- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NOVT

Novanta (NOVT): Reassessing Valuation After Cautious Revenue Outlook and Persistent Investor Skepticism

Reviewed by Simply Wall St

Novanta (NVDA) recently drew fresh attention after Conestoga Capital Advisors pointed to its soft revenue growth and a quieter full-year outlook. Even though earnings came in above expectations, cautious investor sentiment still lingers.

See our latest analysis for Novanta.

Following cautious revenue signals and a muted full-year forecast, Novanta’s share price has struggled to regain momentum. Despite occasional relief rallies, it is down over 28% year-to-date, and the one-year total shareholder return stands at -36.96%. Recent events have clearly weighed on sentiment, with investors awaiting signs of a more persistent turnaround.

If you are weighing your next move in the tech sector, consider discovering other fast growers with high insider ownership. Sometimes that is where fresh opportunities emerge. fast growing stocks with high insider ownership

With Novanta’s share price trading well below analyst targets and sentiment at a low ebb, is this a hidden value play waiting for a rebound, or is the market simply pricing in realistic expectations for subdued growth?

Most Popular Narrative: 23% Undervalued

With Novanta trading at $108.43 and the most widely referenced narrative setting fair value at $141.50, the latest analysis positions shares well below this benchmark. This prompts a closer look at the assumptions behind the number.

The company's active pipeline of strategic acquisitions, supported by a robust balance sheet and increased credit facility, is allowing it to continually enter new high-growth, niche markets and increase its share of recurring, software-driven revenue. This is catalyzing long-term revenue growth and reducing earnings volatility.

Want to see what justifies this aggressive upside? There’s more driving this price target than hype. The narrative hinges on pivotal deal-making, margin expansion, and future profitability rarely seen in this sector. Curious which bold projections shape this outlook? Dive in for the full breakdown.

Result: Fair Value of $141.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade disruptions and reliance on acquisitions could challenge Novanta's ambitious growth outlook and potentially limit its ability to deliver the expected rebound.

Find out about the key risks to this Novanta narrative.

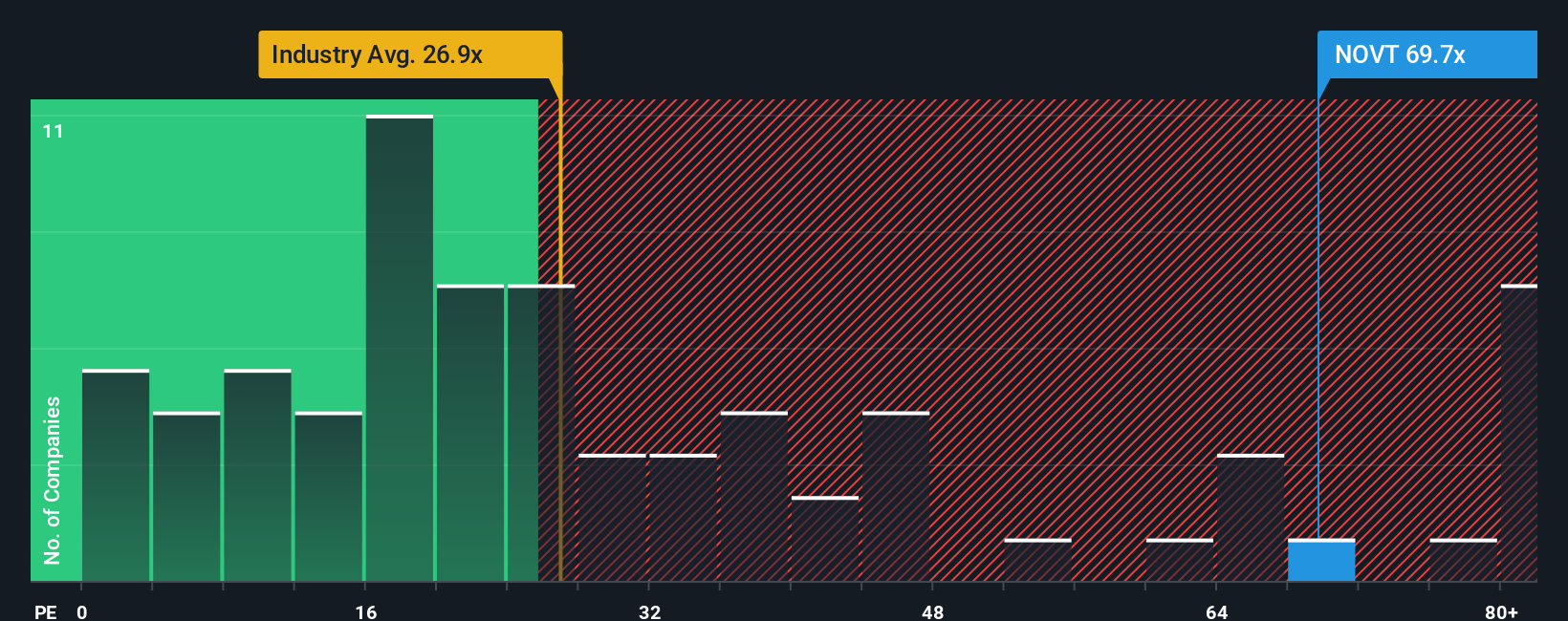

Another View: Market Multiples Raise Questions

Taking a step back from growth narratives, Novanta trades at a price-to-earnings ratio of 63.6 times. This is not only higher than the industry average of 26.4 times but also exceeds the fair ratio of 37.5 times. This sizable premium means investors are paying much more than what comparable businesses and the fair value model would suggest. Is this optimism, or is the market overlooking risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Novanta Narrative

If you would rather dig into the fundamentals yourself or have your own perspective, you can craft your own take on Novanta in just a few minutes: Do it your way.

A great starting point for your Novanta research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Your investment journey should not stop here. Step confidently toward your next opportunity by checking out unique stocks and fast-moving sectors. There is always a market you might be missing.

- Spot strong cash flow potential and grab opportunities others might overlook by checking out these 876 undervalued stocks based on cash flows.

- Tap into booming digital trends and amp up your portfolio with exposure to these 79 cryptocurrency and blockchain stocks right now.

- Unlock consistent income streams by reviewing these 17 dividend stocks with yields > 3% with healthy yields and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novanta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NOVT

Novanta

Provides precision medicine, precision manufacturing, medical solutions, robotics and automation solutions, and advanced surgery solutions in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives