- United States

- /

- Communications

- /

- NasdaqGS:LITE

The Bull Case For Lumentum Holdings (LITE) Could Change Following AI-Driven Hyperscale Data Center Demand Surge

Reviewed by Sasha Jovanovic

- In its fiscal Q1 2026 results released earlier this year, Lumentum Holdings reported very strong year-over-year revenue growth and margin expansion, powered by heightened demand for its optical and photonics products used in AI data center infrastructure.

- This performance underscores Lumentum’s role as a key supplier to hyperscale cloud platforms building AI capacity, while also spotlighting risks such as customer concentration, manufacturing limits, leverage, and potential dilution.

- We’ll now consider how this AI-driven demand surge and Lumentum’s hyperscale data center positioning may reshape the company’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lumentum Holdings Investment Narrative Recap

To own Lumentum, you need to believe that AI data center buildouts will keep driving strong demand for its optical and photonics products, and that the company can scale profitably despite customer concentration and manufacturing constraints. The blowout fiscal Q1 2026 numbers and stronger near term guidance reinforce the core AI and hyperscale demand catalyst, but they also heighten the importance of execution on capacity expansion as the most immediate swing factor for results.

Among recent developments, the fiscal Q1 2026 report, with revenue up 58% year over year to US$533.8 million and a return to profitability, stands out as most relevant to the AI thesis. It shows that earlier expectations of strong hyperscale demand and early adoption of higher speed cloud modules are already flowing through the income statement, but it also brings valuation and concentration risks into sharper focus as investors weigh how sustainable this ramp might be.

Yet investors should also be aware that reliance on just a few hyperscale customers could...

Read the full narrative on Lumentum Holdings (it's free!)

Lumentum Holdings' narrative projects $3.1 billion revenue and $389.1 million earnings by 2028. This requires 23.4% yearly revenue growth and about a $363 million earnings increase from $25.9 million today.

Uncover how Lumentum Holdings' forecasts yield a $231.33 fair value, a 29% downside to its current price.

Exploring Other Perspectives

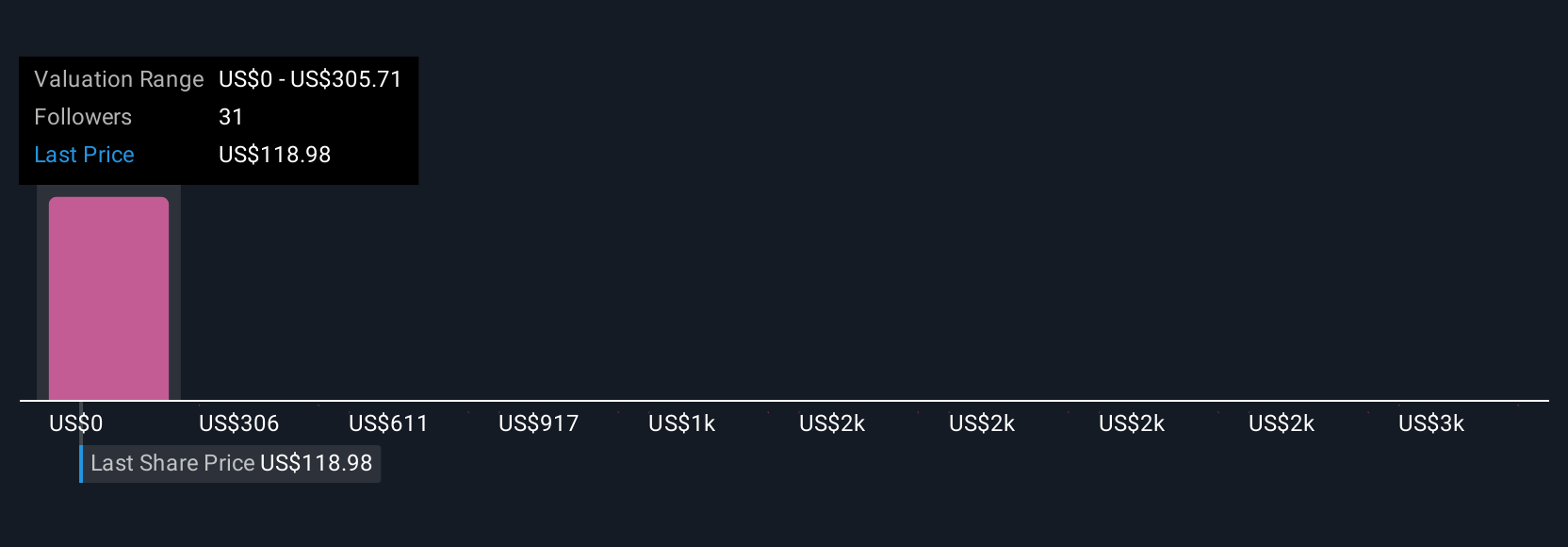

Eleven members of the Simply Wall St Community currently place Lumentum’s fair value anywhere between about US$68 and US$578, reflecting sharply different expectations. Before the latest AI driven surge in results, many focused on both rapid hyperscale demand as a key catalyst and the execution risk around Lumentum’s ability to add capacity, so it makes sense to compare several of these viewpoints when thinking about how the story could evolve.

Explore 11 other fair value estimates on Lumentum Holdings - why the stock might be worth as much as 76% more than the current price!

Build Your Own Lumentum Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumentum Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lumentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumentum Holdings' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026