- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:RCAT

Red Cat Holdings (RCAT) Is Up 13.3% After $172.5M Raise for Unmanned Vessel Expansion – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Red Cat Holdings recently completed a public offering, raising approximately US$172.5 million by issuing 15,625,000 shares at US$9.60 each, with plans to invest in a new unmanned surface vessel division.

- Despite ongoing financial challenges and director share sales, increased call option trading suggests investors are interested in the company’s expansion ambitions and future initiatives.

- We’ll explore how Red Cat’s sizable capital raise and new division plans affect its investment narrative and future positioning.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Red Cat Holdings' Investment Narrative?

For anyone following Red Cat Holdings, the investment thesis is all about believing in the company's ability to translate ambitious defense technology bets, like its newly funded unmanned surface vessel division, into eventual market traction despite ongoing losses. The recent US$172.5 million capital raise is a clear signal of investor appetite for this transformation story, and it boosts Red Cat's balance sheet at a time when revenue and profitability are still well out of reach. Short-term catalysts now center on execution of maritime expansion as well as any contract or production milestones, while the persistent risks remain substantial: repeated insider selling, very high share price volatility, delayed financial filings, a pending class action, and the reality that new money also means greater shareholder dilution. The scale of this latest offering may alter the risk-return tradeoff, but with analysts already flagging challenges and the business still unprofitable, the biggest risks remain in execution, not just in fundraising.

However, insider selling and executive turnover are fresh hurdles investors should keep top of mind.

Exploring Other Perspectives

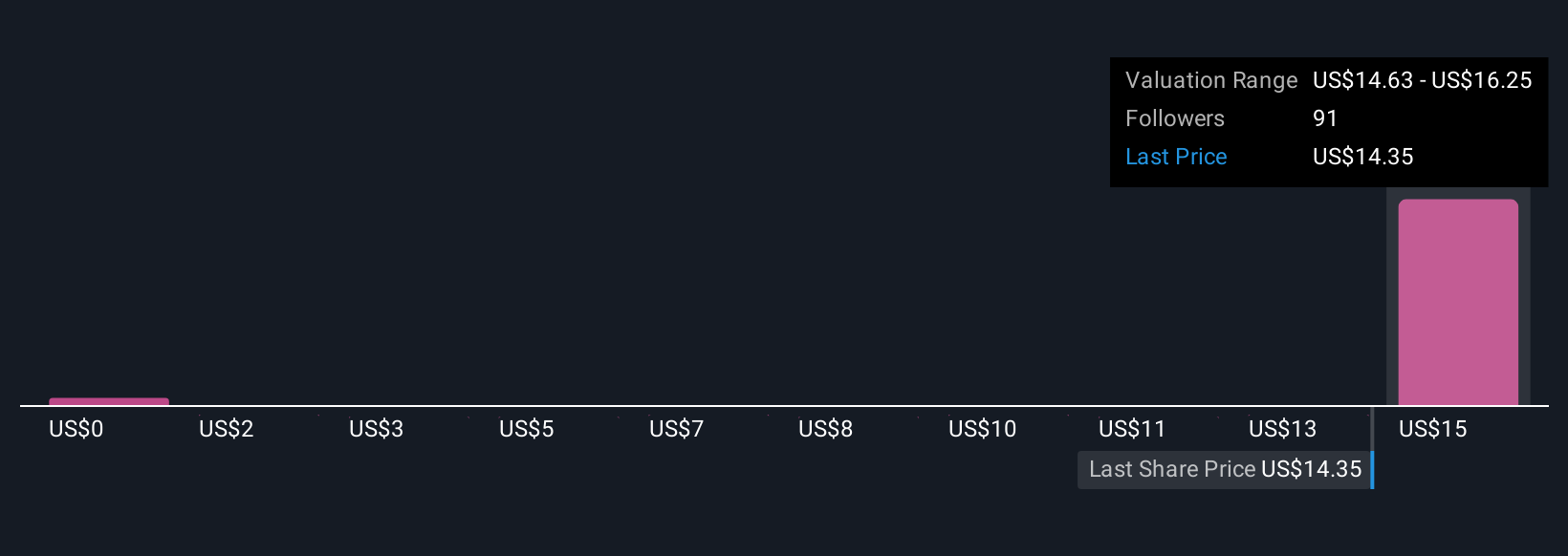

Explore 9 other fair value estimates on Red Cat Holdings - why the stock might be worth less than half the current price!

Build Your Own Red Cat Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Red Cat Holdings research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Red Cat Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Red Cat Holdings' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RCAT

Red Cat Holdings

Provides products, services, and solutions to the drone industry in the United States.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives