- United States

- /

- Communications

- /

- NasdaqGS:NTCT

Assessing NetScout Systems (NTCT) Valuation After Recent Share Price Momentum And Analyst Expectations

Reviewed by Simply Wall St

Why NetScout Systems Is On Investors’ Radar Today

NetScout Systems (NTCT) has been drawing attention after a period where its share price has moved differently across time frames, including a 1 day decline, a flat month, and positive past 3 months and 1 year returns.

See our latest analysis for NetScout Systems.

With the share price at $27.20, NetScout Systems has seen a 5.84% 90 day share price return and a 25% 1 year total shareholder return, which indicates recent momentum alongside some shorter term pullbacks.

If NetScout has put the tech sector on your radar, this could be a moment to see what else is moving and compare it with high growth tech and AI stocks.

With NetScout trading at $27.20, some investors will focus on its 38.58% intrinsic discount and 11.85% gap to analyst targets and ask the key question: is this a genuine mispricing, or is the market already accounting for future growth potential?

Most Popular Narrative: 12.5% Undervalued

With NetScout Systems last closing at $27.20 and the narrative fair value at $31.09, the focus is on whether current pricing fully reflects its earnings and margin outlook.

The analysts have a consensus price target of $25.817 for NetScout Systems based on their expectations of its future earnings growth, profit margins, and other risk factors. However, there is some disagreement among analysts, with the most bullish reporting a price target of $33.0 and the most bearish reporting a price target of $21.0.

Curious what sits behind that fair value gap? The narrative emphasizes modest revenue growth, slimmer profit margins, and a future earnings multiple that assumes investor confidence holds. Want to see how those moving parts fit together?

Result: Fair Value of $31.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change if cloud migration and IT stack consolidation reduce demand for legacy products, or if pricing pressure squeezes the margins that analysts are assuming.

Find out about the key risks to this NetScout Systems narrative.

Another Angle On Valuation

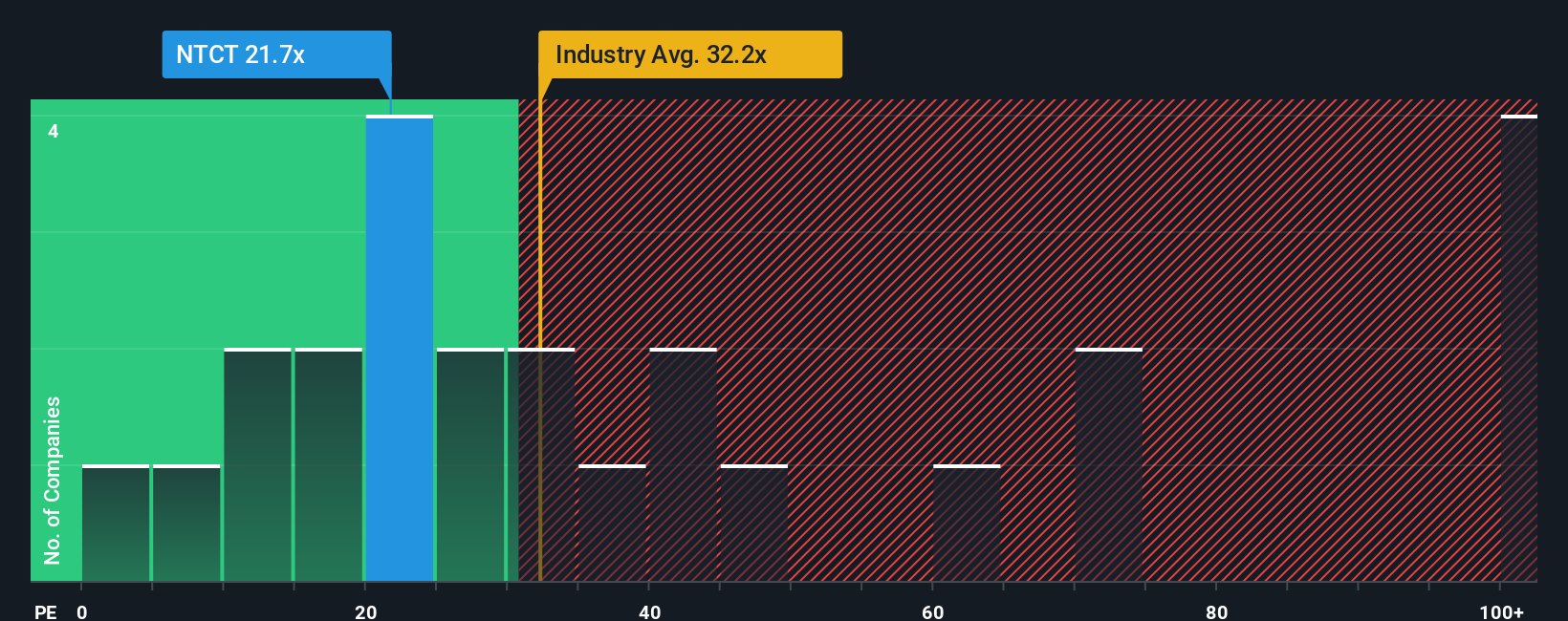

NetScout looks inexpensive compared with our fair value estimate. However, its P/E of 21.9x is above the fair ratio of 18.2x. It is still below the US Communications industry at 39.5x and close to peers at 22.4x. Is this a margin of safety or a warning flag?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NetScout Systems Narrative

If you think this view misses something or simply prefer to test your own assumptions with the numbers, you can build a full NetScout story yourself in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding NetScout Systems.

Looking for more investment ideas?

If NetScout has you thinking more broadly about your portfolio, this is a great moment to line up a few other ideas before the market moves without you.

- Spot potential value setups early by scanning these 881 undervalued stocks based on cash flows that may be pricing in more caution than their cash flows suggest.

- Chase future growth themes by checking out these 28 AI penny stocks that are tied to real business models instead of just hype.

- Build a steadier income stream with these 11 dividend stocks with yields > 3% that already offer yields above 3% and might complement your growth positions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetScout Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTCT

NetScout Systems

Provides service assurance and cybersecurity solutions to protect digital business services against disruptions in the United States, Europe, Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

GameStop will ace the financial crisis wave with its strategic Bitcoin investment and cash reserves

BABA Analysis: Buying the Fear, Holding the Cloud

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026