- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:LFUS

What Littelfuse (LFUS)'s Demand Slowdown and Earnings Pressure Means For Shareholders

Reviewed by Sasha Jovanovic

- In recent days, Littelfuse has faced challenges marked by declining sales, slowing demand, and lower earnings growth, raising concerns among market watchers. This operational headwind signals a period of heightened uncertainty, as persistent weakness in key end markets could influence business confidence and planning.

- To assess the impact of this slowing demand, we'll examine how these recent operational challenges may alter Littelfuse's long-term growth outlook and risk profile.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Littelfuse Investment Narrative Recap

Belief in Littelfuse comes down to confidence in secular growth trends for electrified and industrial applications, as well as the company’s operational improvement initiatives. Recent news highlighting declining sales and softer demand has brought fresh attention to whether core end markets can recover quickly enough to be a near-term catalyst; at the same time, exposure to cyclical industries remains the primary risk, as downturns there could make earnings less predictable if weakness persists.

Of the recent announcements, the appointment of Dr. Karim Hamed as Senior Vice President and General Manager for the Semiconductor Business stands out given ongoing weakness in power semiconductor volumes. This move may be connected to efforts aimed at regaining momentum in a segment that is currently dampening overall margin performance and weighing on near-term earnings, a critical focus for the company and its investors.

On the other hand, ongoing softness and execution challenges in the power semiconductor business are risks that investors should be aware of if weak demand continues…

Read the full narrative on Littelfuse (it's free!)

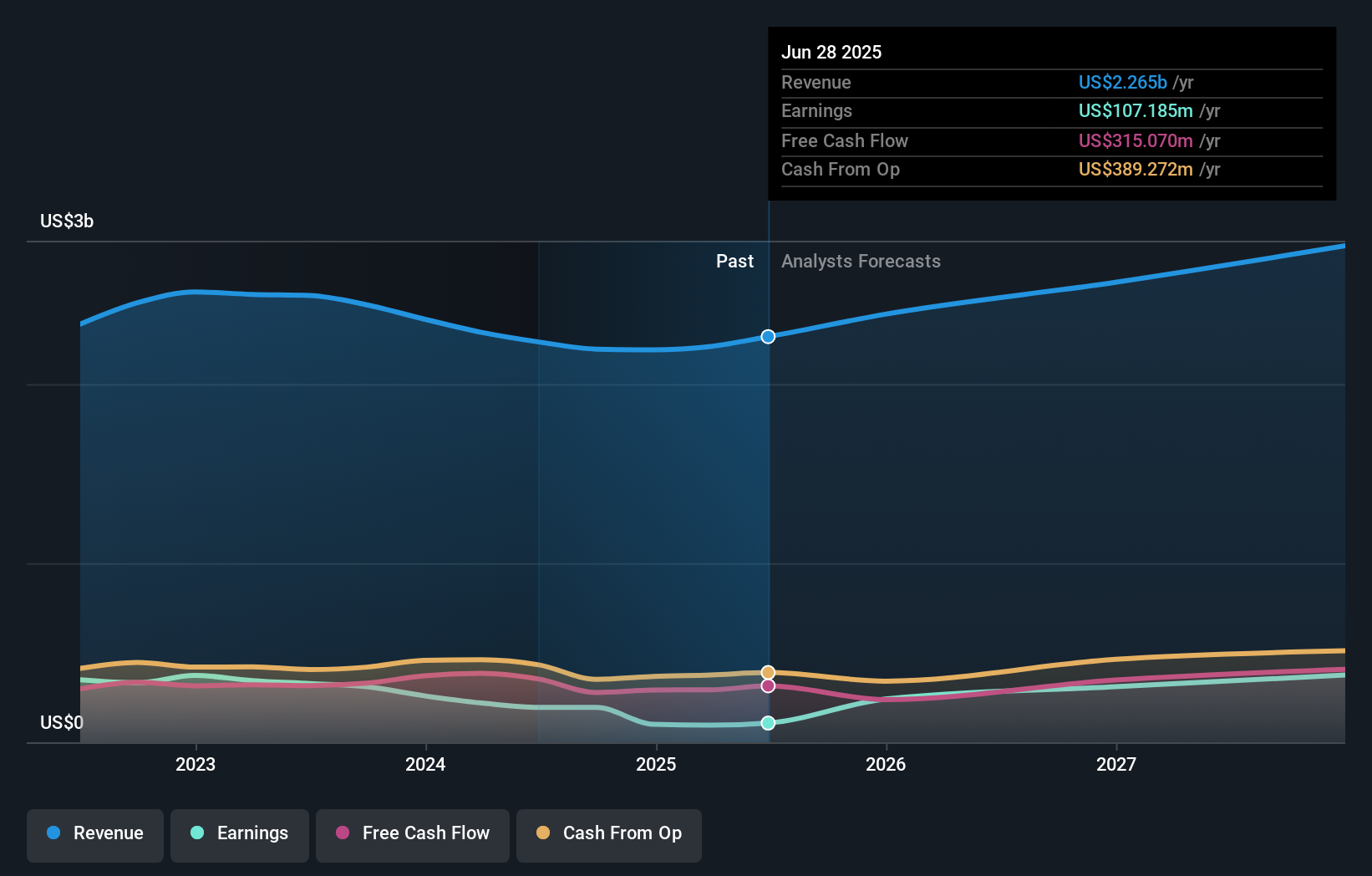

Littelfuse's outlook anticipates $2.9 billion in revenue and $400.8 million in earnings by 2028. This implies an 8.6% annual revenue growth and a $293.6 million increase in earnings from the current $107.2 million.

Uncover how Littelfuse's forecasts yield a $307.50 fair value, a 16% upside to its current price.

Exploring Other Perspectives

All 1 fair value estimate from the Simply Wall St Community pegs Littelfuse's worth at US$307.50 per share. With weaker end market demand now in focus, readers can weigh how short-term concerns may influence forecasts and broader expectations for Littelfuse’s recovery.

Explore another fair value estimate on Littelfuse - why the stock might be worth as much as 16% more than the current price!

Build Your Own Littelfuse Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Littelfuse research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Littelfuse research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Littelfuse's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LFUS

Littelfuse

Designs, manufactures, and sells electronic components, modules, and subassemblies.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives