- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:LFUS

Littelfuse (LFUS) Valuation Check After Strong Q3 Revenue Growth and Electronics Segment Outperformance

Reviewed by Simply Wall St

Littelfuse (LFUS) just delivered a third quarter that turned some heads, with revenue up roughly 10% year on year and the Electronics segment and adjusted operating income topping Wall Street’s expectations.

See our latest analysis for Littelfuse.

Investors have been warming back up to Littelfuse, with a 1 month share price return of 6.84% helping lift the year to date share price return to 10.59%. However, the 1 year total shareholder return sits at a more muted 3.45%, suggesting momentum is only now starting to rebuild after a softer stretch.

If this earnings beat has you thinking about where else growth and electrification trends could show up next, it is worth exploring aerospace and defense stocks as another hunting ground for ideas.

With shares up recently but still trading below analyst targets and our view of intrinsic value, is Littelfuse quietly offering a rare entry point in electrification, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 15.6% Undervalued

With Littelfuse last closing at $259.55 against a fair value of $307.50 in the most followed narrative, the gap hinges on ambitious growth and margin assumptions.

The rapid buildout of renewable energy infrastructure, grid storage, and sustainable grid ecosystems is resulting in double digit sales growth and a robust opportunity pipeline for Littelfuse, positioning the company to benefit from continued secular tailwinds and expanding its addressable market, which should positively impact both revenues and margins.

Curious how steady mid single digit top line growth could still support a much larger earnings base and lower future multiple than today? The narrative leans on compounding margin gains and a powerful earnings ramp that might surprise anyone only glancing at headline forecasts. Want to see exactly how those moving pieces add up to this fair value call?

Result: Fair Value of $307.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower progress in power semiconductors or a sharper downturn in auto and industrial demand could quickly challenge the upbeat long term earnings narrative.

Find out about the key risks to this Littelfuse narrative.

Another View: Rich Multiple, Higher Bar

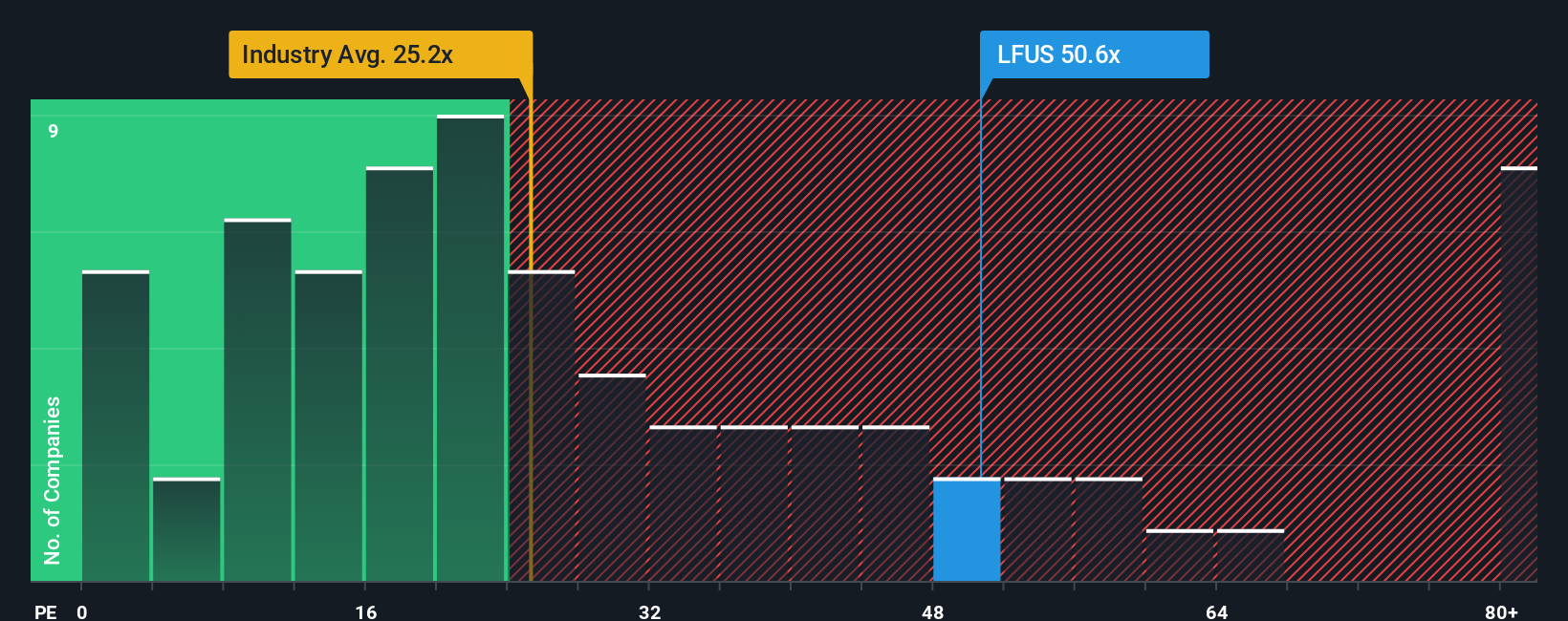

Step back from narratives and the picture looks tougher. Littelfuse trades on a lofty 54.5x earnings versus 24.6x for the US Electronic industry and a 29.1x fair ratio. This means any stumble could hit the share price hard. Is this premium really worth paying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Littelfuse Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way

A great starting point for your Littelfuse research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next smart move?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover focused stock ideas that match how you actually want to build wealth.

- Target income you can count on by reviewing these 15 dividend stocks with yields > 3% that aim to balance yield with underlying business strength.

- Position yourself for structural growth trends by assessing these 26 AI penny stocks shaping everything from automation to intelligent software.

- Act on value before the crowd catches on by checking these 902 undervalued stocks based on cash flows that our models flag as trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LFUS

Littelfuse

Designs, manufactures, and sells electronic components, modules, and subassemblies.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026