- United States

- /

- Communications

- /

- NasdaqGS:LITE

Did a Wave of Analyst Endorsements Just Shift Lumentum Holdings' (LITE) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, several major financial institutions, including JP Morgan, Morgan Stanley, Rosenblatt, Barclays, and Citigroup, each reiterated positive analyst ratings for Lumentum Holdings. This wave of endorsements signals growing analyst confidence in the company's position within the optical and photonics industry.

- The broad agreement among influential analysts suggests that institutional sentiment may be increasingly aligning around Lumentum's potential in advanced optical technologies.

- To understand how these renewed analyst endorsements might impact Lumentum’s investment narrative, we'll focus on the strengthened institutional confidence highlighted by these updates.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Lumentum Holdings Investment Narrative Recap

To be a shareholder in Lumentum Holdings, you need confidence in the accelerating adoption of advanced optical technologies driven by AI and cloud computing, and belief that the company can scale its capacity fast enough to capture growth. The recent wave of positive analyst updates reinforces the company’s leadership positioning, but doesn’t materially lessen short-term revenue concentration risks or the critical importance of executing new manufacturing ramps.

Of the company’s recent product unveilings, the 1.6T DR8 TRO OSFP transceiver module stands out as most relevant, its alignment with hyperscale cloud and AI demand directly supports the analyst optimism and illustrates a tangible catalyst for near-term revenue growth potential. However, this development also puts the spotlight back on whether Lumentum can secure and grow orders from a small group of large, hyperscale customers amid tight supply chains and rising competition.

In contrast, investors should be aware that Lumentum’s rapid growth is still highly dependent on demand from just a few key hyperscale customers, and if even one of them ...

Read the full narrative on Lumentum Holdings (it's free!)

Lumentum Holdings' outlook projects $3.1 billion in revenue and $389.1 million in earnings by 2028. This requires 23.4% annual revenue growth and an increase in earnings of $363.2 million from the current $25.9 million.

Uncover how Lumentum Holdings' forecasts yield a $146.16 fair value, a 11% downside to its current price.

Exploring Other Perspectives

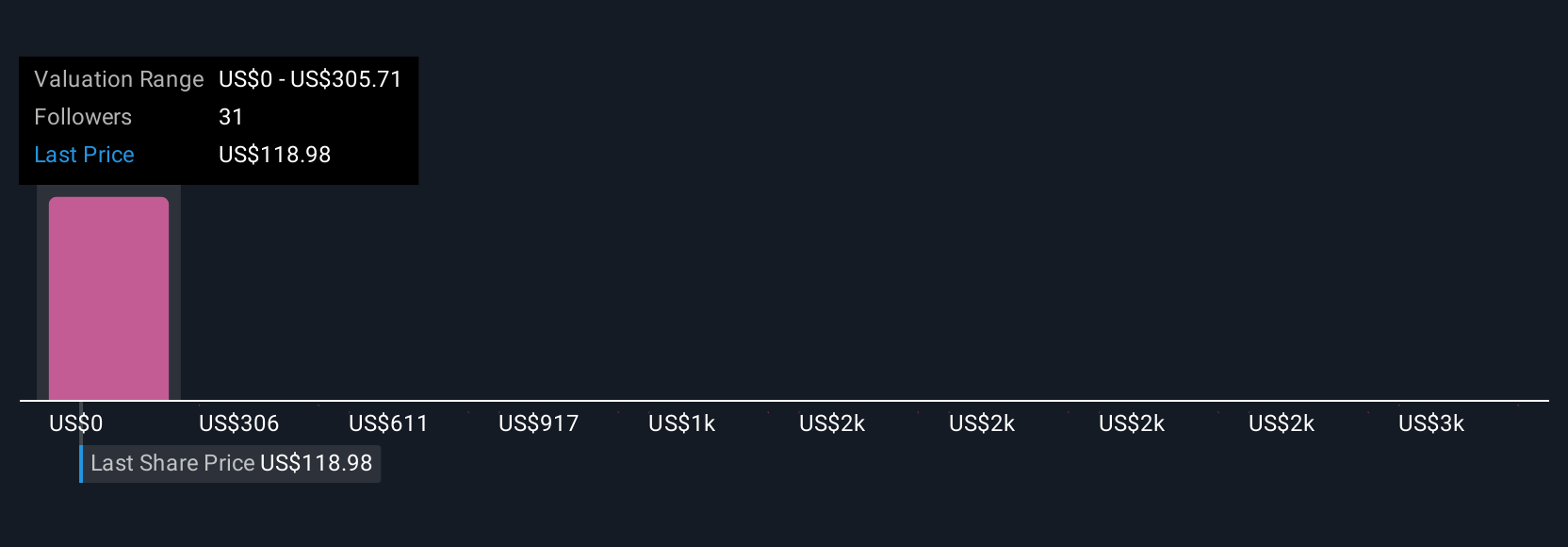

Eleven fair value estimates from the Simply Wall St Community range from US$305,706 to US$3,057,060, revealing a wide gulf in expectations. With hyperscale client concentration still a major risk, this diversity of opinion encourages you to consider multiple viewpoints on the company’s prospects.

Explore 11 other fair value estimates on Lumentum Holdings - why the stock might be worth just $305.71!

Build Your Own Lumentum Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lumentum Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lumentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lumentum Holdings' overall financial health at a glance.

No Opportunity In Lumentum Holdings?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives