- United States

- /

- Software

- /

- NasdaqGS:TRMB

The Returns At Trimble (NASDAQ:TRMB) Aren't Growing

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after briefly looking over the numbers, we don't think Trimble (NASDAQ:TRMB) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Trimble:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

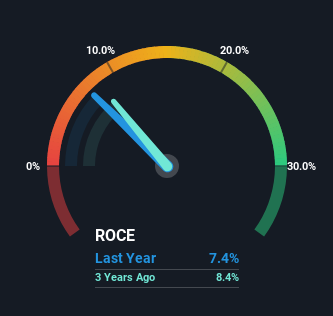

0.074 = US$567m ÷ (US$9.5b - US$1.8b) (Based on the trailing twelve months to December 2023).

Therefore, Trimble has an ROCE of 7.4%. In absolute terms, that's a low return and it also under-performs the Electronic industry average of 11%.

See our latest analysis for Trimble

In the above chart we have measured Trimble's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Trimble .

What Does the ROCE Trend For Trimble Tell Us?

In terms of Trimble's historical ROCE trend, it doesn't exactly demand attention. The company has employed 63% more capital in the last five years, and the returns on that capital have remained stable at 7.4%. Given the company has increased the amount of capital employed, it appears the investments that have been made simply don't provide a high return on capital.

The Key Takeaway

As we've seen above, Trimble's returns on capital haven't increased but it is reinvesting in the business. Since the stock has gained an impressive 52% over the last five years, investors must think there's better things to come. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

Trimble does come with some risks though, we found 2 warning signs in our investment analysis, and 1 of those is potentially serious...

While Trimble isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Trimble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TRMB

Trimble

Offers technology solutions and platform that enable office professionals and field workers to connect workflows and industry lifecycles in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Santos: Undervalued After Takeover Fallout

Realty Income - A Fundamental and Historical Valuation

A Structured Counter‑Analysis of "The Leaking Dreadnought"

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks