- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Ondas Holdings (ONDS): Examining Valuation After Strategic $41 Million Investment in Kopin Corporation

Reviewed by Kshitija Bhandaru

Ondas Holdings (ONDS) has shaken things up with a strategic investment in Kopin Corporation as part of a $41 million private placement. This move targets microdisplay and AI-powered drone solutions and aligns with Ondas’ integrated technology goals.

See our latest analysis for Ondas Holdings.

The past year has seen Ondas Holdings capture attention with moves like its inclusion in the S&P Global BMI Index and the addition of a seasoned defense leader to its advisory board. Momentum in AI-powered drone technologies is picking up. This larger strategic story is matched by a solid 11.4% one-year total shareholder return, which shows that investors are responding to both near-term innovation and the company’s long-term prospects.

If today’s defense tech highlights sparked your curiosity, it’s worth expanding your search and discovering fast growing stocks with high insider ownership

But with shares recently returning more than 11 percent over the past year, investors might wonder if Ondas Holdings is flying under the radar at a discount or if the market already reflects its future trajectory and growth prospects.

Most Popular Narrative: 56% Overvalued

Ondas Holdings' most followed narrative estimates a fair value well below the current share price, creating an intriguing divergence between analyst outlook and the market’s optimism. The company closed at $9.21, versus a consensus narrative value of $5.90. This represents a stark disconnect for investors to consider.

The company is viewed as well-positioned within the fast-growing unmanned aerial systems industry, targeting high-growth market verticals with a comprehensive end-to-end drone portfolio. Analysts note significant recent traction in the defense market, underpinning confidence in sustained, industry-leading revenue growth and execution on Ondas’ strategic roadmap.

Want a behind-the-scenes look at the calculations driving this ambitious valuation? The real engine of this narrative is rooted in game-changing assumptions about future revenue and profit margins. Curious which bullish projections could justify the soaring price tag? See what’s fueling the high-stakes story behind the stock.

Result: Fair Value of $5.90 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in platform adoption and volatility in gross margins could undermine the bullish outlook for Ondas Holdings, particularly if revenue growth slows.

Find out about the key risks to this Ondas Holdings narrative.

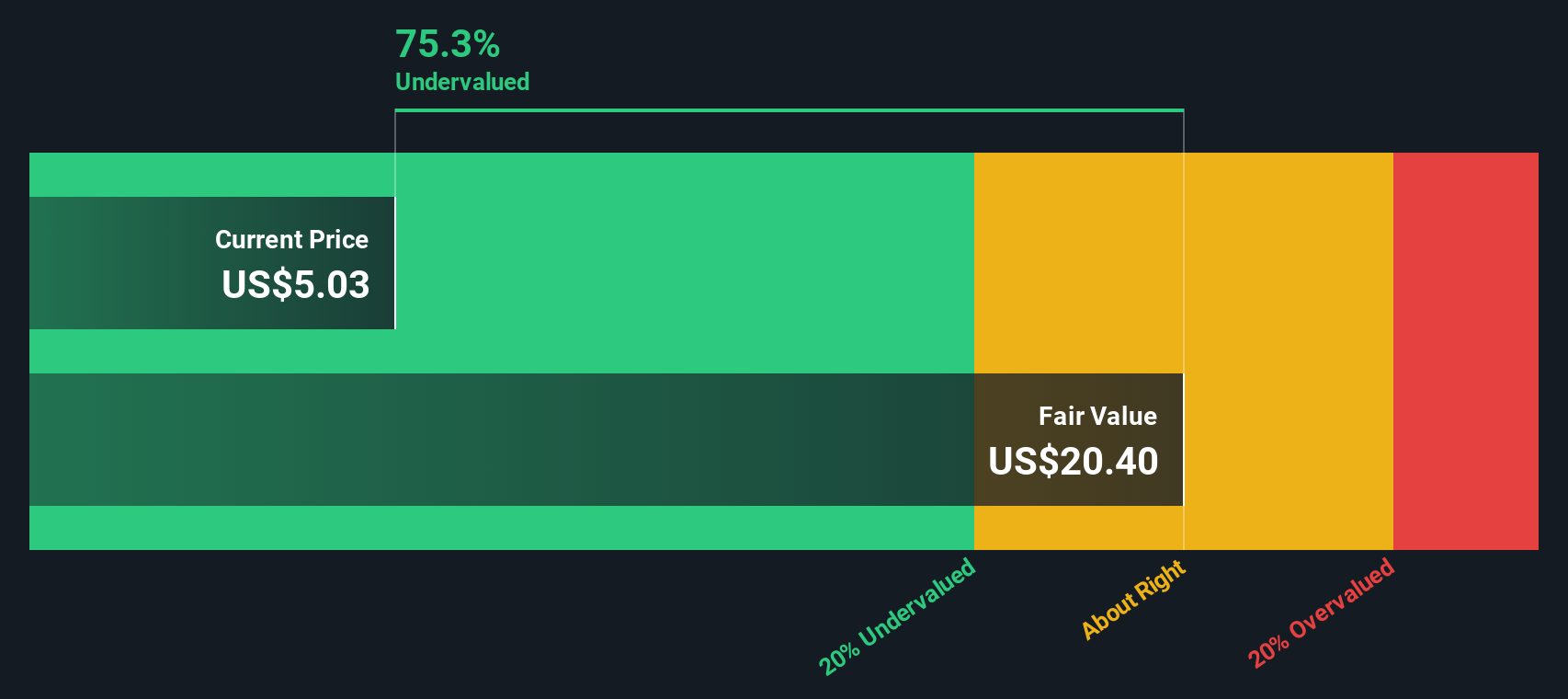

Another View: Discounted Cash Flow Model Suggests Upside

For a different perspective, the Simply Wall St DCF model estimates Ondas Holdings' fair value at $16.20 per share. This is significantly higher than recent trading levels. While market prices reflect certain risks, this approach hints at a possible undervaluation. Which side of the story will play out for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ondas Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ondas Holdings Narrative

If you’d rather shape your own outlook or prefer to dig into the numbers yourself, it’s easy to craft your own scenario in just a few minutes. Do it your way.

A great starting point for your Ondas Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on other breakthrough opportunities. Some of the market’s most exciting stocks are just a click away with the right strategy and research.

- Tap into the fast pace of innovation by checking out these 24 AI penny stocks, transforming industries with advanced artificial intelligence solutions and automation technologies.

- Seize the potential for steady returns by finding these 19 dividend stocks with yields > 3%, offering higher yields and consistent income streams to support your long-term goals.

- Ride the next wave of technological disruption by investigating these 26 quantum computing stocks, at the forefront of quantum computing, cybersecurity, and future-ready hardware.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives