In 2016 Yaron Ravkaie was appointed CEO of RADCOM Ltd. (NASDAQ:RDCM). First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for RADCOM

How Does Yaron Ravkaie's Compensation Compare With Similar Sized Companies?

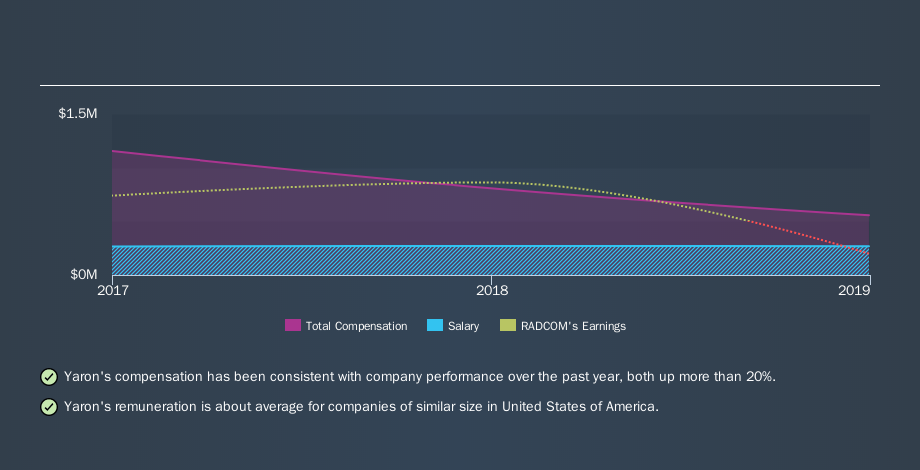

Our data indicates that RADCOM Ltd. is worth US$136m, and total annual CEO compensation was reported as US$557k for the year to December 2018. While we always look at total compensation first, we note that the salary component is less, at US$269k. We took a group of companies with market capitalizations below US$200m, and calculated the median CEO total compensation to be US$506k.

So Yaron Ravkaie is paid around the average of the companies we looked at. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context. Shareholders might be interested in this free visualization of analyst forecasts.

The graphic below shows how CEO compensation at RADCOM has changed from year to year.

Is RADCOM Ltd. Growing?

Over the last three years RADCOM Ltd. has shrunk its earnings per share by an average of 81% per year (measured with a line of best fit). It saw its revenue drop 31% over the last year.

Sadly for shareholders, earnings per share are actually down, over three years. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO.

Has RADCOM Ltd. Been A Good Investment?

With a three year total loss of 48%, RADCOM Ltd. would certainly have some dissatisfied shareholders. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Yaron Ravkaie is paid around the same as most CEOs of similar size companies.

After looking at EPS and total shareholder returns, it's certainly hard to argue the company has performed well, since both metrics are down. Few would argue that it's wise for the company to pay any more, before returns improve. Whatever your view on compensation, you might want to check if insiders are buying or selling RADCOM shares (free trial).

If you want to buy a stock that is better than RADCOM, this free list of high return, low debt companies is a great place to look.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:RDCM

RADCOM

Provides cloud-native and 5G-ready network intelligence solutions for communication service providers (CSPs).

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion