- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LINK

Some Interlink Electronics, Inc. (NASDAQ:LINK) Shareholders Look For Exit As Shares Take 26% Pounding

The Interlink Electronics, Inc. (NASDAQ:LINK) share price has fared very poorly over the last month, falling by a substantial 26%. The recent drop has obliterated the annual return, with the share price now down 5.6% over that longer period.

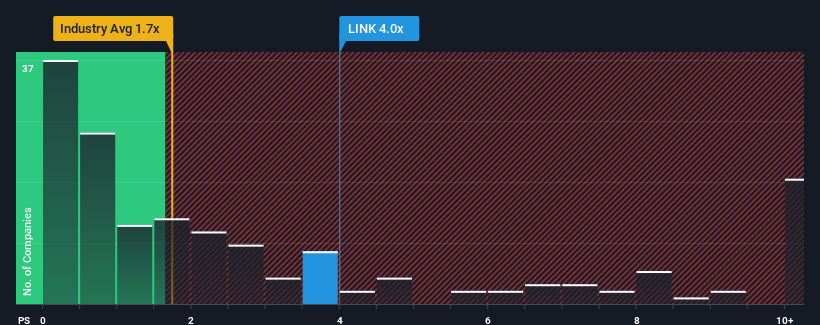

In spite of the heavy fall in price, you could still be forgiven for thinking Interlink Electronics is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 1.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Interlink Electronics

How Interlink Electronics Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Interlink Electronics has been doing quite well of late. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Interlink Electronics.Is There Enough Revenue Growth Forecasted For Interlink Electronics?

In order to justify its P/S ratio, Interlink Electronics would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 86% last year. The latest three year period has also seen an excellent 102% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 1.4% over the next year. That's shaping up to be materially lower than the 3.9% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Interlink Electronics' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Interlink Electronics' P/S Mean For Investors?

Interlink Electronics' shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've concluded that Interlink Electronics currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you take the next step, you should know about the 2 warning signs for Interlink Electronics (1 makes us a bit uncomfortable!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LINK

Interlink Electronics

Provides sensors and printed electronics for use in human-machine interface (HMI) devices and internet-of-things solutions in the United States, Asia, the Middle East, Europe, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Bunker Hill Mine: A Case For $5 Per Share by 2030

VTEX - A hidden Latin American growth opportunity?

Coherent Corp. (COHR): The Silicon Photonics Powerhouse – Joining the S&P 500 Benchmark in 2026.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026