- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NSSC

Should Napco Security Technologies’ (NSSC) Earnings Beat Prompt a Rethink of Its Growth Outlook?

Reviewed by Sasha Jovanovic

- In its most recent financial results, Napco Security Technologies delivered the largest analyst estimates beat among its peers, outperforming expectations by 14.1% and surprising the market with its performance.

- This significant outperformance came despite previous concerns about softer demand trends and subscale operations, highlighting the company's ability to deliver above expectations even in a challenging environment.

- We'll explore how Napco’s substantial earnings beat could reshape analyst assumptions about its future revenue and earnings growth trajectory.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Napco Security Technologies Investment Narrative Recap

To be a Napco Security Technologies shareholder, you need to believe in the company’s ability to grow its high-margin recurring service revenue amid ongoing digital transformation and evolving security needs, despite recent hardware demand headwinds. The impressive earnings beat could prompt renewed optimism around short-term margin stability, but the most significant risk, sustained weakness in hardware sales, remains largely unchanged after this report.

Among recent company announcements, the showcase of StarLink Fire MAX 2 and MVP EZ platforms at ISC West 2025 stands out as most relevant to Napco’s growth catalysts, reinforcing the company’s push to expand recurring revenue streams through innovative product launches that target new markets and increase customer retention.

Yet, despite this positive momentum, the potential for continued gross margin compression due to hardware pricing pressures is a risk investors should not overlook, especially if...

Read the full narrative on Napco Security Technologies (it's free!)

Napco Security Technologies' outlook projects $233.3 million in revenue and $57.8 million in earnings by 2028. This scenario assumes 8.7% annual revenue growth and a $14.4 million increase in earnings from the current $43.4 million.

Uncover how Napco Security Technologies' forecasts yield a $40.33 fair value, a 8% downside to its current price.

Exploring Other Perspectives

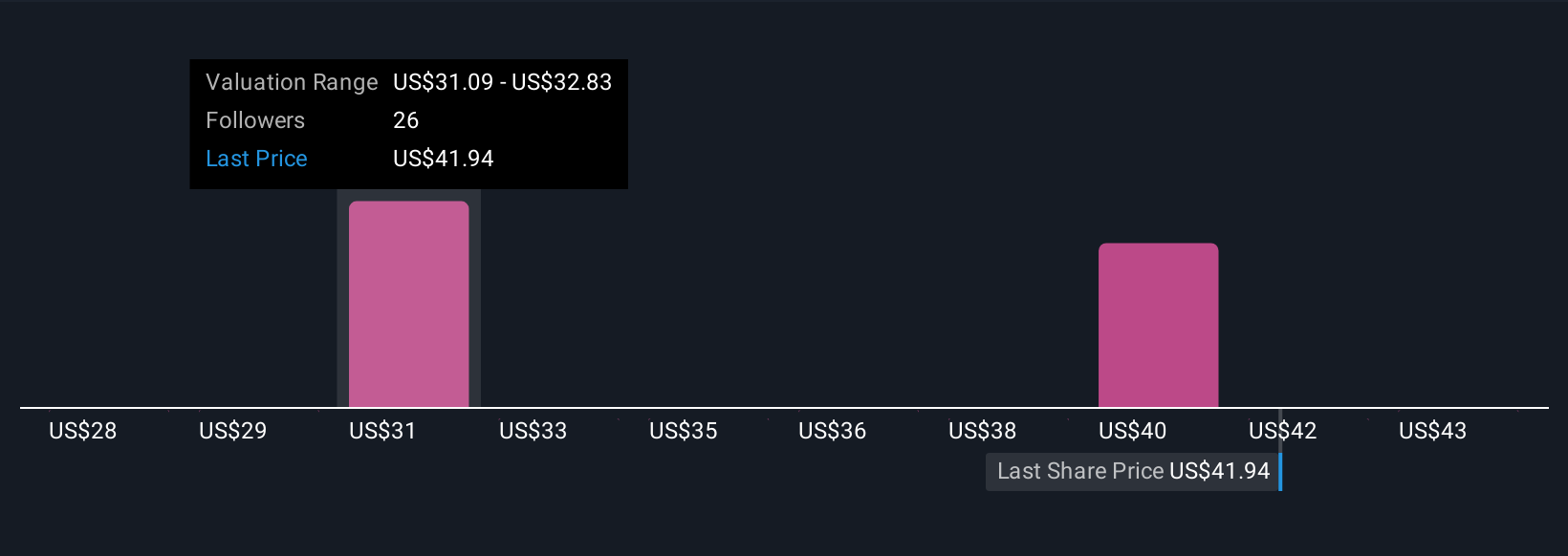

Six Simply Wall St Community members estimate Napco’s fair value between US$27.61 and US$45 per share. With such wide-ranging views, consider how ongoing hardware margin pressures could shape future outlooks and why it’s worth comparing multiple community insights.

Explore 6 other fair value estimates on Napco Security Technologies - why the stock might be worth as much as $45.00!

Build Your Own Napco Security Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Napco Security Technologies research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Napco Security Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Napco Security Technologies' overall financial health at a glance.

No Opportunity In Napco Security Technologies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Napco Security Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NSSC

Napco Security Technologies

Engages in the development, manufacturing, and sale of electronic security systems for commercial, residential, institutional, industrial, and governmental applications in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives