- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LINK

Some Interlink Electronics, Inc. (NASDAQ:LINK) Shareholders Look For Exit As Shares Take 27% Pounding

To the annoyance of some shareholders, Interlink Electronics, Inc. (NASDAQ:LINK) shares are down a considerable 27% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

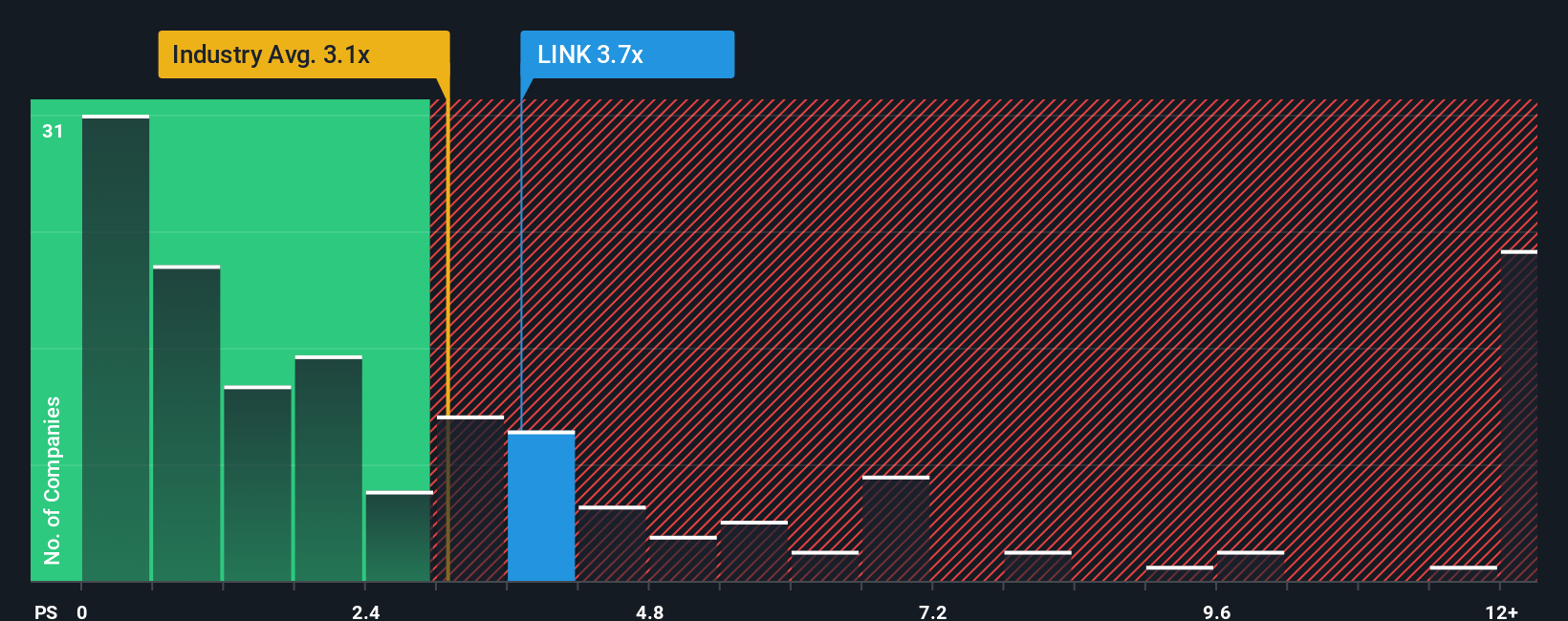

Although its price has dipped substantially, Interlink Electronics may still be sending sell signals at present with a price-to-sales (or "P/S") ratio of 3.7x, when you consider almost half of the companies in the Electronic industry in the United States have P/S ratios under 3.1x and even P/S lower than 0.9x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Interlink Electronics

How Has Interlink Electronics Performed Recently?

For instance, Interlink Electronics' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Interlink Electronics' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Interlink Electronics' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 1.7% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 60% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 19% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's curious that Interlink Electronics' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Interlink Electronics' P/S

There's still some elevation in Interlink Electronics' P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Interlink Electronics revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Interlink Electronics (1 can't be ignored!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LINK

Interlink Electronics

Provides sensors and printed electronics for use in human-machine interface (HMI) devices and internet-of-things solutions in the United States, Asia, the Middle East, Europe, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Novo Nordisk - A Fundamental and Historical Valuation

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion