- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:RELL

Is Richardson Electronics, Ltd.'s (NASDAQ:RELL) Recent Stock Performance Influenced By Its Fundamentals In Any Way?

Richardson Electronics' (NASDAQ:RELL) stock is up by a considerable 37% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Particularly, we will be paying attention to Richardson Electronics' ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Richardson Electronics

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Richardson Electronics is:

7.1% = US$8.9m ÷ US$125m (Based on the trailing twelve months to November 2021).

The 'return' refers to a company's earnings over the last year. That means that for every $1 worth of shareholders' equity, the company generated $0.07 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Richardson Electronics' Earnings Growth And 7.1% ROE

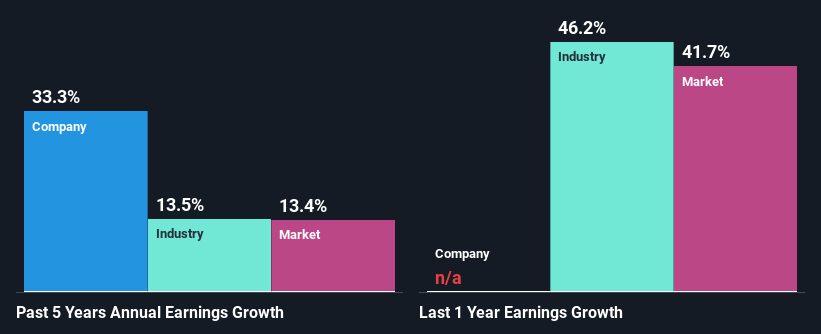

At first glance, Richardson Electronics' ROE doesn't look very promising. Next, when compared to the average industry ROE of 14%, the company's ROE leaves us feeling even less enthusiastic. However, we we're pleasantly surprised to see that Richardson Electronics grew its net income at a significant rate of 33% in the last five years. So, there might be other aspects that are positively influencing the company's earnings growth. Such as - high earnings retention or an efficient management in place.

As a next step, we compared Richardson Electronics' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 14%.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Richardson Electronics''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Richardson Electronics Making Efficient Use Of Its Profits?

Richardson Electronics' LTM (or last twelve month) payout ratio is a pretty moderate 36%, meaning the company retains 64% of its income. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like Richardson Electronics is reinvesting its earnings efficiently.

Additionally, Richardson Electronics has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

Overall, we feel that Richardson Electronics certainly does have some positive factors to consider. Even in spite of the low rate of return, the company has posted impressive earnings growth as a result of reinvesting heavily into its business. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 2 risks we have identified for Richardson Electronics.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RELL

Richardson Electronics

Provides engineered solutions, power grid and microwave tube, and related consumables in North America, the Asia Pacific, Europe, and Latin America.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Adobe (ADBE): Record Q1 AI-Revenue and the End of the Shantanu Narayen Era

MDxHealth (MDXH): Liquid Biopsy Hypergrowth and the Strategic Path to 10% EBITDA Margins

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks