- United States

- /

- Communications

- /

- NasdaqGS:LITE

Investors in Lumentum Holdings (NASDAQ:LITE) have made a respectable return of 33% over the past three years

Lumentum Holdings Inc. (NASDAQ:LITE) shareholders have seen the share price descend 18% over the month. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. To wit, the share price did better than an index fund, climbing 33% during that period.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

However if you'd rather see where the opportunities and risks are within LITE's industry, you can check out our analysis on the US Communications industry.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, Lumentum Holdings moved from a loss to profitability. That would generally be considered a positive, so we'd expect the share price to be up.

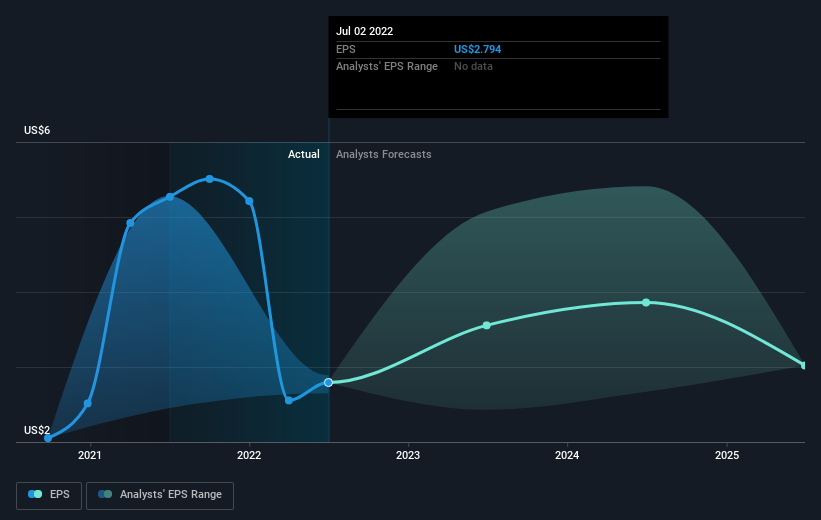

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Lumentum Holdings has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Lumentum Holdings' financial health with this free report on its balance sheet.

A Different Perspective

While it's never nice to take a loss, Lumentum Holdings shareholders can take comfort that their trailing twelve month loss of 20% wasn't as bad as the market loss of around 22%. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. It's always interesting to track share price performance over the longer term. But to understand Lumentum Holdings better, we need to consider many other factors. Take risks, for example - Lumentum Holdings has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)