- United States

- /

- Tech Hardware

- /

- NasdaqGM:TACT

Time To Worry? Analysts Are Downgrading Their TransAct Technologies Incorporated (NASDAQ:TACT) Outlook

Today is shaping up negative for TransAct Technologies Incorporated (NASDAQ:TACT) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon.

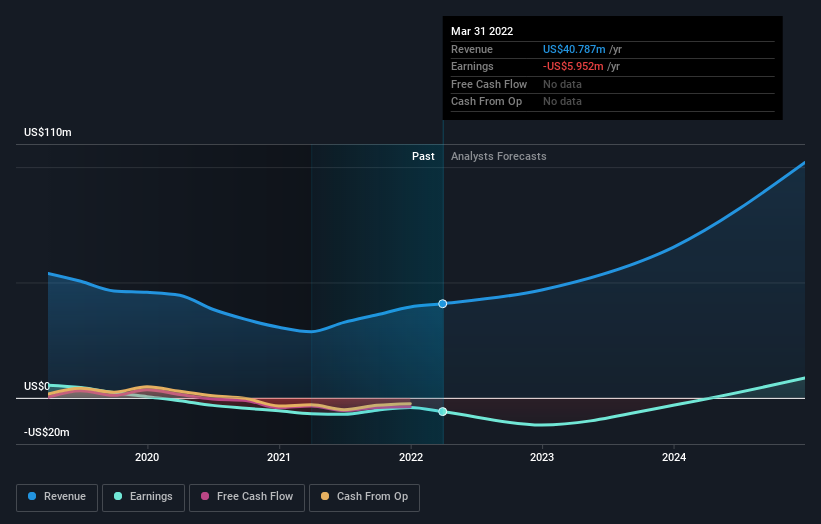

Following the downgrade, the current consensus from TransAct Technologies' three analysts is for revenues of US$47m in 2022 which - if met - would reflect a decent 15% increase on its sales over the past 12 months. Per-share losses are expected to explode, reaching US$1.18 per share. However, before this estimates update, the consensus had been expecting revenues of US$52m and US$0.65 per share in losses. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

See our latest analysis for TransAct Technologies

The consensus price target fell 9.8% to US$12.33, implicitly signalling that lower earnings per share are a leading indicator for TransAct Technologies' valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic TransAct Technologies analyst has a price target of US$14.00 per share, while the most pessimistic values it at US$10.00. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. For example, we noticed that TransAct Technologies' rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 20% growth to the end of 2022 on an annualised basis. That is well above its historical decline of 12% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 5.0% annually. So it looks like TransAct Technologies is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at TransAct Technologies. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for TransAct Technologies going out to 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if TransAct Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TACT

TransAct Technologies

Designs, develops, and markets transaction-based and specialty printers and terminals in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Czechoslovak Group - is it really so hot?

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion