- United States

- /

- Communications

- /

- NasdaqGS:LITE

Lumentum (LITE): Gauging Valuation as New Optical Innovations Target AI Data Center Growth

Reviewed by Kshitija Bhandaru

Following a series of product announcements at the ECOC conference, Lumentum Holdings (LITE) is turning heads with new optical circuit switch and transceiver technologies. These innovations are aimed at meeting the growing demands of AI-powered data centers.

See our latest analysis for Lumentum Holdings.

Lumentum’s strong push into AI-focused photonics has certainly caught the market’s attention, and investors appear to be weighing the longer-term growth these innovations promise. The stock’s latest share price is $163.81, and while near-term movement has been modest, Lumentum’s 1-year total shareholder return of 1.44% suggests the company is quietly rebuilding momentum after a period of muted performance. Recent product launches could be the spark it needed.

If you’re interested in how other tech and AI companies are evolving alongside Lumentum, there’s no better time to check out the latest movers and innovators with our See the full list for free.

With a string of new launches and a stock price that has been relatively steady, the question for investors now is whether Lumentum is trading at a hidden discount or if the market has already accounted for its next wave of growth.

Most Popular Narrative: 13.9% Overvalued

Lumentum’s latest closing price of $163.81 stands above the fair value suggested by the most widely followed narrative, which sees notable reasons for optimism and risk. This popular perspective highlights how near-term demand and supply constraints could shape the company's path.

Capacity constraints in high-value product lines (for example, EMLs, lasers for 1.6T transceivers, and OCS) combined with a multi-quarter supply and demand imbalance are currently enabling favorable pricing dynamics and elevated margin potential. These conditions are likely to positively impact both gross margins and overall profitability as new manufacturing investments come online.

Want to know what bold growth estimates are fueling this rich price tag? The backbone is unwavering confidence in future revenues, margins, and major market share gains. Find out which projections set the bar high and why they’ve shaped analyst targets in such a dramatic way.

Result: Fair Value of $143.79 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on a small group of major cloud customers, along with persistent production constraints, could quickly shift the outlook for Lumentum’s growth story.

Find out about the key risks to this Lumentum Holdings narrative.

Another View: Digging Deeper into Value

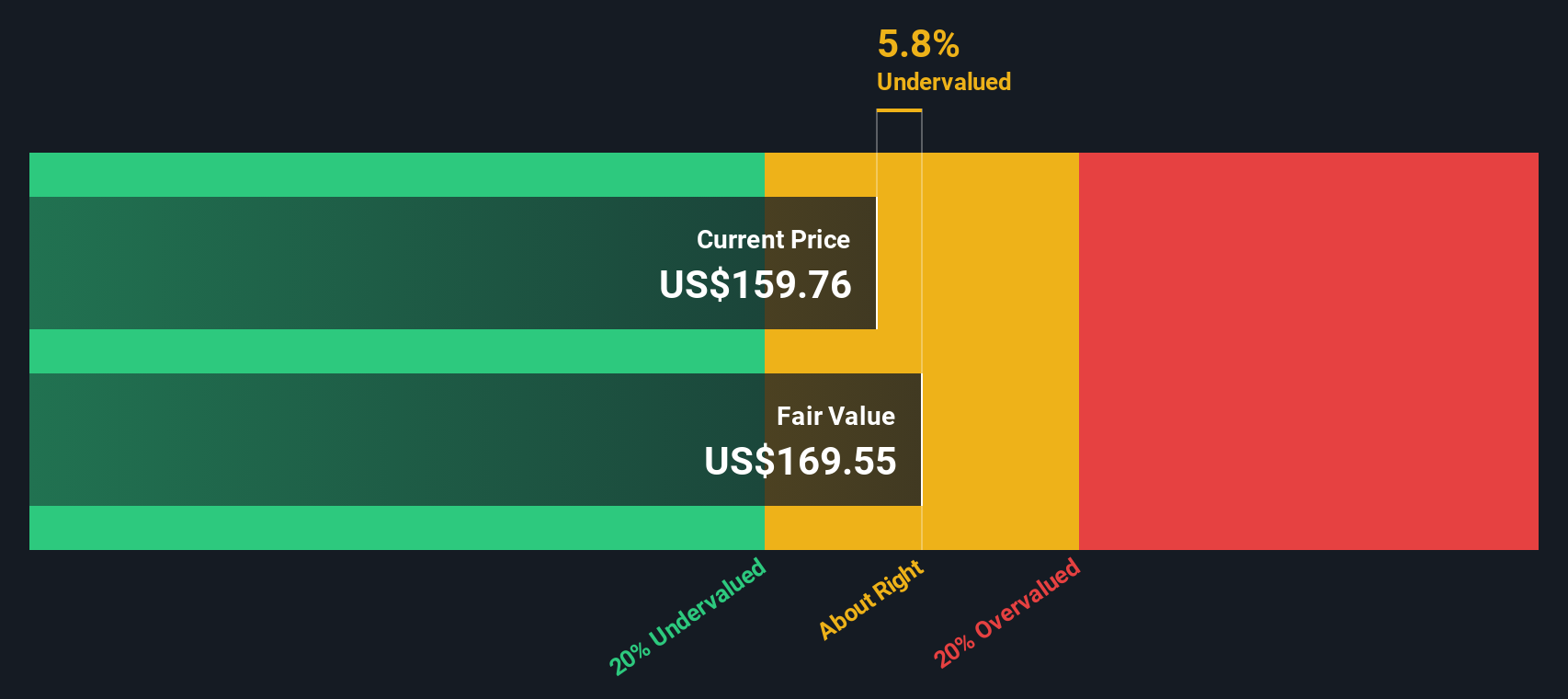

While the analyst consensus price target suggests Lumentum is overvalued, our DCF model tells a different story. Based on long-term projected cash flows, Lumentum actually appears to be trading below its fair value. This hints at potential upside that may be overlooked by the market. Does this DCF optimism signal a true bargain or just another layer of uncertainty for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lumentum Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lumentum Holdings Narrative

If you have a different perspective on Lumentum's valuation or want to analyze the numbers yourself, you can easily create your own view in just a few minutes with our tools, so Do it your way

A great starting point for your Lumentum Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t hesitate—there are countless opportunities you could miss! Let the Simply Wall Street Screener guide you toward companies that fit your goals and match your interests.

- Maximize your income potential by checking out these 19 dividend stocks with yields > 3%. These offer consistently strong yields and reliable payouts.

- Catch the next wave of tech disruption by targeting these 25 AI penny stocks. These companies are leading innovation in artificial intelligence and reshaping today’s markets.

- Spot the market’s best bargains and kickstart smarter investing with these 886 undervalued stocks based on cash flows. These stocks are handpicked for exceptional value based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives