- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:OSIS

OSI Systems (OSIS): Assessing Valuation After Record Earnings, Upbeat Guidance, and Legislative Tailwinds

Reviewed by Simply Wall St

OSI Systems (OSIS) just reported results that turned a few heads. The company not only topped Wall Street’s estimates for its latest quarter, but also posted record revenues and profits, fueled by standout performance in its Security and Optoelectronics divisions. What also caught attention was management’s upbeat guidance for the coming year, with revenue projected to grow beyond prior expectations and a record backlog, helped in part by new U.S. legislation providing funds for border and infrastructure security.

The market has taken notice. OSI Systems’ stock is now up 56% over the past year, with most of those gains coming alongside a steady stream of contract wins and stronger-than-expected earnings. While momentum hasn’t been entirely linear, the stock’s climb has occurred as optimism around federal spending has grown and the company’s backlog has topped $1.8 billion, giving investors renewed confidence in its growth prospects.

All the good news raises a familiar question: after a year of strong returns, should investors view OSI Systems as an undervalued growth story, or has the market already factored in the best days ahead?

Most Popular Narrative: 6% Undervalued

According to community narrative, OSI Systems is seen as modestly undervalued based on analyst consensus about its growth outlook, profit margins, and industry dynamics.

The Security division's strong backlog and increasing recurring service revenues, driven by expanding aviation and border security contracts, are expected to enhance future earnings. This could lead to increased confidence in revenue stability and higher margins.

Wondering what’s fueling this bullish price target? The narrative points to bold growth assumptions and a profit trajectory not often seen in this sector. Curious which future milestones could push OSI higher, or expose the risks beneath the surface? Find out what top analysts are betting on to justify this premium valuation.

Result: Fair Value of $243.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, changes in U.S. defense policies or unexpected slowdowns in global aviation security upgrades could put pressure on OSI Systems’ growth outlook.

Find out about the key risks to this OSI Systems narrative.Another View: Our DCF Model Weighs In

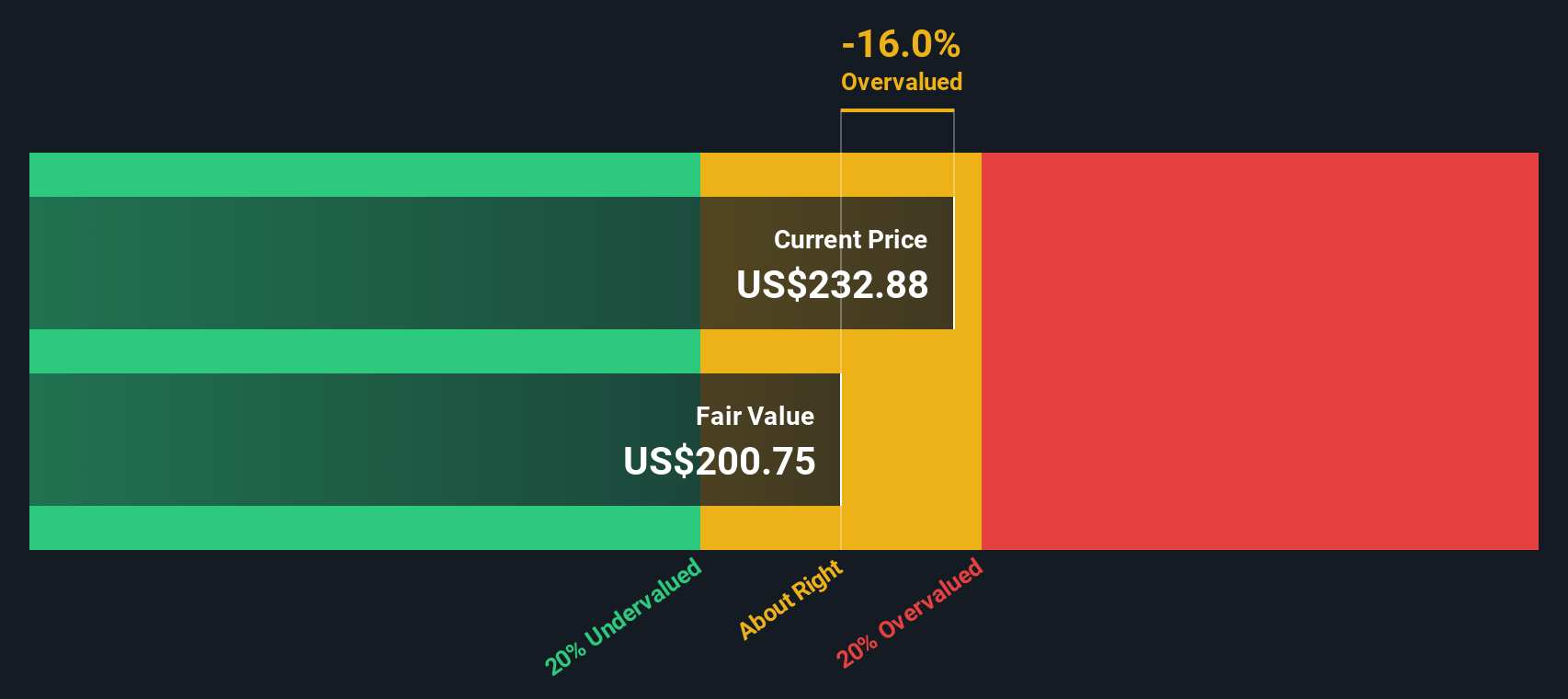

While analysts see OSI Systems as slightly undervalued based on growth and profit projections, our DCF model takes a different stance and suggests the shares may be trading above fair value. Which approach provides a more accurate perspective?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OSI Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OSI Systems Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can assemble your own OSI Systems story in just a few minutes. do it your way.

A great starting point for your OSI Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Seize More Opportunities with Unique Stock Picks

Why limit your strategy to just one stock when there are countless compelling stories taking shape right now? Unlock access to investment ideas that match your goals and stay ahead of the market’s curve with these hand-selected themes:

- Target stable income sources by reviewing dividend stocks with yields > 3%, which may help boost your portfolio with reliable yields above 3%.

- Catch the momentum in next-generation healthcare by exploring emerging opportunities among healthcare AI stocks. AI is transforming the way we approach medical innovation.

- Capitalize on strong fundamentals in overlooked segments with penny stocks with strong financials. These stand out for their robust financial health and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OSIS

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives