- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:WRAP

Wrap Technologies' (NASDAQ:WRAP) Shareholders Are Down 23% On Their Shares

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Wrap Technologies, Inc. (NASDAQ:WRAP) share price slid 23% over twelve months. That contrasts poorly with the market return of 27%. Wrap Technologies may have better days ahead, of course; we've only looked at a one year period.

See our latest analysis for Wrap Technologies

Given that Wrap Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Wrap Technologies grew its revenue by 492% over the last year. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 23% seems quite harsh. Our sympathies to shareholders who are now underwater. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

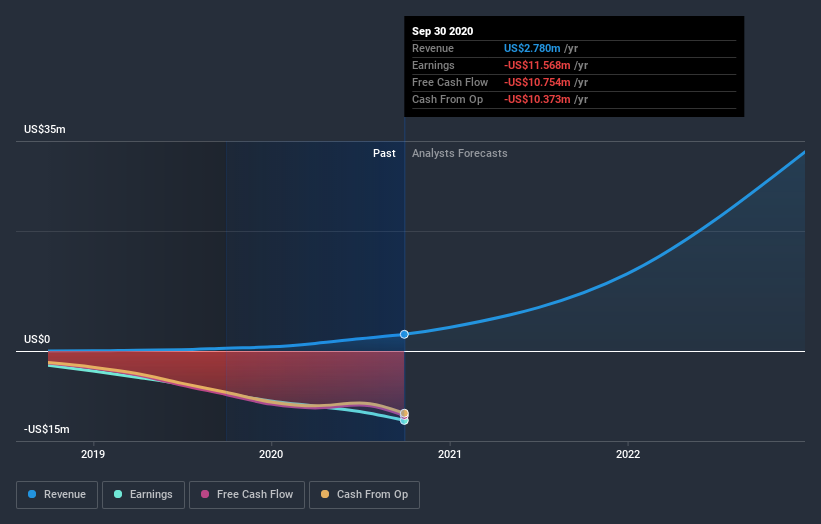

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for Wrap Technologies in this interactive graph of future profit estimates.

A Different Perspective

Given that the market gained 27% in the last year, Wrap Technologies shareholders might be miffed that they lost 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 4.5%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Wrap Technologies (1 is concerning) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Wrap Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wrap Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:WRAP

Wrap Technologies

A public safety technology and services company, develops policing solutions to law enforcement and security personnel worldwide.

Flawless balance sheet slight.