- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ZBRA

The Bull Case For Zebra Technologies (ZBRA) Could Change Following AI-Driven Product Debuts at ZONE Summit

Reviewed by Simply Wall St

- Zebra Technologies recently hosted its annual ZONE conference and inaugural Frontline AI Summit in Nashville, focusing on AI-driven solutions transforming frontline operations with new product launches and real-world industry use cases.

- The company showcased innovations like the Mobile Computing AI Suite, expanded Workcloud software, and integrated RFID devices, highlighting its push toward smarter, more connected frontline workplaces.

- We'll explore how Zebra's emphasis on AI-powered workflow optimization could influence its investment narrative and future growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Zebra Technologies Investment Narrative Recap

To be a Zebra Technologies shareholder, you need to see value in its ability to convert ongoing automation and digital transformation trends, like real-time inventory and workflow optimization, into durable, long-term growth, supported by a mix of hardware innovation and expanding SaaS offerings. While the recent ZONE and Frontline AI Summit events spotlight Zebra’s commitment to AI-driven innovation, these announcements are not expected to materially shift short-term sales momentum, which remains the most immediate catalyst, nor do they directly address the largest risk: reliance on hardware-driven revenue as SaaS adoption progresses slowly.

Of the new launches, Zebra’s expanded Workcloud software suite is most relevant, as it aims to address the demand for workflow productivity and recurring revenue opportunities. How successfully these tools increase SaaS penetration could influence earnings stability and potentially impact how investors view Zebra’s progress toward reducing reliance on hardware sales as highlighted in its latest investor guidance.

Yet, in contrast, investors should be aware that despite these product advances, there remains a risk if recurring software revenue fails to scale at the pace required to...

Read the full narrative on Zebra Technologies (it's free!)

Zebra Technologies' narrative projects $6.2 billion revenue and $855.4 million earnings by 2028. This requires 6.0% yearly revenue growth and a $307.4 million earnings increase from $548.0 million currently.

Uncover how Zebra Technologies' forecasts yield a $364.67 fair value, a 15% upside to its current price.

Exploring Other Perspectives

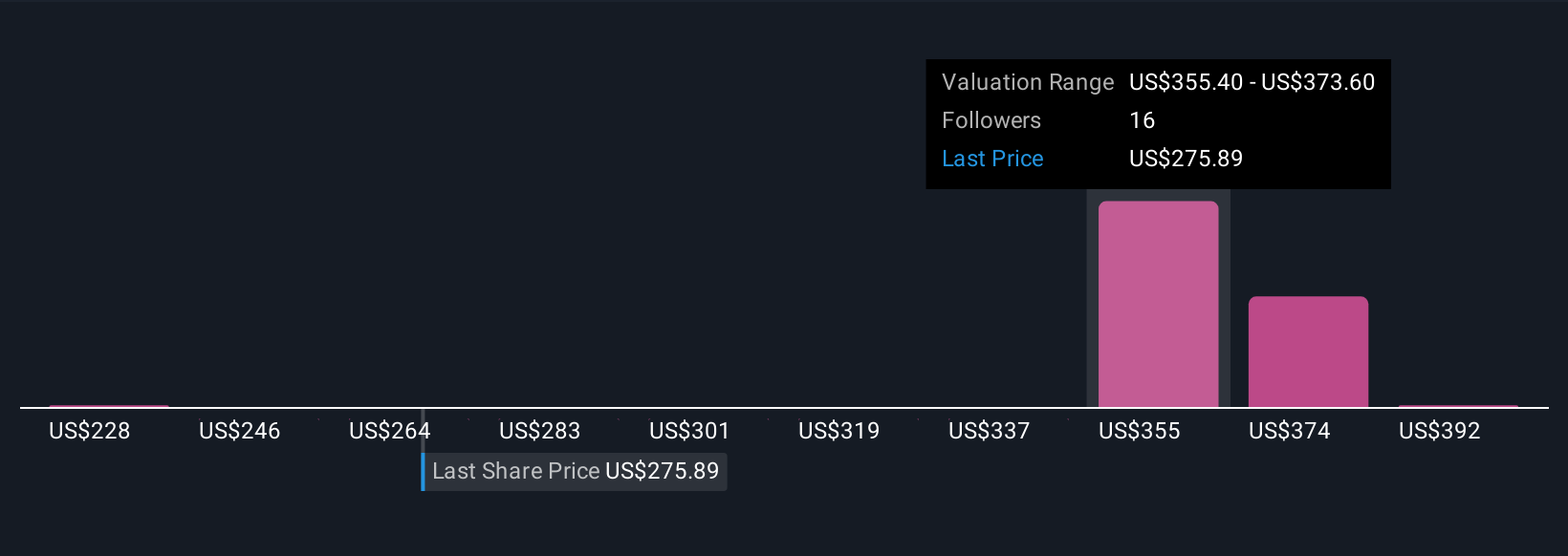

Simply Wall St Community contributors offered four fair value estimates for Zebra Technologies, ranging widely from US$228 to US$410 per share. While perspectives vary sharply, many are weighing the ongoing need for Zebra to accelerate SaaS revenue growth given its fundamental impact on earnings stability and risk.

Explore 4 other fair value estimates on Zebra Technologies - why the stock might be worth 28% less than the current price!

Build Your Own Zebra Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zebra Technologies research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Zebra Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zebra Technologies' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zebra Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZBRA

Zebra Technologies

Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026