- United States

- /

- Communications

- /

- NYSE:ANET

Does Arista’s Strong 52% Rally Signal More Growth Ahead in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Arista Networks stock? You are not alone. Whether you have been holding on for the ride or just now caught a glimpse of this tech standout, it is hard not to be drawn in by Arista's stellar performance. With shares closing at $149.5 and racking up an eye-catching 52.3% gain over the past year, the momentum feels hard to ignore. Zoom out even further and the growth story becomes even more compelling; a massive 948.0% return over five years makes this one of the market's most impressive long-term performers.

As network infrastructure continues to attract investor interest, especially amid ongoing shifts in data center demand and cloud computing trends, Arista's recent 4.3% uptick just this past week shows that market sentiment remains bullish. However, all this excitement leads to a crucial question: is it too late to buy, or is there more runway ahead?

Valuation can sometimes feel like a moving target, and with Arista scoring just 1 out of 6 possible checks for being undervalued, the numbers suggest the stock is not the slam dunk bargain it once was. Still, investors know there is no single formula for finding value, and every metric tells only part of the story.

So how do all the standard approaches stack up, and is there a smarter way to gauge whether shares are worth your money right now? Let us break down the classic valuation checks, then explore a more powerful way to understand the real worth of Arista Networks.

Arista Networks scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Arista Networks Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model calculates a company’s intrinsic value by projecting its future free cash flows and then discounting those amounts back to their present value. This provides investors with a sense of what the business is really worth today, based on the money it is expected to generate over the long term.

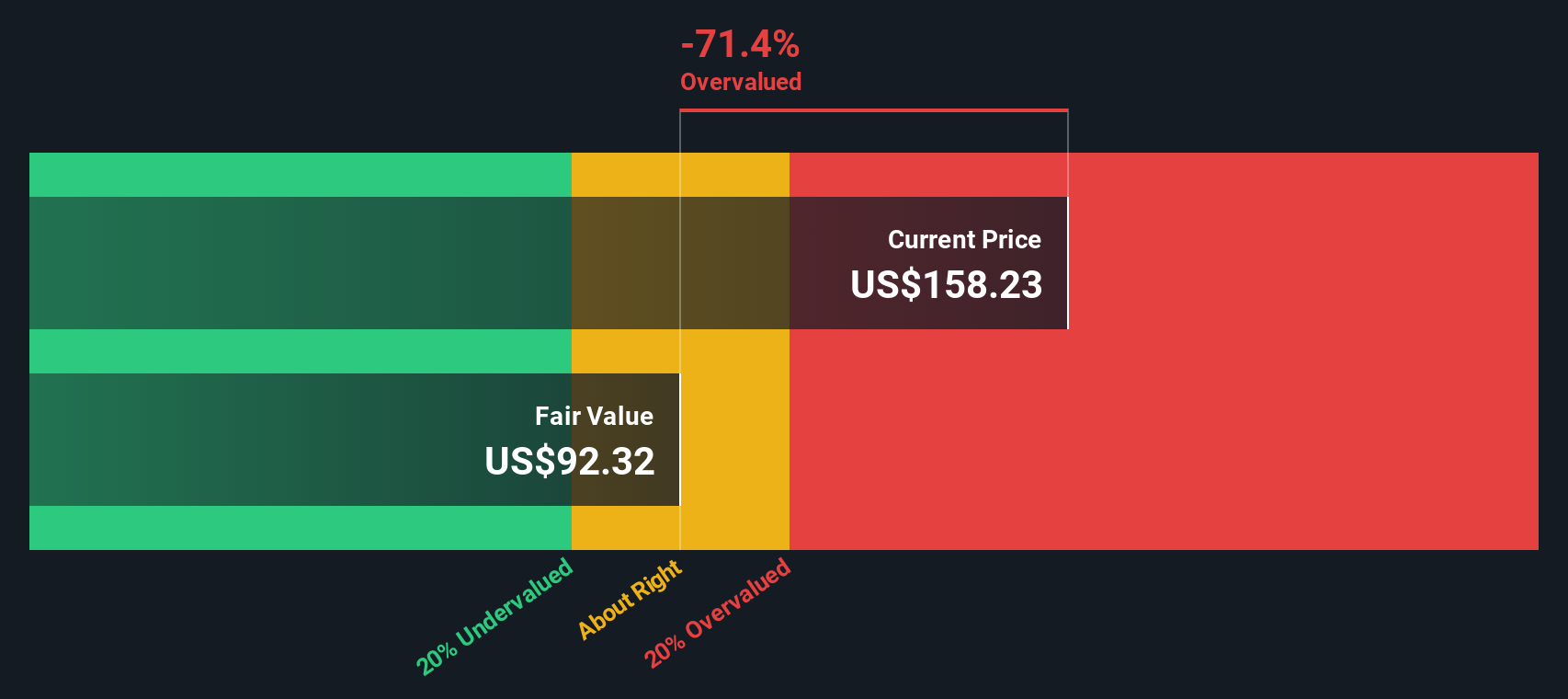

For Arista Networks, the most recent trailing twelve months’ Free Cash Flow is $3.99 billion. Analyst estimates extend out five years, projecting robust growth, while years beyond that are extrapolated by Simply Wall St. By 2028, Arista’s Free Cash Flow is expected to grow to roughly $6.12 billion, with ten-year projections reaching as high as $7.75 billion by 2035. These figures suggest a healthy and expanding cash generation profile for the company.

Despite this growth story, the DCF model projects an intrinsic fair value of $92.74 per share for Arista Networks. With the current share price at $149.50, the stock is considered 61.2% overvalued according to this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arista Networks may be overvalued by 61.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Arista Networks Price vs Earnings

The Price-to-Earnings (PE) ratio is widely recognized as a go-to metric for valuing profitable companies, as it measures how much investors are willing to pay for each dollar of earnings. It is especially suitable for companies like Arista Networks that generate consistent profits, giving a straightforward lens into market expectations.

When assessing what counts as a "normal" or "fair" PE ratio, growth expectations and risk play critical roles. Companies with stronger projected earnings growth or lower perceived risk typically command higher PE multiples. Those with lower growth or higher uncertainty tend to trade at a discount.

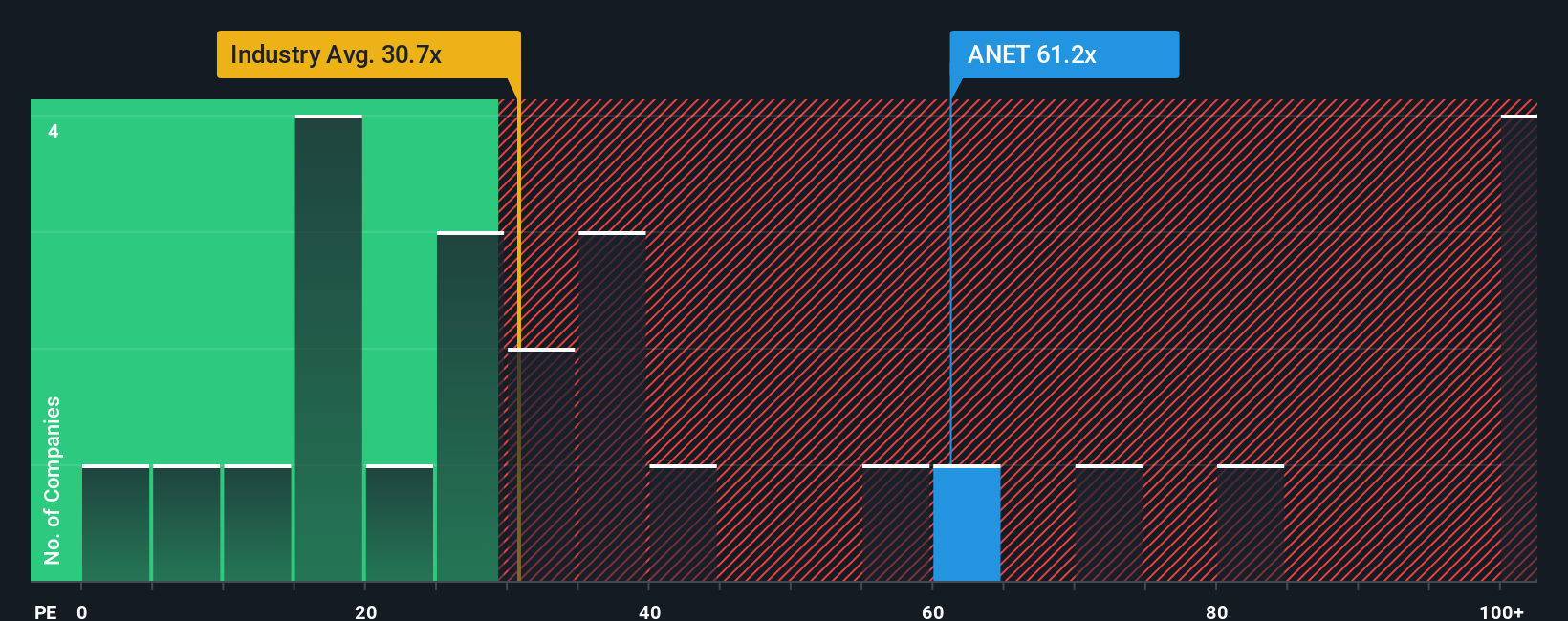

Currently, Arista Networks trades at a PE ratio of 57.8x. This is noticeably higher than the communications industry average of 30.1x, although it is lower than the peer group average of 68.2x. On the surface, this could suggest the stock is expensive, but raw comparisons do not account for the specific characteristics that set Arista apart from its peers.

This is where Simply Wall St's "Fair Ratio" comes in. The Fair Ratio, calculated to be 42.3x for Arista, adjusts for growth rates, profitability, risk profile, industry dynamics, and market capitalization. Unlike industry or peer averages that treat all companies as equal, the Fair Ratio reflects what a reasonable PE multiple should be for Arista's unique profile right now.

Comparing these numbers, Arista’s current PE of 57.8x is substantially above its Fair Ratio of 42.3x. This suggests investors are paying a premium that is not entirely warranted by its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arista Networks Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. At Simply Wall St, a Narrative is your opportunity to attach your own story or perspective to the company, shaping what you believe Arista Networks’ future holds and translating that story into assumptions about revenue, margins, and eventual fair value.

Unlike static valuation models, Narratives connect a company's current business context to your personal financial forecast, tying these assumptions directly to a dynamically calculated fair value. This means you are not just crunching numbers; you are expressing an outlook, whether optimistic or cautious, and seeing in real time how new news or earnings releases might change your outlook as facts on the ground evolve.

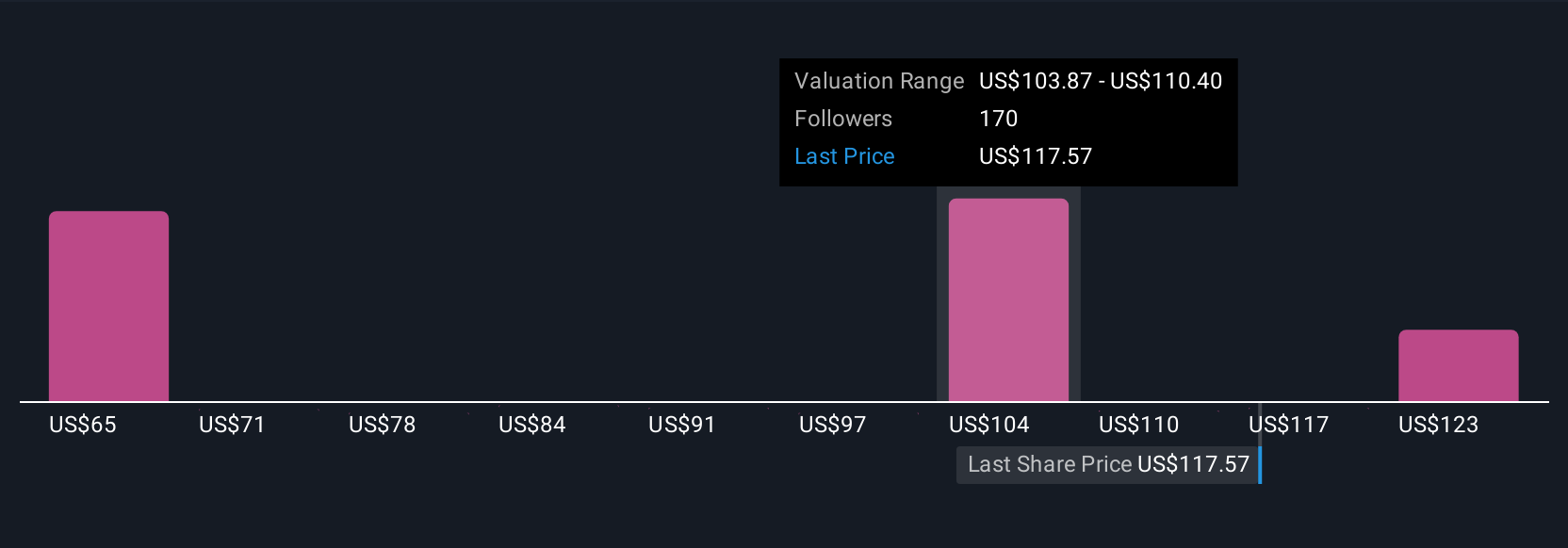

Available to millions of investors on Simply Wall St’s Community page, Narratives are easy to use and let you compare your fair value with the market price, helping guide your decision to buy or sell. For example, some investors estimate Arista's fair value as high as $156 while others calculate just $76, underlining how Narratives capture the diversity of investor expectations and financial logic. All of this is grounded in up-to-date, transparent assumptions that you can adjust yourself in seconds.

For Arista Networks, we present previews of two leading Arista Networks Narratives:

Fair Value: $156.38

Current Price vs. Fair Value: 4.4% undervalued

Revenue Growth Rate: 20.6%

- Arista’s leadership in open and high-bandwidth AI networking positions the company for multi-year growth and market share expansion as the industry moves away from proprietary systems.

- Rapid adoption of AI, software-driven platform growth, and expansion into enterprise and campus markets are expected to diversify revenue and increase long-term earnings stability.

- Consensus among analysts supports a higher price target thanks to rising earnings forecasts and strong demand for AI and cloud infrastructure. Risks such as customer concentration, competition, and margin pressures remain.

Fair Value: $127.06

Current Price vs. Fair Value: 17.7% overvalued

Revenue Growth Rate: 15.0%

- Arista disrupts established players in high-speed data center and AI networking, maintaining high customer satisfaction through strong integration of hardware and software.

- Despite being debt-free and generating strong returns on equity, the company’s fair value based on future free cash flow growth is below the current share price. This indicates limited upside.

- Maintaining ambitious growth in free cash flow will be challenging, so current valuation may reflect optimism that is tough to sustain long term.

Do you think there's more to the story for Arista Networks? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANET

Arista Networks

Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives