- United States

- /

- Communications

- /

- NasdaqGS:PCTI

Increases to CEO Compensation Might Be Put On Hold For Now at PCTEL, Inc. (NASDAQ:PCTI)

CEO David Neumann has done a decent job of delivering relatively good performance at PCTEL, Inc. (NASDAQ:PCTI) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 26 May 2021. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

View our latest analysis for PCTEL

Comparing PCTEL, Inc.'s CEO Compensation With the industry

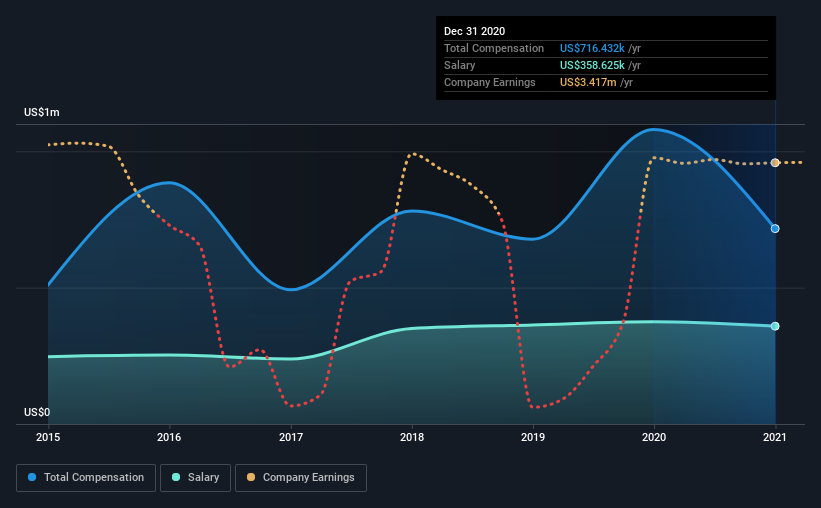

At the time of writing, our data shows that PCTEL, Inc. has a market capitalization of US$121m, and reported total annual CEO compensation of US$716k for the year to December 2020. That's a notable decrease of 34% on last year. We note that the salary of US$358.6k makes up a sizeable portion of the total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$434k. Accordingly, our analysis reveals that PCTEL, Inc. pays David Neumann north of the industry median. Moreover, David Neumann also holds US$1.8m worth of PCTEL stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$359k | US$375k | 50% |

| Other | US$358k | US$705k | 50% |

| Total Compensation | US$716k | US$1.1m | 100% |

On an industry level, around 23% of total compensation represents salary and 77% is other remuneration. It's interesting to note that PCTEL pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at PCTEL, Inc.'s Growth Numbers

PCTEL, Inc. has seen its earnings per share (EPS) increase by 2.4% a year over the past three years. Its revenue is down 11% over the previous year.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest improvement in EPS is good. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has PCTEL, Inc. Been A Good Investment?

PCTEL, Inc. has not done too badly by shareholders, with a total return of 7.3%, over three years. It would be nice to see that metric improve in the future. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for PCTEL that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade PCTEL, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:PCTI

PCTEL

PCTEL, Inc., together with its subsidiaries, provides industrial Internet of Thing devices (IoT), antenna systems, and test and measurement solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026