- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Assessing Ondas Holdings (ONDS) Valuation After Its Recent Share Price Momentum

Reviewed by Simply Wall St

Ondas Holdings (ONDS) has been on a wild ride this year, and the stock’s latest move is catching more investor attention. With sharp swings but strong gains over the past 3 months, it is prompting a closer look.

See our latest analysis for Ondas Holdings.

That surge to a recent share price of $8.09 comes after a choppy stretch. However, the 3 month share price return of 32.62 percent and 1 year total shareholder return of 384.43 percent suggest momentum is still firmly building around Ondas as investors reassess its growth story and risk profile.

If Ondas has you rethinking what strong momentum can look like, it is worth exploring fast growing stocks with high insider ownership as another way to uncover standout growth stories on your radar.

Yet with rapid revenue growth, persistent losses, and a share price still sitting well below analyst targets, investors face a key question: Is Ondas undervalued today, or is the market already pricing in its future growth?

Most Popular Narrative: 26.5% Undervalued

With Ondas Holdings last closing at $8.09 against a fair value estimate of $11.00, the most closely watched narrative leans toward meaningful upside potential grounded in aggressive growth and margin expansion assumptions.

The analysts have a consensus price target of $2.5 for Ondas Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $3.0, and the most bearish reporting a price target of just $2.0.

Want to see what justifies a double digit fair value uplift, despite deep current losses? The narrative leans on explosive revenue scaling, rising margins, and a rich future earnings multiple. Curious how those moving parts combine into that target valuation? The full story connects the dots.

Result: Fair Value of $11.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on execution, and setbacks in integrating acquisitions or converting backlog amid high operating costs could quickly undermine the growth narrative.

Find out about the key risks to this Ondas Holdings narrative.

Another View: Rich on Book Value

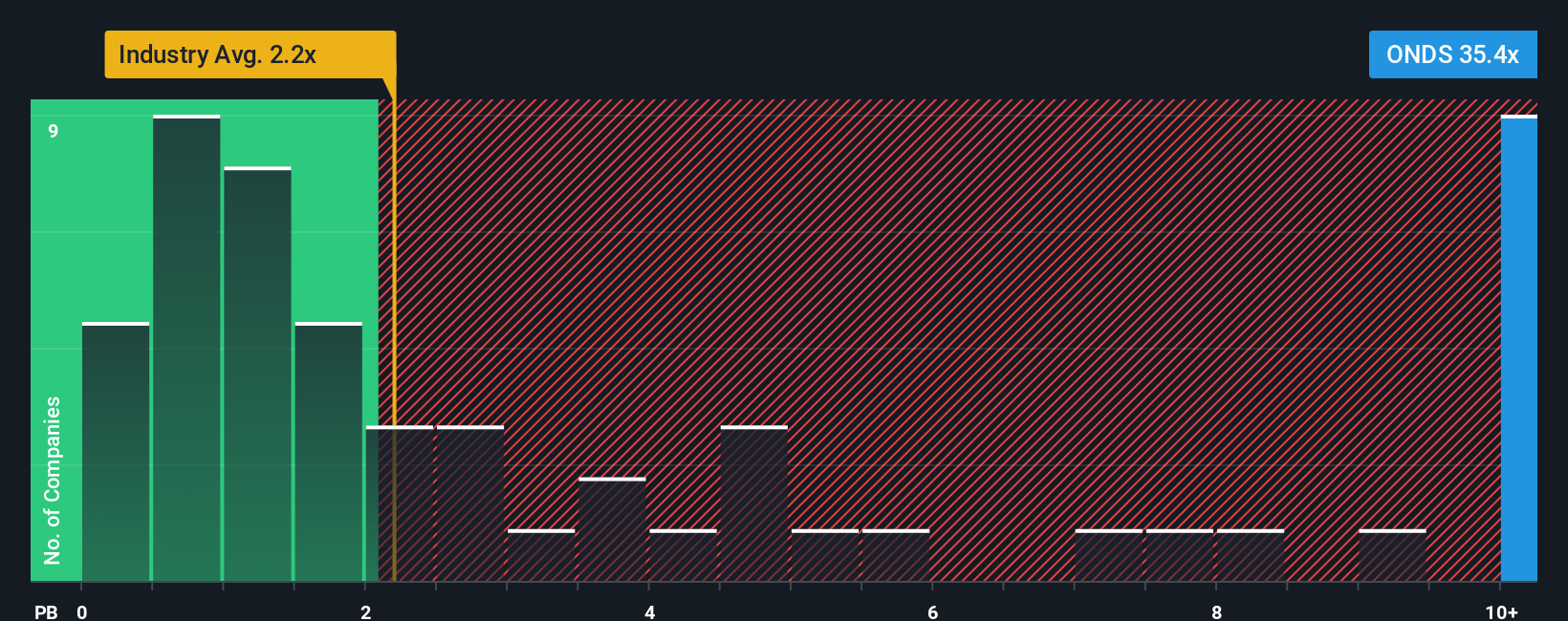

While the narrative fair value and growth forecasts suggest upside, a simpler book value lens tells a different story. Ondas trades at 6.2 times book value, far above the US Communications industry at 1.9 times and the peer average of 3.6 times. This hints at a stretched valuation if execution wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ondas Holdings Narrative

If you see Ondas differently or want to dig into the numbers yourself, you can build a personalized narrative in just minutes by starting with Do it your way.

A great starting point for your Ondas Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Before sentiment shifts again, put your momentum to work with fresh, data backed stock ideas from the Simply Wall St Screener that you can act on today.

- Capture potential mispricings by targeting companies trading below their estimated cash flow value through these 915 undervalued stocks based on cash flows tailored to forward looking investors.

- Ride structural shifts in medicine by scanning these 30 healthcare AI stocks focused on innovators using algorithms to reshape diagnostics and treatment.

- Capitalize on market volatility by filtering these 80 cryptocurrency and blockchain stocks packed with businesses building real world applications around digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion