- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:WRAP

Wrap Technologies (NASDAQ:WRAP shareholders incur further losses as stock declines 14% this week, taking three-year losses to 78%

As an investor, mistakes are inevitable. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of Wrap Technologies, Inc. (NASDAQ:WRAP), who have seen the share price tank a massive 78% over a three year period. That would be a disturbing experience. The last week also saw the share price slip down another 14%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Wrap Technologies

Given that Wrap Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Wrap Technologies saw its revenue grow by 13% per year, compound. That's a fairly respectable growth rate. So it's hard to believe the share price decline of 21% per year is due to the revenue. It could be that the losses were much larger than expected. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

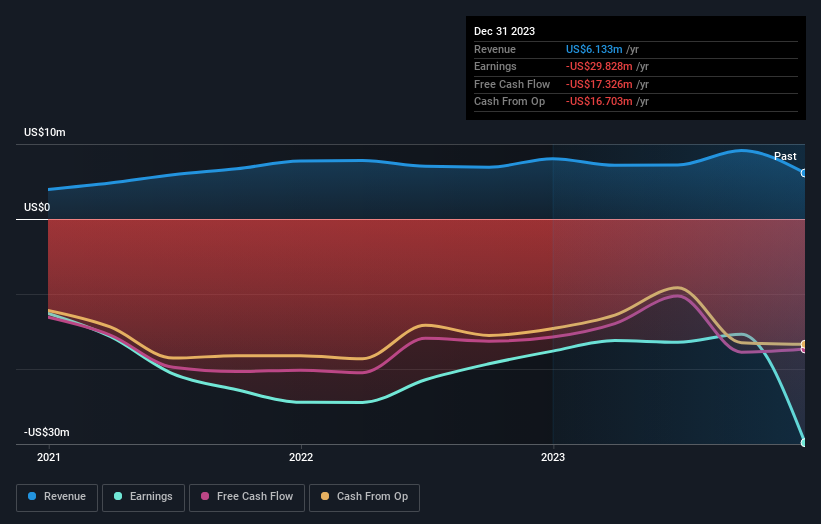

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Wrap Technologies had a tough year, with a total loss of 14%, against a market gain of about 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 11% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for Wrap Technologies you should be aware of, and 1 of them shouldn't be ignored.

We will like Wrap Technologies better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wrap Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:WRAP

Wrap Technologies

A public safety technology and services company, develops policing solutions for law enforcement and security personnel in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

Strategic pivot in maximizing corporate value

Buy-out proposal for BARK Inc., at $1.10 has be confirmed by the acquisition group

Paladin Energy: Betting on the Nuclear Renaissance

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks