- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:LASR

Why Investors Shouldn't Be Surprised By nLIGHT, Inc.'s (NASDAQ:LASR) 27% Share Price Surge

The nLIGHT, Inc. (NASDAQ:LASR) share price has done very well over the last month, posting an excellent gain of 27%. Looking back a bit further, it's encouraging to see the stock is up 48% in the last year.

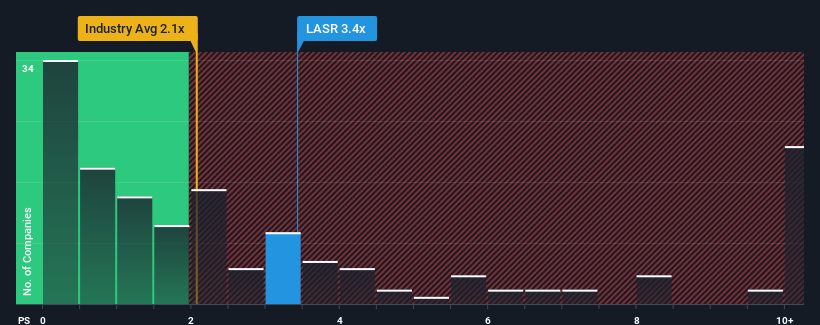

After such a large jump in price, you could be forgiven for thinking nLIGHT is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.4x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 2.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for nLIGHT

How nLIGHT Has Been Performing

nLIGHT could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on nLIGHT will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For nLIGHT?

In order to justify its P/S ratio, nLIGHT would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. The last three years don't look nice either as the company has shrunk revenue by 23% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 15% as estimated by the eight analysts watching the company. That's shaping up to be materially higher than the 9.1% growth forecast for the broader industry.

With this information, we can see why nLIGHT is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does nLIGHT's P/S Mean For Investors?

The large bounce in nLIGHT's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of nLIGHT's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for nLIGHT that you should be aware of.

If you're unsure about the strength of nLIGHT's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LASR

nLIGHT

Designs, develops, manufactures, and sells semiconductor and fiber lasers for industrial, microfabrication, and aerospace and defense applications.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026