- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:RVSN

Here's Why We're Watching Rail Vision's (NASDAQ:RVSN) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, Rail Vision (NASDAQ:RVSN) shareholders have done very well over the last year, with the share price soaring by 216%. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

In light of its strong share price run, we think now is a good time to investigate how risky Rail Vision's cash burn is. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Rail Vision

Does Rail Vision Have A Long Cash Runway?

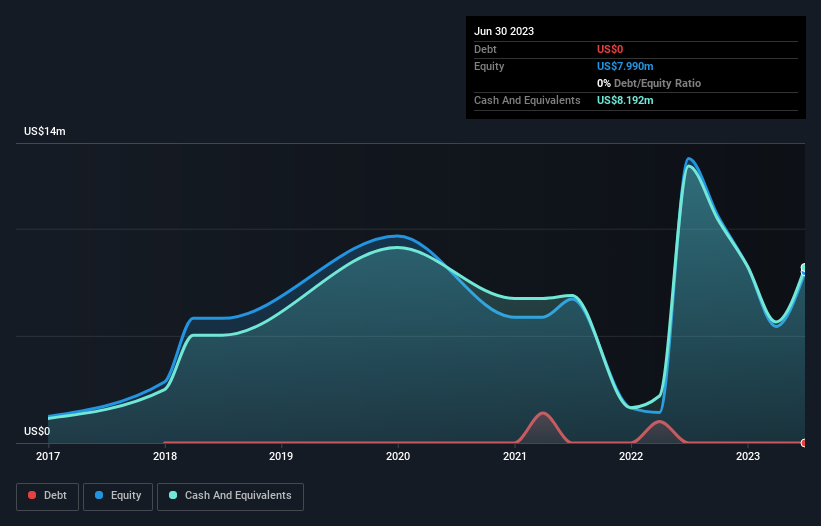

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In June 2023, Rail Vision had US$8.2m in cash, and was debt-free. In the last year, its cash burn was US$10m. That means it had a cash runway of around 10 months as of June 2023. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. Depicted below, you can see how its cash holdings have changed over time.

How Is Rail Vision's Cash Burn Changing Over Time?

Whilst it's great to see that Rail Vision has already begun generating revenue from operations, last year it only produced US$202k, so we don't think it is generating significant revenue, at this point. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. As it happens, the company's cash burn reduced by 3.6% over the last year, which suggests that management may be mindful of the risks of their depleting cash reserves. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Rail Vision To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Rail Vision to raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Rail Vision's cash burn of US$10m is about 23% of its US$45m market capitalisation. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is Rail Vision's Cash Burn Situation?

On this analysis of Rail Vision's cash burn, we think its cash burn reduction was reassuring, while its cash runway has us a bit worried. Summing up, we think the Rail Vision's cash burn is a risk, based on the factors we mentioned in this article. On another note, we conducted an in-depth investigation of the company, and identified 6 warning signs for Rail Vision (5 are a bit unpleasant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RVSN

Rail Vision

Designs, develops, assembles, and sells railway detection systems for railway operational safety, efficiency, and predictive maintenance in Israel, Latin America, and the United States.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026