- United States

- /

- Communications

- /

- NasdaqGS:LITE

Is Lumentum’s Return to Profitability and Revenue Growth Reshaping the Investment Thesis for LITE?

Reviewed by Simply Wall St

- Lumentum Holdings Inc. recently reported earnings for the fourth quarter and full year ended June 28, 2025, with quarterly sales of US$480.7 million and a return to profitability compared to the prior year's loss.

- The company’s transition back to positive net income and a strong year-over-year increase in revenue reflect a significant improvement in business performance.

- We’ll explore how the company’s improved profitability and robust sales growth influence the broader investment narrative for Lumentum Holdings.

Find companies with promising cash flow potential yet trading below their fair value.

Lumentum Holdings Investment Narrative Recap

To own shares in Lumentum Holdings today, you need to believe the company can sustain momentum in cloud, AI, and next-generation optical networking, while managing supply constraints and intense competition. The recent surge in revenue and return to profitability signals improved operational execution; however, the short-term outlook is still shaped by concentration risk among just a few hyperscale customers, which remains the biggest variable for near-term results. The latest quarterly earnings do not materially change this risk profile, strong results reinforce the catalyst, but the top-line remains closely tied to demand from its largest clients.

Of the recent company announcements, the guidance projecting first-quarter fiscal 2026 revenue between US$510 million and US$540 million is most relevant. This outlook supports investor enthusiasm around continued AI and cloud-driven demand, highlighting how supply-demand tightness in high-end modules still underpins revenue growth. While this is a clear catalyst for optimism, the company’s heavy reliance on a few customers means risks could quickly re-emerge should order patterns shift unexpectedly.

Yet, in contrast to this upbeat outlook, investors should be aware that a sudden reduction in orders from any hyperscale customer could quickly change the story for Lumentum ...

Read the full narrative on Lumentum Holdings (it's free!)

Lumentum Holdings’ outlook projects $3.0 billion in revenue and $389.1 million in earnings by 2028. This requires a 21.9% annual revenue growth rate and a $363.2 million increase in earnings from the current $25.9 million.

Uncover how Lumentum Holdings' forecasts yield a $135.59 fair value, a 14% upside to its current price.

Exploring Other Perspectives

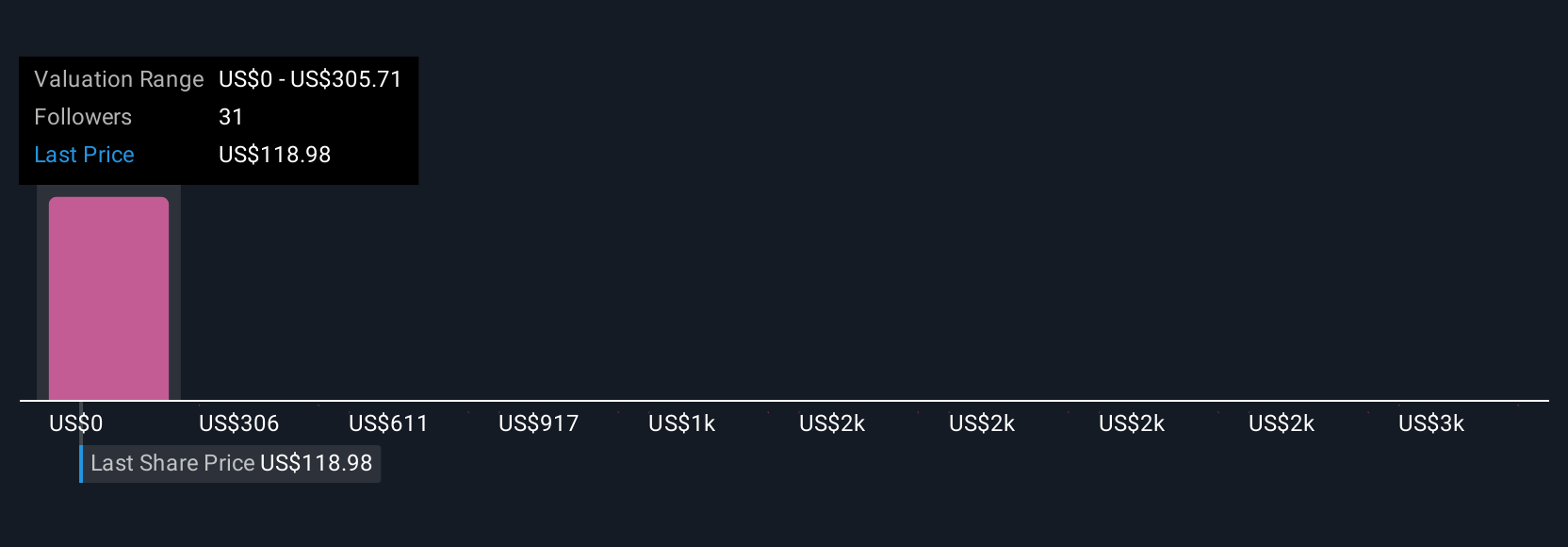

Simply Wall St Community fair value estimates for Lumentum range from US$305,706 to US$3,057,060 across nine individual views. Many are betting on robust revenue growth, but the company’s concentrated hyperscale customer base means fortunes may swing rapidly, so take time to consider all sides.

Explore 9 other fair value estimates on Lumentum Holdings - why the stock might be a potential multi-bagger!

Build Your Own Lumentum Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumentum Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lumentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumentum Holdings' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives