- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:RELL

Richardson Electronics (NASDAQ:RELL) Has Affirmed Its Dividend Of $0.06

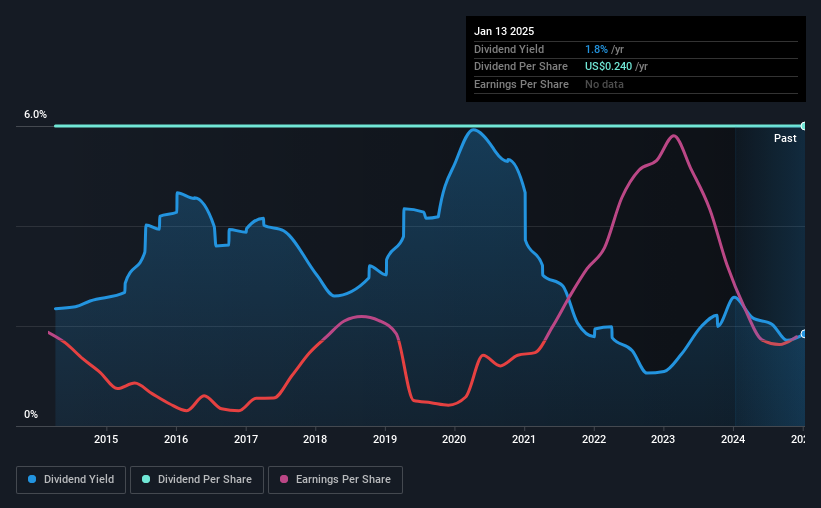

Richardson Electronics, Ltd. (NASDAQ:RELL) has announced that it will pay a dividend of $0.06 per share on the 26th of February. The dividend yield will be 1.8% based on this payment which is still above the industry average.

Check out our latest analysis for Richardson Electronics

Estimates Indicate Richardson Electronics' Could Struggle to Maintain Dividend Payments In The Future

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, Richardson Electronics' dividend was higher than its profits, but the free cash flows quite comfortably covered it. Generally, we think cash is more important than accounting measures of profit, so with the cash flows easily covering the dividend, we don't think there is much reason to worry.

Over the next year, EPS is forecast to expand by 134.5%. Assuming the dividend continues along recent trends, we think the payout ratio could get very high, which probably can't continue without starting to put some pressure on the balance sheet.

Richardson Electronics Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The most recent annual payment of $0.24 is about the same as the annual payment 10 years ago. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

Dividend Growth Could Be Constrained

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. We are encouraged to see that Richardson Electronics has grown earnings per share at 31% per year over the past five years. While EPS is growing rapidly, Richardson Electronics paid out a very high 730% of its income as dividends. If earnings continue to grow, this dividend may be sustainable, but we think a payout this high definitely bears watching.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 2 warning signs for Richardson Electronics that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RELL

Richardson Electronics

Provides engineered solutions, power grid and microwave tube, and related consumables in North America, the Asia Pacific, Europe, and Latin America.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hims & Hers Health aims for three dimensional revenue expansion

Endeavour Group's Future PE Expected to Climb to 15.51%

A Quality Compounder Marked Down on Overblown Fears

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion