- United States

- /

- Communications

- /

- NasdaqGS:LITE

Earnings Rebound and US Semiconductor Expansion Might Change the Case for Investing in Lumentum Holdings (LITE)

Reviewed by Simply Wall St

- Lumentum Holdings Inc. recently released its fourth quarter and full year 2025 earnings, reporting US$480.7 million in quarterly sales and US$213.3 million net income, reversing last year's loss, along with full-year sales of US$1.65 billion and US$25.9 million net income.

- Alongside these financial improvements, the company announced a major U.S. semiconductor capacity expansion aimed at supporting AI and data center demand, reinforcing its manufacturing footprint and role in the growing advanced optics industry.

- We will explore how Lumentum's robust quarterly results and forward guidance may influence its investment outlook, especially given ongoing manufacturing investments.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lumentum Holdings Investment Narrative Recap

To own Lumentum shares, you need conviction in fast-growing demand for advanced optical components in AI and cloud, with confidence the company can execute capacity expansions and retain key hyperscale customers. The latest quarterly earnings improvements and upbeat revenue guidance directly reinforce the primary short-term catalyst, unlocking more revenue from accelerated cloud module shipments, while persistent customer concentration risk remains the business’s main vulnerability. For now, the impact of the new earnings is material, strengthening momentum behind both growth opportunities and risk management focus.

Among recent news, the announced expansion of Lumentum's U.S. semiconductor facility stands out as especially relevant. Adding manufacturing capacity could help resolve current production constraints and support supply assurance, directly addressing bottlenecks that influence the stock's short-term performance and outlook for earnings growth.

By contrast, investors should remain alert to revenue concentration risk tied to the small number of hyperscale customers, since...

Read the full narrative on Lumentum Holdings (it's free!)

Lumentum Holdings' narrative projects $3.0 billion in revenue and $389.1 million in earnings by 2028. This requires 21.9% yearly revenue growth and an increase in earnings of about $363 million from the current $25.9 million.

Uncover how Lumentum Holdings' forecasts yield a $135.59 fair value, a 17% upside to its current price.

Exploring Other Perspectives

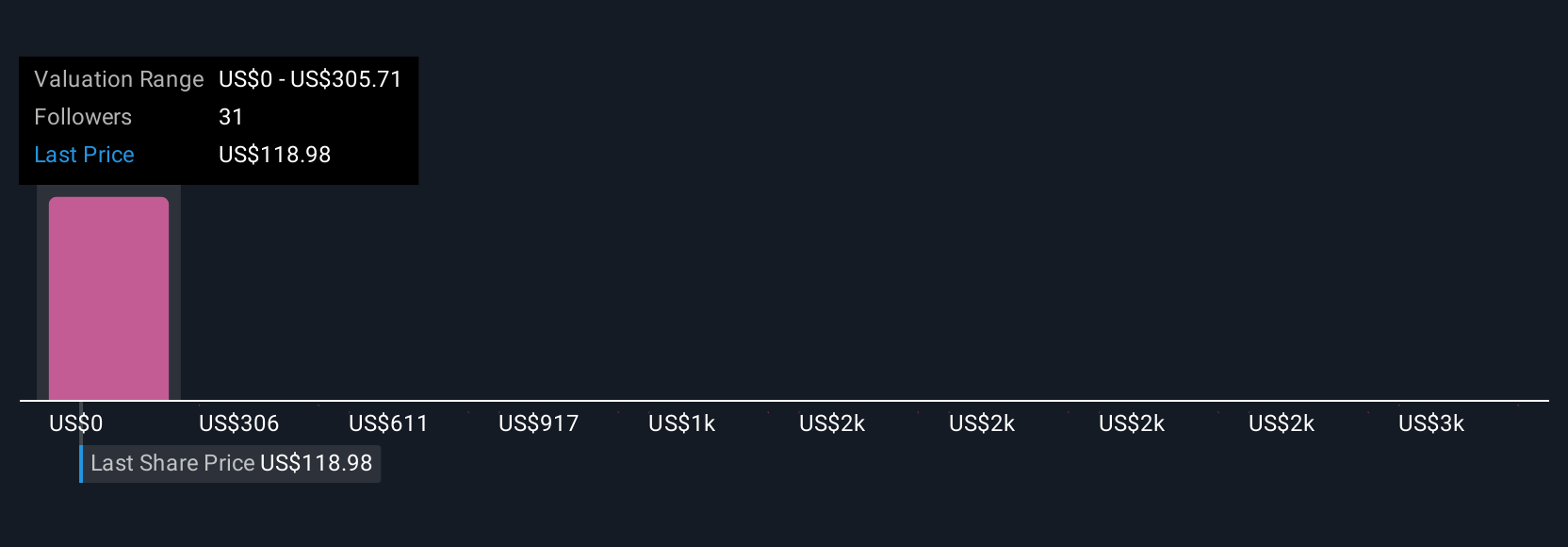

Fair value estimates from nine Simply Wall St Community members range wildly from US$305.71 to US$3,057.06 per share. With recent results highlighting both growth and revenue concentration risk, perspectives on Lumentum's potential can vary significantly, see how your view compares.

Explore 9 other fair value estimates on Lumentum Holdings - why the stock might be a potential multi-bagger!

Build Your Own Lumentum Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumentum Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lumentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumentum Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives