- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ZBRA

Zebra Technologies (ZBRA) Jumps After Salesforce Partnership Unveils New Retail Cloud POS Solution—Has Growth Outlook Shifted?

Reviewed by Sasha Jovanovic

- On October 14, 2025, Zebra Technologies announced a collaboration with Salesforce to unveil the new Retail Cloud POS on Android, integrating Zebra’s mobile computing hardware with Salesforce’s cloud platform to streamline retail operations and enhance customer engagement globally.

- This partnership underscores a push to tackle operational challenges in retail, such as inefficient inventory management and store associate workflows, by combining cutting-edge hardware and cloud software for immediate, front-line impact.

- We'll examine how the Salesforce partnership and new Retail Cloud POS solution could influence Zebra Technologies' path toward growth and innovation.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Zebra Technologies Investment Narrative Recap

To be a Zebra Technologies shareholder today, you need confidence in automation trends fueling demand for intelligent retail solutions, particularly as the company pivots further into high-growth, software-enabled markets. The recent Salesforce partnership could support Zebra's aim to boost recurring revenue, but the shift from hardware will remain gradual; the most significant near-term catalyst is whether this cloud POS solution accelerates software and services adoption, while reliance on hardware sales persists as the biggest risk. The impact on these factors from the Salesforce collaboration is promising, but it's too early to call material shifts in risk or catalysts just yet.

Among Zebra's recent milestones, the acquisition of Elo Touch Solutions stands out most in the context of this Salesforce news. The move deepens Zebra’s reach in the consumer-facing retail segment at a time when its joint solution with Salesforce targets new efficiency and engagement standards for frontline workers, a direct response to the demand for more integrated, digital retail workflows seen as critical to the company’s transformation efforts and key growth levers.

Yet, despite genuine progress toward innovation, investors should remain mindful that, in contrast to software-oriented peers, Zebra’s earnings stability still relies heavily on...

Read the full narrative on Zebra Technologies (it's free!)

Zebra Technologies' narrative projects $6.2 billion in revenue and $855.4 million in earnings by 2028. This requires 6.0% yearly revenue growth and a $307.4 million earnings increase from $548.0 million today.

Uncover how Zebra Technologies' forecasts yield a $372.33 fair value, a 21% upside to its current price.

Exploring Other Perspectives

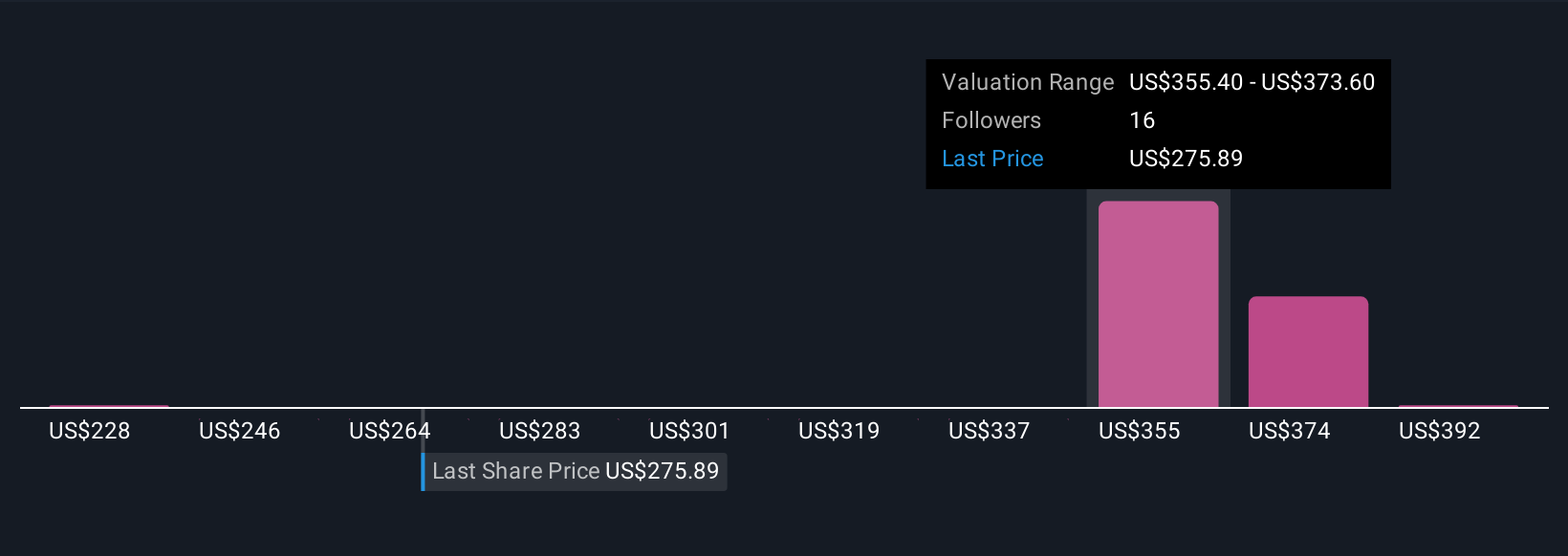

Simply Wall St Community fair value estimates for Zebra Technologies range from US$228 to US$410 across 4 valuations. With recurring software revenue still growing slowly, the spread of opinions shows how perspectives on Zebra's future profitability can diverge, consider several community takes before forming your own view.

Explore 4 other fair value estimates on Zebra Technologies - why the stock might be worth 26% less than the current price!

Build Your Own Zebra Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zebra Technologies research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zebra Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zebra Technologies' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zebra Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZBRA

Zebra Technologies

Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion