- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NOVT

Novanta (NOVT): How Slower Growth and Margin Pressure Are Shaping Its Current Valuation

Reviewed by Kshitija Bhandaru

Recent updates show Novanta (NOVT) facing softer financial performance, as revenue growth has not kept pace with its historical averages. Declining free cash flow margins may also hint at a shifting capital landscape for the company.

See our latest analysis for Novanta.

After a challenging set of results, Novanta’s share price has kept sliding, down 12.7% in the last month and experiencing a steep 43.4% total return decline over the past year. Momentum has clearly turned negative, as investors respond to slowing growth and changing expectations around profitability.

If you’re on the lookout for companies that are bucking the trend and showing fresh potential, now’s a smart time to discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and negative sentiment weighing on valuations, investors are left to consider whether Novanta’s challenges are fully reflected in the price. Alternatively, there may still be further upside remaining.

Most Popular Narrative: 29.4% Undervalued

With Novanta’s consensus fair value set at $141.50 and shares last closing at $99.96, the narrative signals a substantial gap that could mean missed upside or continued skepticism. High expectations for future growth and profitability frame the outlook, making this valuation worth exploring in detail.

"Rapid adoption of robotics and automation in manufacturing and healthcare (including AI-enabled warehouse automation, surgical robotics, and future humanoid robotics) is accelerating demand for Novanta's advanced sensing and precision motion technologies. The company's design wins and multi-year contracts (e.g., $50M warehouse robotics deal, multiple new design wins in physical AI and robotics) position it to grow revenue at above-market rates through 2026 and beyond."

Want the inside story behind that bold price target? Discover why the narrative leans on aggressive growth forecasts, higher profit margins, and a premium valuation multiple that is rarely seen outside sector leaders. Don’t miss which exact financial drivers are expected to push Novanta’s value far above its current price.

Result: Fair Value of $141.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower organic growth or delays in integrating acquisitions could quickly undermine the optimistic outlook that supports current analyst targets for Novanta.

Find out about the key risks to this Novanta narrative.

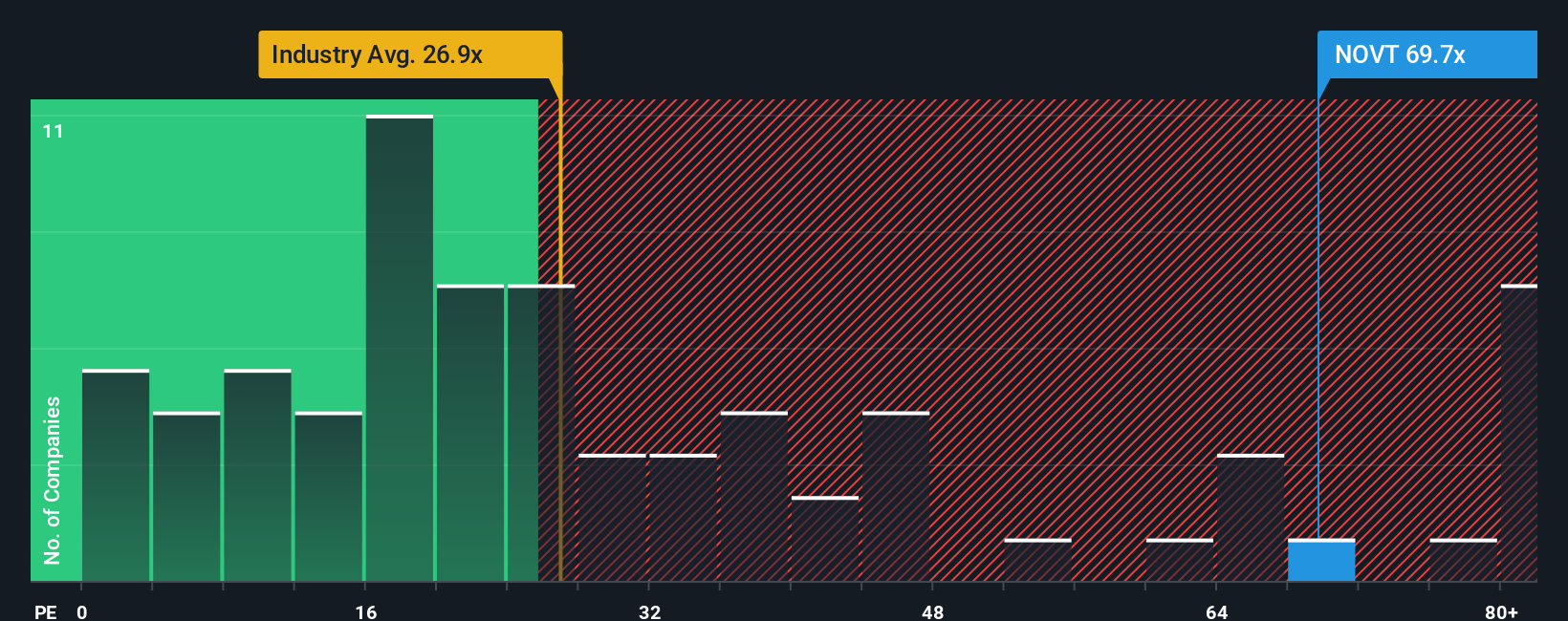

Another View: Multiples Raise Red Flags

Even with the narrative pointing to upside, a different angle emerges when looking at Novanta's earnings multiple. The shares currently trade at 58.6 times earnings, which is far higher than both the industry average of 24.9x and the peer group average of 22.3x. This is also well above the market’s fair ratio of 37.2x. This premium suggests the market expects exceptional growth, which may not materialize if recent challenges persist. Could this high multiple signal valuation risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Novanta Narrative

If you’re not convinced by this perspective, or you want a hands-on look at the numbers, shaping your own narrative takes less than three minutes. Do it your way

A great starting point for your Novanta research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the next big winner could be just a click away. Don’t leave money on the table by missing these targeted opportunities from our screener:

- Uncover the strongest income plays by targeting stocks with sustainable yields through these 19 dividend stocks with yields > 3%.

- Seize opportunities in high-potential breakthrough technology by researching these 24 AI penny stocks, which are shaping tomorrow’s digital landscape.

- Get ahead of the market by spotting bargains with robust upside using these 894 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novanta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NOVT

Novanta

Provides precision medicine, precision manufacturing, medical solutions, robotics and automation solutions, and advanced surgery solutions in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives