- United States

- /

- Communications

- /

- NasdaqCM:MOB

Taking Stock of Mobilicom (NasdaqCM:MOB)’s Valuation After Its Recent Share Price Strength

Reviewed by Simply Wall St

Mobilicom (MOB) has quietly turned into one of the stronger performers in defense-tech, with the stock up about 13% over the past day and roughly 21% over the past month.

See our latest analysis for Mobilicom.

That jump in the latest share price to $7.975, on top of a hefty year to date share price return, suggests investors are steadily repricing Mobilicom for higher growth and possibly lower perceived risk. Momentum appears to be building rather than fading.

If Mobilicom’s run has you rethinking your defense exposure, this is a good moment to explore other aerospace and security names through aerospace and defense stocks.

With revenue surging yet profits still in the red, and shares trading at a steep discount to analyst targets, the big question now is simple: is Mobilicom still mispriced, or is the market already discounting its next growth leg?

Price to Book of 5,199.8x: Is it justified?

Mobilicom’s latest close at $7.975 lines up with a towering price to book ratio of 5,199.8 times, putting its valuation far above peer levels.

Price to book compares a company’s market value to the net assets on its balance sheet. It is a common yardstick for asset light, high growth tech and communications names where tangible book value can understate future earnings potential.

In this case, however, Mobilicom’s price to book multiple near 5,200 times, versus a peer average of 22.6 times and a broader US Communications industry average of just 2 times, signals that investors are paying a large premium relative to the company’s current asset base.

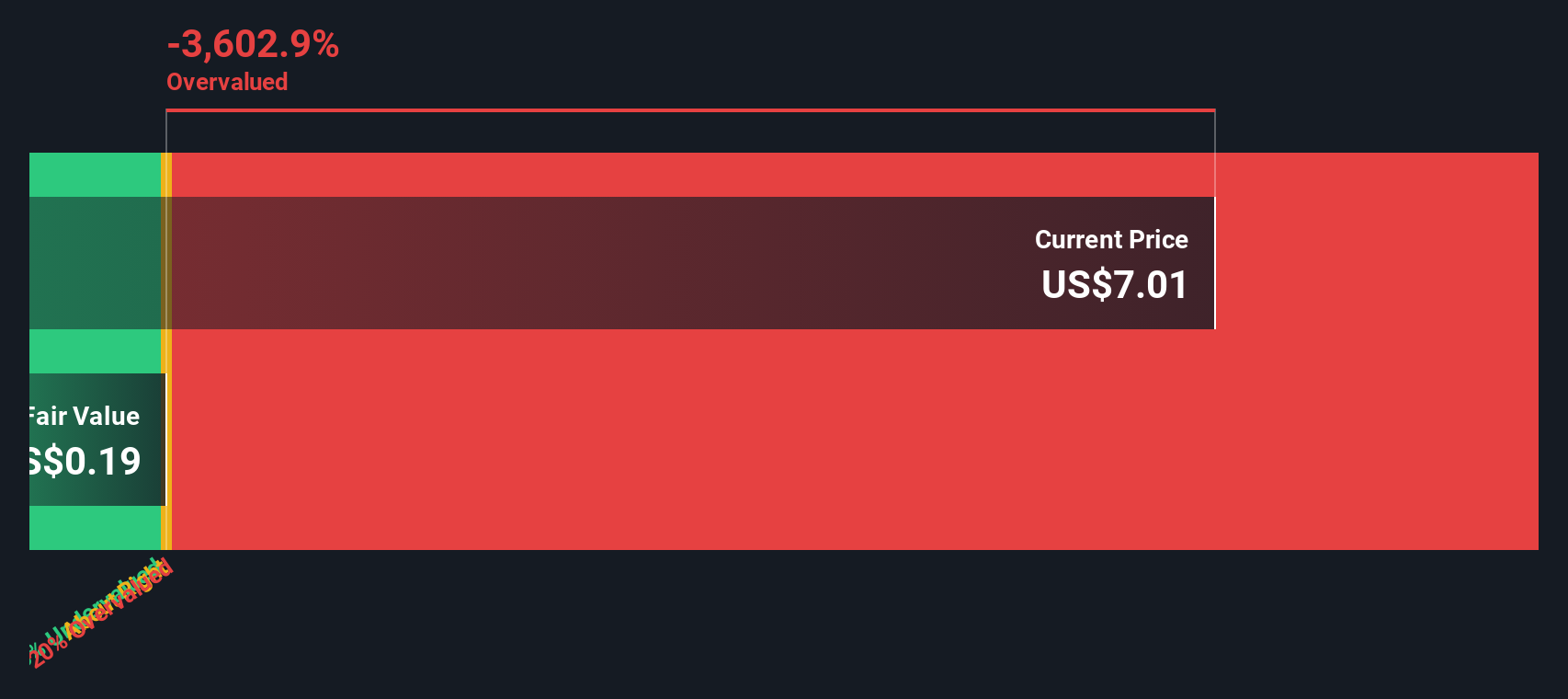

That premium appears especially stark when set against the SWS DCF model, which pegs fair value at just $0.22 per share. This indicates that the present share price is trading far above the level suggested by this cash flow based framework.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 5,199.8x (OVERVALUED)

However, investors still face execution risk around scaling profitable revenue, as well as potential sentiment reversals if defense-tech spending or drone demand softens.

Find out about the key risks to this Mobilicom narrative.

Another View: Cash Flows Paint a Harsher Picture

While the towering price to book ratio already looks stretched, our DCF model is even more cautious, putting fair value at about $0.22 per share, far below today’s $7.98 level. If both assets and cash flows appear rich, it raises the question of what exactly the market is paying up for here.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mobilicom for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 896 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mobilicom Narrative

If this perspective does not quite match your own, or you would rather dig into the numbers yourself, you can build a personalized view in just a few minutes by starting with Do it your way.

A great starting point for your Mobilicom research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more high conviction ideas?

Mobilicom might be grabbing headlines today, but you will leave money on the table if you ignore other focused opportunities our powerful screener surfaces in seconds.

- Capture mispriced potential by targeting companies trading below intrinsic value through these 896 undervalued stocks based on cash flows, where strong cash flows meet attractive entry points.

- Ride breakthrough innovation by using these 27 AI penny stocks to zero in on smaller AI names pushing the frontier of automation and intelligent software.

- Lock in income potential by scanning these 15 dividend stocks with yields > 3% and spot businesses combining robust balance sheets with dependable payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MOB

Mobilicom

Engages in the provision of hardware products and software and cybersecurity solutions for drones, small-sized unmanned aerial vehicles (SUAV), and robotics in Israel, the United States, Canada, and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026