- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Is Ondas Holdings' (ONDS) Capital Raise Signaling a Strategic Shift in Autonomous Defense Ambitions?

Reviewed by Simply Wall St

- Earlier this month, Ondas Holdings completed a US$200 million follow-on equity offering and filed multiple shelf registrations covering common stock, preferred stock, debt securities, warrants, and units, signaling robust capital-raising activity.

- These fundraising efforts appear closely linked to Ondas's recent launch of Ondas Capital, a business unit aimed at expanding unmanned and autonomous system deployment across Allied defense and security markets, with new leadership and a multinational presence.

- We'll examine how Ondas Holdings' expanded capital base may influence its growth ambitions in defense and autonomous systems markets.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Ondas Holdings Investment Narrative Recap

To own Ondas Holdings stock, you likely need to believe that advancing technology in unmanned and autonomous systems, together with increased capital resources, will drive a step-change in defense and security market opportunities. The recent US$200 million equity raise substantially bolsters Ondas’s ability to pursue growth in these segments, yet it also increases the importance of rapidly converting that capital into revenue momentum and margin improvement, particularly given ongoing losses and volatility in demand at Ondas Networks, which remains a central risk for shareholders.

Of all recent announcements, the launch of Ondas Capital is closely tied to these fundraising efforts, as it signals an intent to deploy new resources for direct investments and advisory offerings focused on Allied defense markets. With a multinational presence and leadership led by sector specialists, this business expansion is positioned as a near-term catalyst, especially if it accelerates the commercial deployment of Ondas’s Optimus and Iron Drone platforms and supports progress toward the company’s revenue targets for 2025.

By contrast, investors should not overlook the continued risk related to high cash burn and the potential for share dilution...

Read the full narrative on Ondas Holdings (it's free!)

Ondas Holdings' narrative projects $151.6 million revenue and $16.3 million earnings by 2028. This requires 141.1% yearly revenue growth and a $63.2 million earnings increase from -$46.9 million currently.

Uncover how Ondas Holdings' forecasts yield a $5.38 fair value, a 18% downside to its current price.

Exploring Other Perspectives

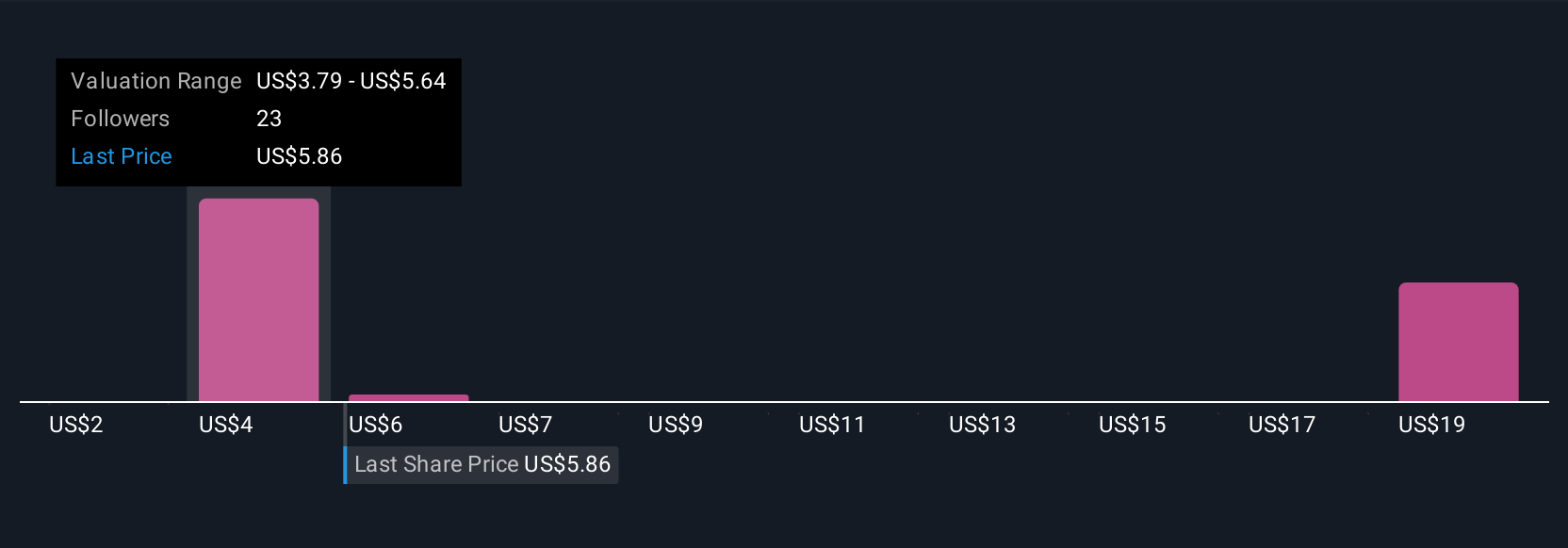

Simply Wall St Community members produced nine fair value estimates for Ondas Holdings ranging from US$1.03 to US$16.32 per share. While views diverge, many maintain a watchful eye on the company’s ability to translate new capital into meaningful revenue growth given the highly competitive defense and technology markets, reinforcing just how many alternative viewpoints are worth considering.

Explore 9 other fair value estimates on Ondas Holdings - why the stock might be worth less than half the current price!

Build Your Own Ondas Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ondas Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ondas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ondas Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives