- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

Should You Reassess Western Digital Shares After the 150% Rally in 2024?

Reviewed by Bailey Pemberton

Trying to decide what to do with Western Digital stock right now? You are definitely not alone. With the price rocketing up by 7.3% over the past week and more than doubling year-to-date, a staggering 102.5% gain, it is only natural to wonder whether there is still room for this stock to run. Even more eye-catching, over the past year shares have surged by 150.3%, and the long-term chart is just as impressive, boasting a 379.8% increase in three years and 334.0% over five years. That kind of track record gets people talking, and it is no surprise that many investors are turning their attention to what is next for Western Digital.

Part of that recent enthusiasm comes as the market adjusts its outlook for tech hardware companies, especially as demand for data storage and memory surges worldwide. There has also been fresh interest from investors hunting for potential value in companies that have previously been overlooked. But before you get caught up in all the excitement, it helps to take a measured look at how the current valuation stacks up and whether the stock’s recent pricing fully reflects its long-term prospects. Based on a comprehensive set of six checks, Western Digital is undervalued in just one area, earning a value score of 1 out of 6.

So, does the current price truly offer value, or has the recent momentum run too far ahead of the fundamentals? Let us unpack the main valuation approaches next. Stick around, because at the end of this article, we will explore an even better way to get a full picture of what the stock is really worth.

Western Digital scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Western Digital Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to their present worth. This approach helps investors gauge how much a business is really worth based on its ability to generate free cash over time.

For Western Digital, the most recent reported Free Cash Flow is $956.4 Million. Analysts forecast continued growth in Free Cash Flow, with projections reaching $2.29 Billion by 2030. Notably, while analyst estimates cover the next five years, forecasts beyond that are extended using reasonable extrapolations based on trends and industry outlooks.

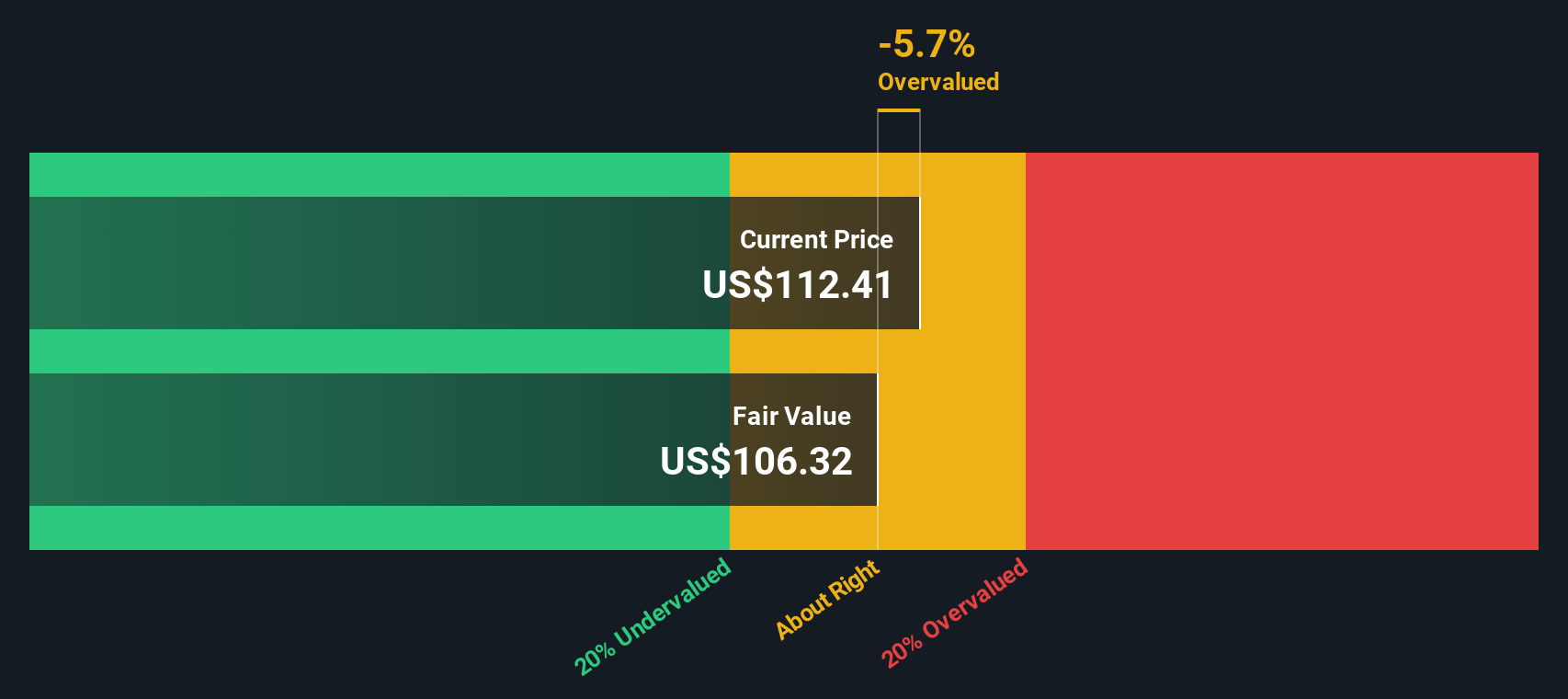

When these projected cash flows are discounted, the model produces an intrinsic value estimate of $108.25 per share. Compared to its current share price, this implies that Western Digital stock is about 15.7% overvalued according to the DCF model. In practical terms, the share price has exceeded what the underlying cash flows suggest is fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Western Digital may be overvalued by 15.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Western Digital Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used measures for valuing profitable companies like Western Digital. It allows investors to see how much they are paying for each dollar of current earnings, which is particularly useful when the company is consistently generating profits.

Determining what qualifies as a "fair" PE ratio goes beyond simply looking at today’s earnings. Growth expectations play a big role. Companies with faster growth prospects tend to trade at higher PE ratios, while those perceived as riskier typically command lower valuations. Industry context and market sentiment can also move the needle up or down.

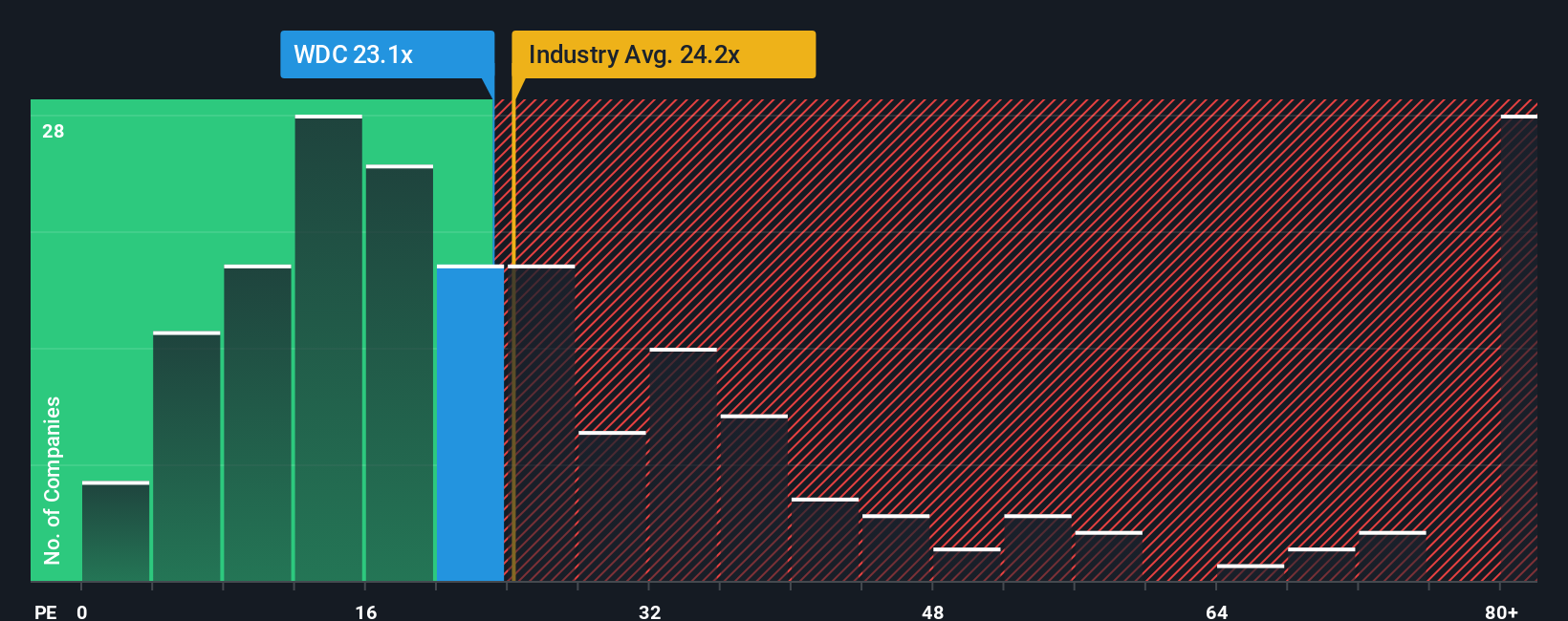

Western Digital is currently trading at a PE ratio of 27.2x. That is higher than both the tech industry average of 24.0x and the peer group average of 23.4x. Simply Wall St’s proprietary Fair Ratio for Western Digital, which considers not just earnings growth but also profit margins, company size, and risk factors, is 33.5x. This Fair Ratio offers a more tailored benchmark because it reflects the company’s specific strengths and risk profile, rather than just broad market comparisons.

Comparing the actual PE of 27.2x to the Fair Ratio of 33.5x suggests that Western Digital is undervalued on this front, since the stock is trading below what would be expected when considering the company’s fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Western Digital Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a powerful, approachable tool that allows you to connect your view of Western Digital’s story—why its future might be bright or challenging—to concrete financial forecasts such as fair value, future revenue, earnings, and margins.

Think of a Narrative as more than just numbers. It is your unique perspective, linked directly to a set of business assumptions that shape what you believe the company is truly worth. On Simply Wall St’s Community page, used by millions of investors, anyone can easily build, update, or explore Narratives created by other investors with diverse viewpoints.

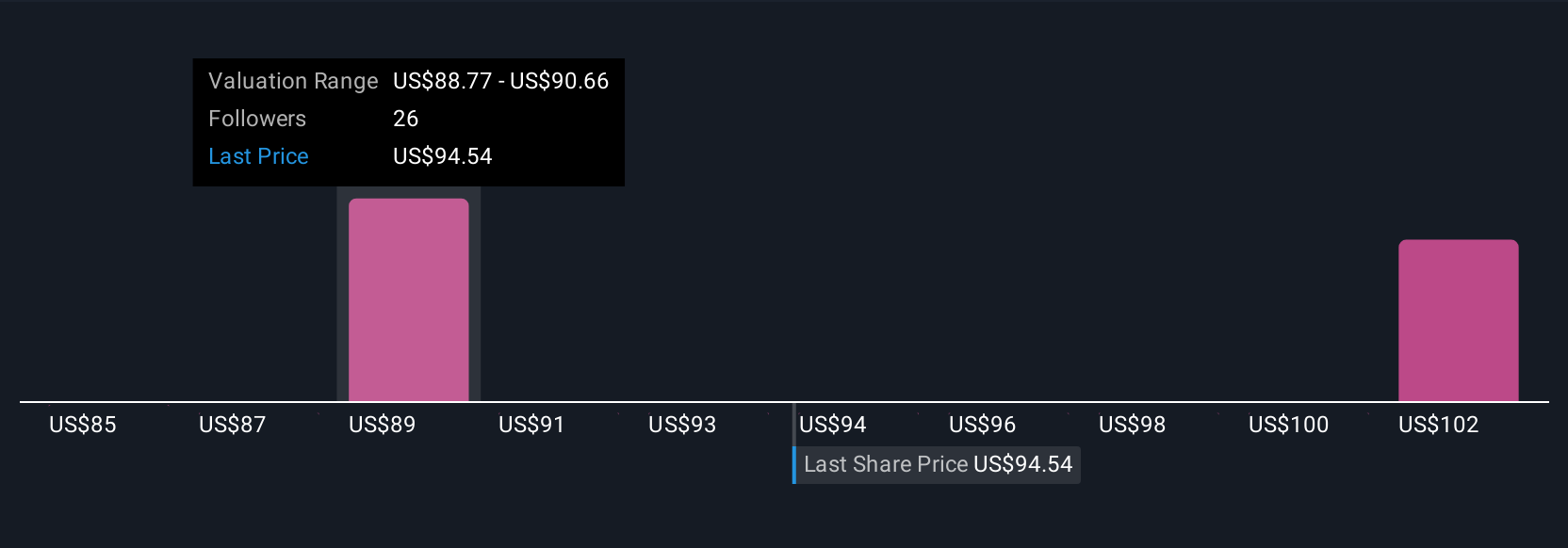

These Narratives make it easy to spot when to buy or sell by directly comparing each Fair Value to the current share price. Because Narratives are refreshed automatically with new earnings or news, your outlook stays relevant. For example, some investors expect Western Digital to reach as high as $110 per share, driven by optimism about AI and storage demand, while others, more cautious about customer concentration risks, see fair value closer to $62. This proves that everyone’s Narrative reflects their own knowledge and beliefs.

Do you think there's more to the story for Western Digital? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the United States, Asia, Europe, the Middle East, and Africa.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives