- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

With EPS Growth And More, Super Micro Computer (NASDAQ:SMCI) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Super Micro Computer (NASDAQ:SMCI), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Super Micro Computer

How Fast Is Super Micro Computer Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Super Micro Computer to have grown EPS from US$2.18 to US$8.39 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. This could point to the business hitting a point of inflection.

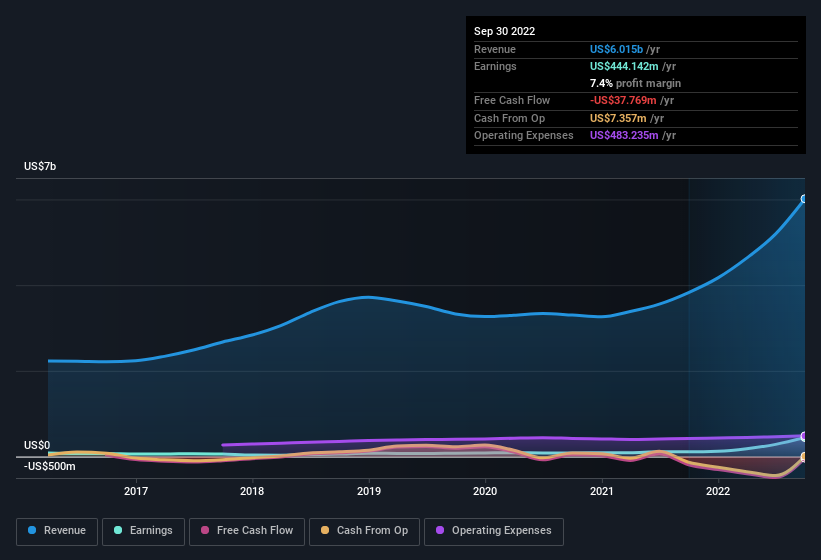

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Super Micro Computer shareholders is that EBIT margins have grown from 3.2% to 8.7% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Super Micro Computer's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Super Micro Computer Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insider selling of Super Micro Computer shares was insignificant compared to the one buyer, over the last twelve months. Namely, Independent Director Shiu Chan out-laid US$1.2m for shares, at about US$81.41 per share. That can definitely be seen as a sign of conviction.

On top of the insider buying, it's good to see that Super Micro Computer insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth US$496m. This totals to 13% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because Super Micro Computer's CEO, Charles Liang, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Super Micro Computer, with market caps between US$2.0b and US$6.4b, is around US$6.5m.

The Super Micro Computer CEO received total compensation of only US$1.0 in the year to June 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Super Micro Computer To Your Watchlist?

Super Micro Computer's earnings per share growth have been climbing higher at an appreciable rate. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Super Micro Computer belongs near the top of your watchlist. Still, you should learn about the 3 warning signs we've spotted with Super Micro Computer (including 2 which shouldn't be ignored).

The good news is that Super Micro Computer is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives