- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Could Ondas Holdings’ (ONDS) Expanded Drone Partnership Reshape Its Role in US Defense Tech?

Reviewed by Sasha Jovanovic

- On October 13, 2025, Ondas Holdings announced the expansion of its partnership with Rift Dynamics to include advanced munitions provider Nammo Raufoss, focusing on the exclusive US deployment of integrated Wasp Drones with munition payloads via American Robotics.

- This development highlights the company's emphasis on delivering NDAA-compliant systems designed for rapid scale-up and mass deployment within the US defense sector.

- We will now assess how the expanded partnership and new NDAA-compliant drone-munitions system could influence Ondas Holdings' investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ondas Holdings Investment Narrative Recap

To hold Ondas Holdings, you need to believe in the long-term growth of its defense and autonomous systems capabilities, especially as they target government and military contracts. The expanded partnership with Nammo Raufoss sharpens investor focus on near-term revenue execution, but the largest risk remains the company’s ability to convert these high-profile collaborations into profitable contracts fast enough to offset significant ongoing losses and liquidity pressures.

Among recent developments, the series of equity offerings completed through October 2025 stands out as highly relevant. These offerings signal the company’s need to secure additional capital to fund its operations and expansion, and they accompany the new defense-focused product launches, illustrating both the opportunities and the pressure on Ondas to deliver results as expectations rise. Despite promising new alliances, investors should be aware of the heightened risk that...

Read the full narrative on Ondas Holdings (it's free!)

Ondas Holdings' outlook projects $151.6 million in revenue and $16.3 million in earnings by 2028. This is based on a forecast annual revenue growth rate of 141.1% and an earnings increase of $63.2 million from current earnings of -$46.9 million.

Uncover how Ondas Holdings' forecasts yield a $8.17 fair value, a 5% upside to its current price.

Exploring Other Perspectives

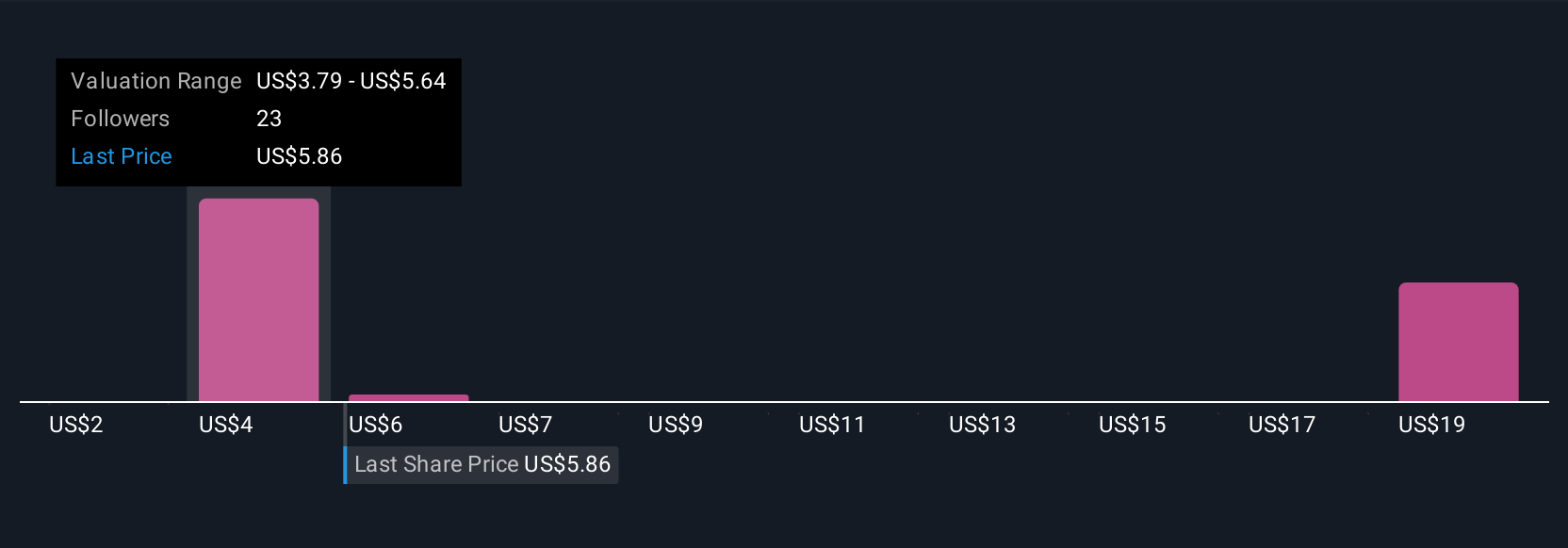

Fair value estimates from 13 Simply Wall St Community members for Ondas Holdings range from US$0.47 to US$13.28 per share. With opinions spanning this wide spectrum, consider how recent capital raises and a demanding path to profitability could influence the company’s financial runway.

Explore 13 other fair value estimates on Ondas Holdings - why the stock might be worth less than half the current price!

Build Your Own Ondas Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ondas Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ondas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ondas Holdings' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives