- United States

- /

- Communications

- /

- NasdaqGS:VIAV

Investors in Viavi Solutions (NASDAQ:VIAV) have unfortunately lost 38% over the last three years

Viavi Solutions Inc. (NASDAQ:VIAV) shareholders should be happy to see the share price up 24% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 38% in the last three years, significantly under-performing the market.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for Viavi Solutions

Viavi Solutions wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years Viavi Solutions saw its revenue shrink by 10% per year. That's not what investors generally want to see. The annual decline of 11% per year in that period has clearly disappointed holders. That makes sense given the lack of either profits or revenue growth. However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

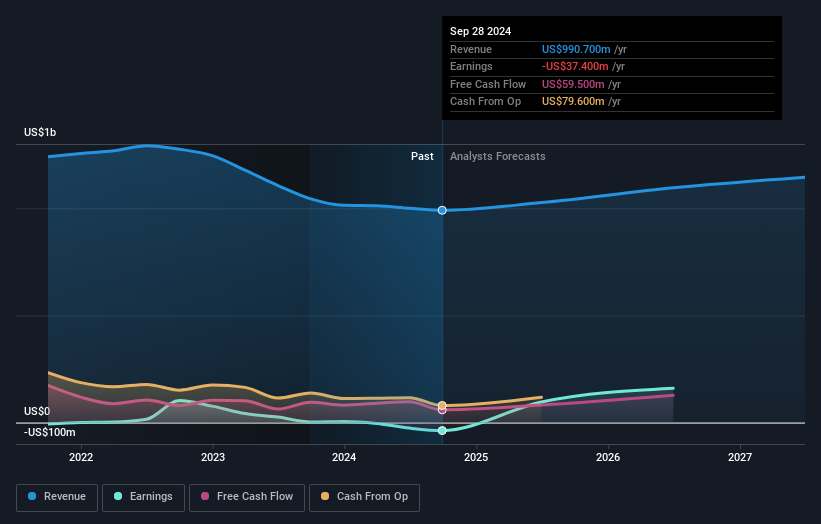

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Viavi Solutions' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Viavi Solutions provided a TSR of 16% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 5% per year, over five years. It could well be that the business is stabilizing. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Viavi Solutions better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VIAV

Viavi Solutions

Provides network test, monitoring, and assurance solutions for communications service providers, hyperscalers, network equipment manufacturers, original equipment manufacturers, government, and avionics customers in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Good value with moderate growth potential.