- United States

- /

- Building

- /

- NasdaqGS:ROCK

Undiscovered Gems Three Promising Small Caps with Strong Potential

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has risen an impressive 26% over the past year, with earnings projected to grow by 15% annually in the coming years. In this environment, identifying promising small-cap stocks that have strong growth potential can offer unique opportunities for investors seeking to capitalize on emerging trends and under-the-radar companies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

CRA International (NasdaqGS:CRAI)

Simply Wall St Value Rating: ★★★★★☆

Overview: CRA International, Inc. offers economic, financial, and management consulting services globally and has a market capitalization of approximately $1.26 billion.

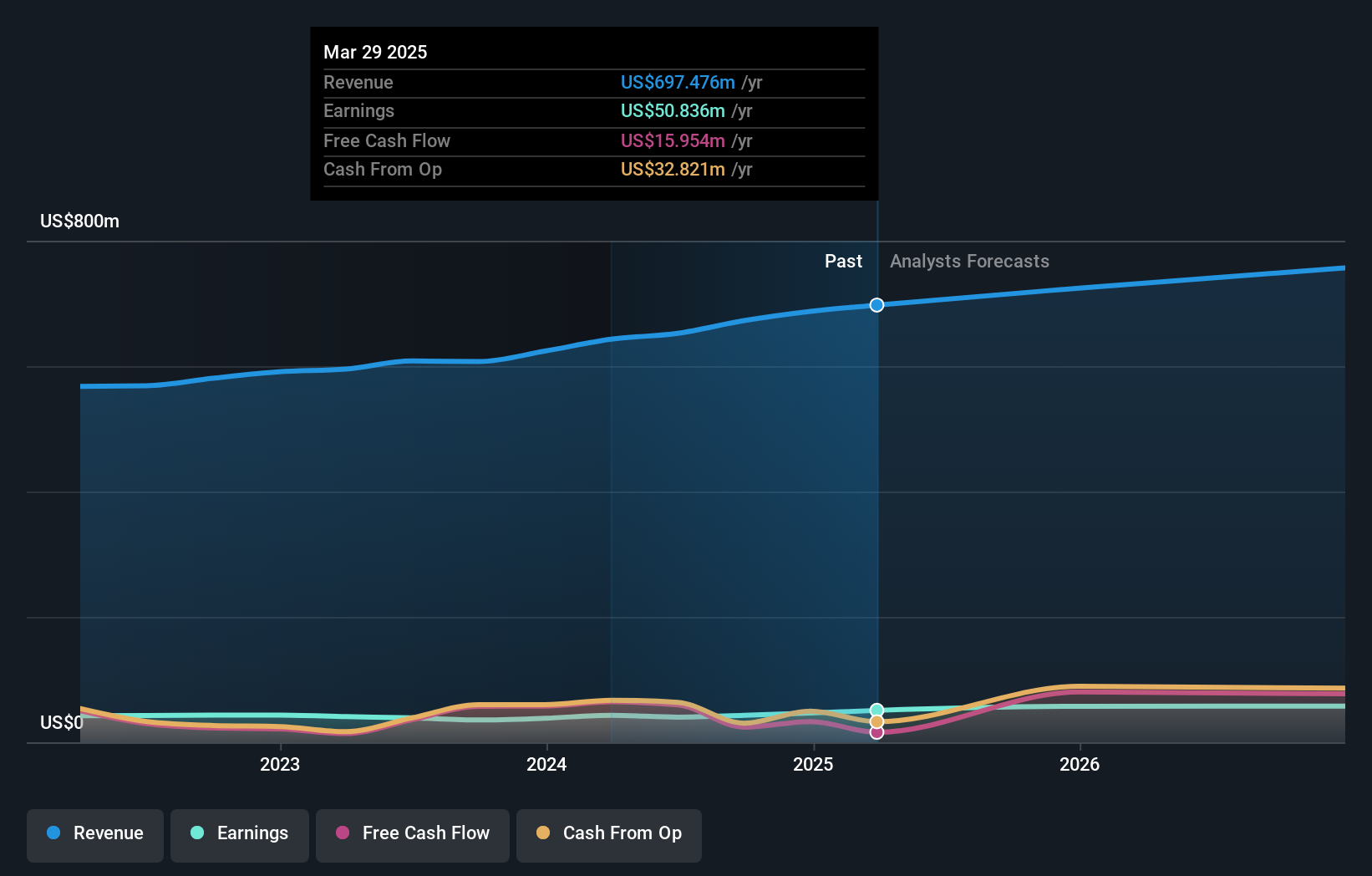

Operations: CRA International generates revenue primarily from its consulting services, totaling $672.59 million. The company focuses on providing specialized expertise across various sectors globally.

CRA International, a dynamic player in the consulting sector, has demonstrated impressive financial health with earnings growing by 20.7% over the past year, surpassing industry growth of 10.2%. The company's net debt to equity ratio stands at a satisfactory 17.4%, while interest payments are well covered by EBIT at 16.4 times coverage. Trading at about 30% below estimated fair value, CRAI appears undervalued with high-quality earnings and positive free cash flow. Despite these strengths, challenges such as increased debt levels and potential staff overextension could impact future performance if not addressed effectively.

Gibraltar Industries (NasdaqGS:ROCK)

Simply Wall St Value Rating: ★★★★★★

Overview: Gibraltar Industries, Inc. is a company that manufactures and provides products and services for the renewable energy, residential, agtech, and infrastructure markets both in the United States and internationally, with a market cap of approximately $1.79 billion.

Operations: Gibraltar Industries generates revenue primarily from its Residential segment at $791.12 million, followed by Renewables at $302.65 million, Agtech at $152.48 million, and Infrastructure at $89.27 million.

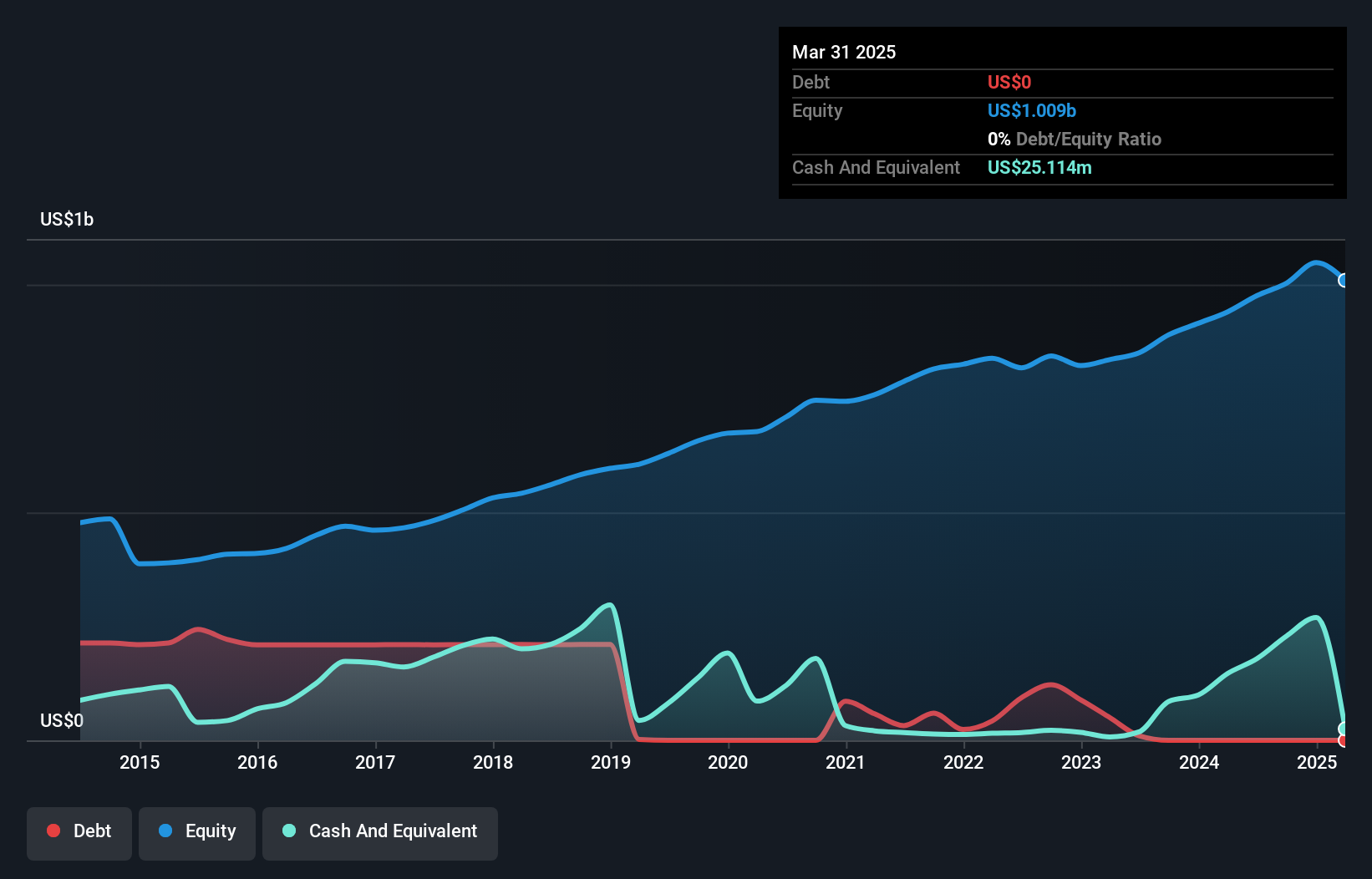

Gibraltar Industries seems to be a promising player in the building products sector, showing resilience despite recent challenges. The company reported third-quarter sales of US$361 million, down from US$391 million the previous year, with net income at US$34 million compared to US$39 million previously. Earnings per share stood at US$1.11 versus last year's US$1.28. Despite these figures, Gibraltar's strategic buyback of 139,427 shares for nearly $9 million reflects confidence in its long-term value proposition. With no debt and a focus on innovation like the 1P tracker product, it remains well-positioned amidst industry volatility.

ScanSource (NasdaqGS:SCSC)

Simply Wall St Value Rating: ★★★★★★

Overview: ScanSource, Inc. is a distributor of technology products and solutions operating in the United States, Canada, and Brazil with a market cap of $1.14 billion.

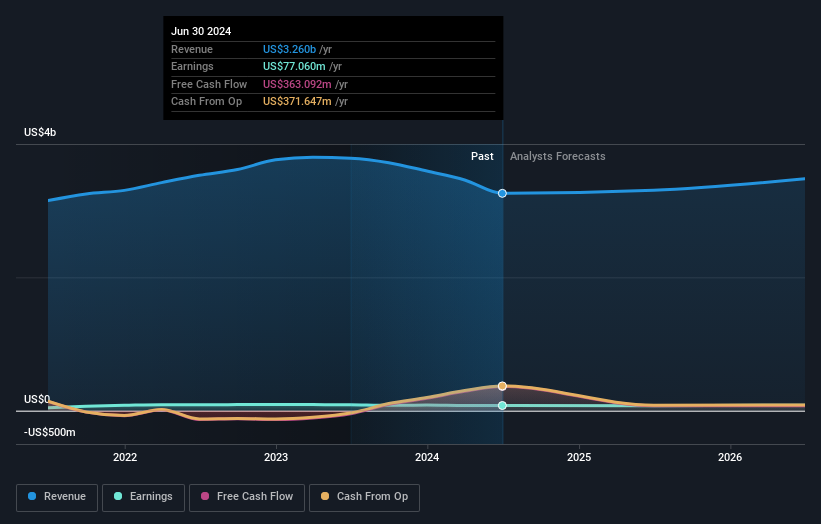

Operations: The company generates revenue primarily from its Specialty Technology Solutions segment, which accounts for $1.90 billion. The Segment Adjustment contributes an additional $1.26 billion to the total revenue stream.

ScanSource, a nimble player in the distribution sector, is navigating through strategic shifts with recent acquisitions like Resourcive and Advantix to bolster high-margin revenue streams. Their debt to equity ratio has impressively dropped from 41.4% to 15.6% over five years, showcasing financial discipline. Despite a slight earnings dip of -1.1%, their price-to-earnings ratio remains attractive at 14.6x compared to the US market's average of 18.4x, indicating good value potential. The company repurchased 588,018 shares for US$27.96 million recently, signaling confidence in its growth prospects amid evolving industry dynamics and competitive pressures.

Turning Ideas Into Actions

- Get an in-depth perspective on all 248 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROCK

Gibraltar Industries

Manufactures and provides products and services for the renewable energy, residential, agtech, and infrastructure markets in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives