- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:OST

Revenues Working Against Ostin Technology Group Co., Ltd.'s (NASDAQ:OST) Share Price Following 37% Dive

Ostin Technology Group Co., Ltd. (NASDAQ:OST) shareholders that were waiting for something to happen have been dealt a blow with a 37% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 77% share price decline.

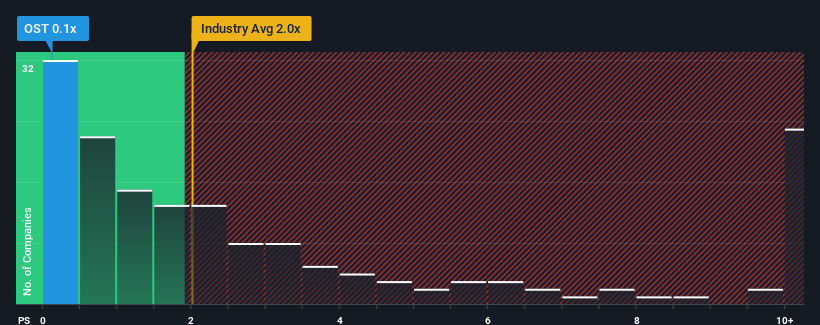

After such a large drop in price, Ostin Technology Group may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Electronic industry in the United States have P/S ratios greater than 2x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Ostin Technology Group

How Ostin Technology Group Has Been Performing

For instance, Ostin Technology Group's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Ostin Technology Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ostin Technology Group's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Ostin Technology Group?

In order to justify its P/S ratio, Ostin Technology Group would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 52%. As a result, revenue from three years ago have also fallen 78% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.2% shows it's an unpleasant look.

In light of this, it's understandable that Ostin Technology Group's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Ostin Technology Group's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Ostin Technology Group maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 4 warning signs for Ostin Technology Group (3 can't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Ostin Technology Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:OST

Ostin Technology Group

Through its subsidiaries, designs, develops, and manufactures thin-film transistor liquid crystal display (TFT-LCD) modules and polarizers in Mainland China, Hong Kong, Taiwan, and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.