- United States

- /

- Communications

- /

- NasdaqCM:LTRX

Lantronix, Inc.'s (NASDAQ:LTRX) Price Is Right But Growth Is Lacking After Shares Rocket 44%

Despite an already strong run, Lantronix, Inc. (NASDAQ:LTRX) shares have been powering on, with a gain of 44% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 30% in the last year.

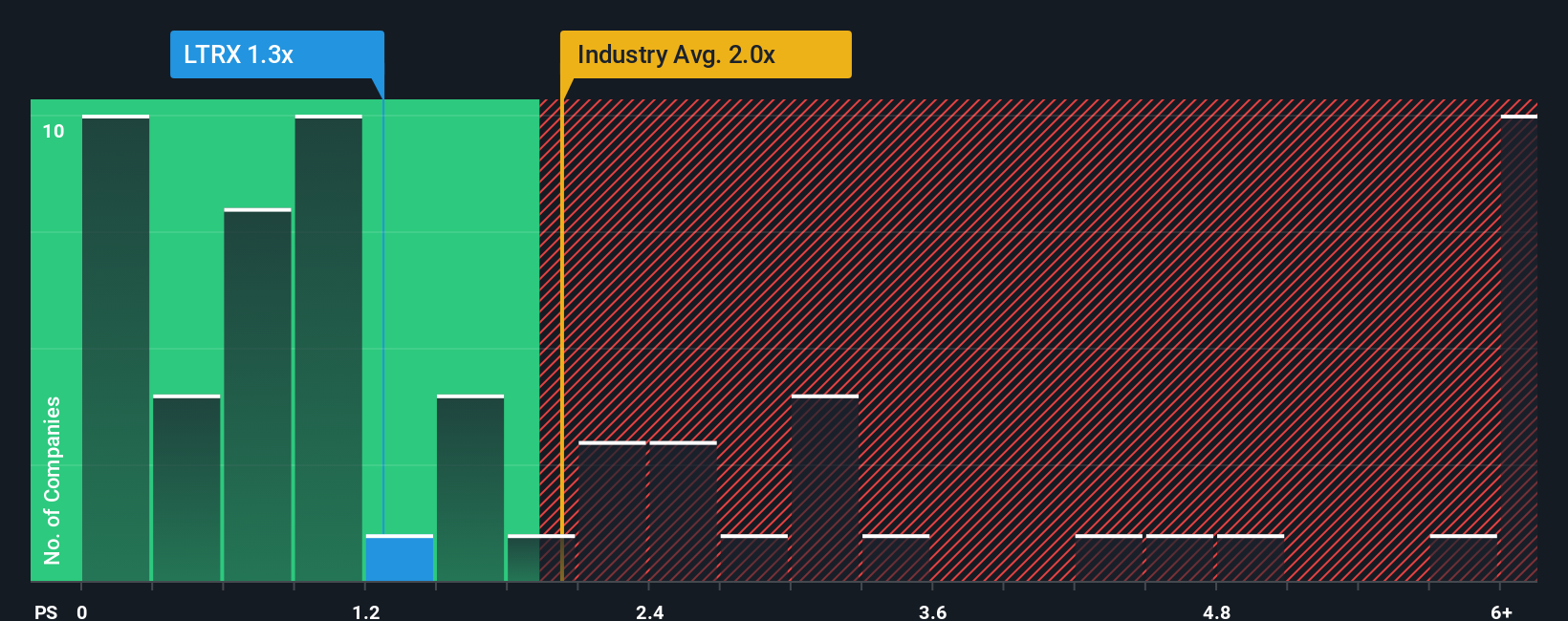

Although its price has surged higher, Lantronix's price-to-sales (or "P/S") ratio of 1.5x might still make it look like a buy right now compared to the Communications industry in the United States, where around half of the companies have P/S ratios above 2x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Lantronix

How Has Lantronix Performed Recently?

While the industry has experienced revenue growth lately, Lantronix's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Lantronix will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Lantronix would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 5.2% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 2.8% over the next year. With the industry predicted to deliver 12% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Lantronix's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Lantronix's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Lantronix's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Lantronix's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Lantronix, and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LTRX

Lantronix

Develops, markets, and sells industrial and enterprise internet of things (IoT) products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific Japan.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026