- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ITRI

Introducing Itron (NASDAQ:ITRI), A Stock That Climbed 47% In The Last Five Years

Itron, Inc. (NASDAQ:ITRI) shareholders might understandably be very concerned that the share price has dropped 35% in the last quarter. On the bright side the returns have been quite good over the last half decade. It has returned a market beating 47% in that time.

See our latest analysis for Itron

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

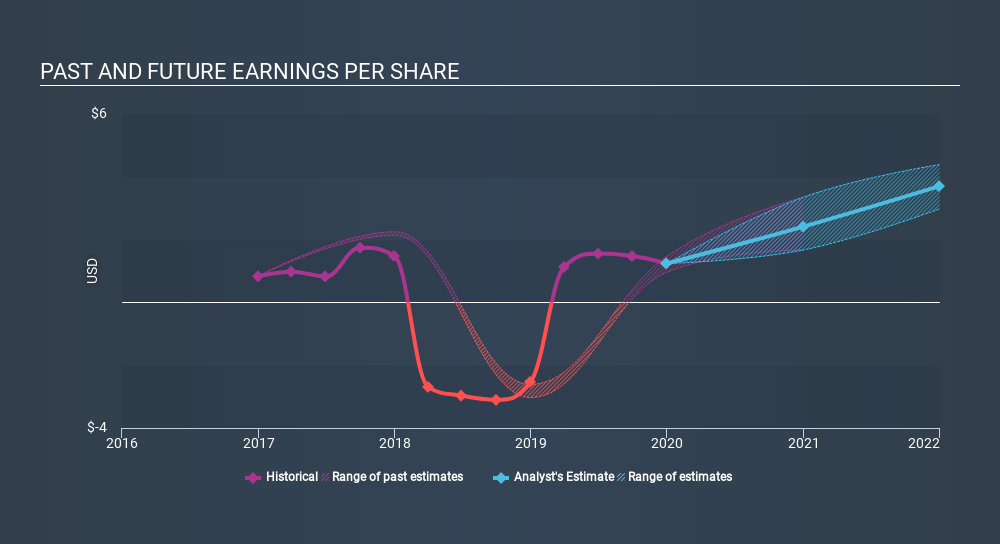

During the five years of share price growth, Itron moved from a loss to profitability. That would generally be considered a positive, so we'd expect the share price to be up. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Itron share price is down 10% in the last three years. In the same period, EPS is up 14% per year. It would appear there's a real mismatch between the increasing EPS and the share price, which has declined -3.5% a year for three years.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Itron has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

It's good to see that Itron has rewarded shareholders with a total shareholder return of 13% in the last twelve months. That gain is better than the annual TSR over five years, which is 8.1%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Itron you should be aware of, and 1 of them is concerning.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:ITRI

Itron

A technology, solutions, and service company, provides end-to-end solutions that help manage energy, water, and smart city operations worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives