estimates report here.

- The analysis detailed in our XPeng valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Navigate through the entire inventory of 200 Fast Growing US Companies With High Insider Ownership here.

- Seeking Other Investments? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANET

Arista Networks

Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success