- United States

- /

- Tech Hardware

- /

- NasdaqGS:IVAC

Investors Who Bought Intevac (NASDAQ:IVAC) Shares Five Years Ago Are Now Up 71%

The main point of investing for the long term is to make money. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the Intevac, Inc. (NASDAQ:IVAC) share price is up 71% in the last five years, that's less than the market return. Over the last twelve months the stock price has risen a very respectable 17%.

See our latest analysis for Intevac

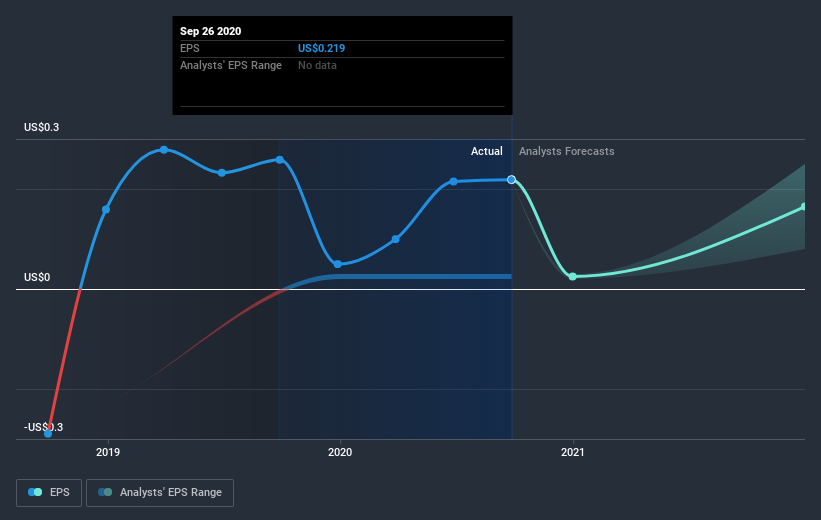

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Intevac became profitable. That's generally thought to be a genuine positive, so we would expect to see an increasing share price.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Intevac shareholders gained a total return of 17% during the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 11% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand Intevac better, we need to consider many other factors. For example, we've discovered 2 warning signs for Intevac that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Intevac, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:IVAC

Intevac

Engages in the designing, developing, and manufacturing thin-film processing systems in the United States, Europe, and Asia.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives