- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:IPGP

IPG Photonics (IPGP): Valuation Insights Following Robust EV Welding Growth and New Defense Facility Launch

Reviewed by Simply Wall St

IPG Photonics (IPGP) delivered strong third-quarter results, supported by increased demand in welding applications for electric vehicle and battery production in Asia. The company also launched a new defense-focused facility in Huntsville, Alabama.

See our latest analysis for IPG Photonics.

Despite IPG Photonics’ recent upbeat news on growth in Asian EV welding demand and a new push into defense tech, the stock’s momentum has faded since summer, with a 1-year total shareholder return of 1.6% and longer-term returns still deep in negative territory. The latest share price bounce reflects growing interest in the company’s efforts to reverse years of revenue and earnings declines, but investors remain cautious as structural challenges persist in the background.

If you’re looking to spot more high-potential companies driving innovation in manufacturing and defense, take a look at our See the full list for free.

With the recent rebound in performance combined with a history of persistent declines, the real question for investors is whether IPG Photonics is trading at a discount to its long-term potential or if the market is already pricing in a turnaround.

Most Popular Narrative: 16.5% Undervalued

With the latest analyst consensus setting IPG Photonics’ fair value at $94, the current closing price of $78.51 suggests clear potential upside. The narrative behind this valuation combines recent business momentum, the company’s opportunity in new markets, and selective caution around future execution.

“New growth initiatives in medical (e.g., thulium lasers for urology), semiconductor, and micromachining end-markets are gaining early traction, diversifying revenue streams and supporting higher margins over time as these higher-value verticals scale. Recent product innovations like the CROSSBOW directed energy system, validated with multiple unit deliveries and key partnerships (e.g., Lockheed Martin), open up opportunities in defense and critical infrastructure, supporting both revenue acceleration and improved operating leverage.”

Curious what big, bold assumptions drive this optimism? The blueprint for IPG Photonics’ valuation goes far beyond surface trends. Find out exactly which future profit milestones and ambitious growth bets underpin this target—some numbers may surprise you.

Result: Fair Value of $94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff pressures and competitive threats in key markets could quickly disrupt revenue growth and challenge IPG Photonics’ path to recovery.

Find out about the key risks to this IPG Photonics narrative.

Another View: Price-to-Earnings Signals Caution

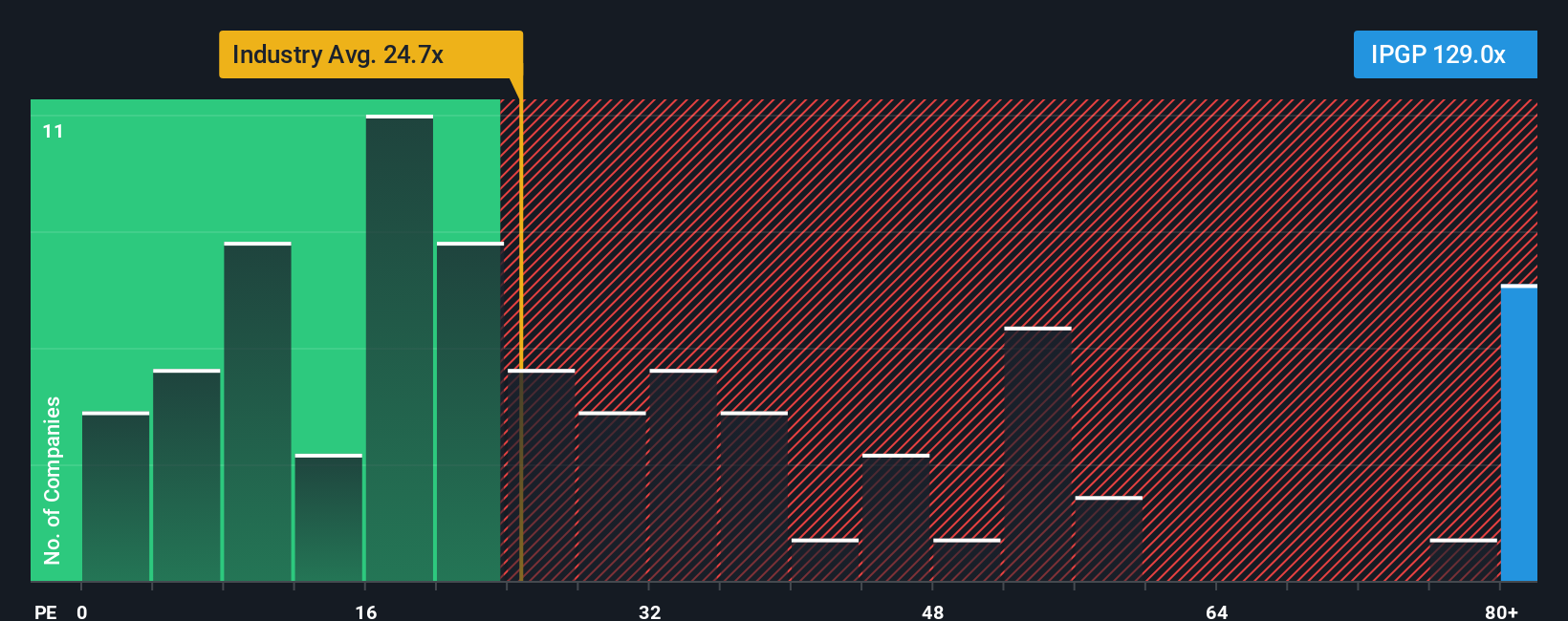

Looking from a market multiples perspective, IPG Photonics trades at a price-to-earnings ratio of 129x, which is significantly higher than the US Electronic industry average of 24.6x and the peer group average of 34.9x. Even compared to its fair ratio of 38.6x, IPG’s valuation looks stretched. This suggests that investors are paying a big premium for future growth. Does this risk justify the potential reward, or is the market getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IPG Photonics Narrative

If you see a different story in the numbers or want to take your own path through IPG Photonics’ data, it’s easy to dig in and craft your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding IPG Photonics.

Looking for more investment ideas?

Don’t let promising opportunities slip by. Expand your watchlist with investment themes shaping the future. Here are three fresh ways to strengthen your research and uncover hidden gems:

- Boost your portfolio with consistent income by targeting these 15 dividend stocks with yields > 3% offering attractive yields above 3% and strong fundamentals to back them up.

- Accelerate your exposure to technology’s frontier by tapping into these 25 AI penny stocks packed with innovators driving new progress in artificial intelligence.

- Capitalize on growth potential in unique niches with these 27 quantum computing stocks that are pioneering the quantum computing revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IPGP

IPG Photonics

Develops, manufactures, and sells various high-performance fiber lasers, fiber amplifiers, and diode lasers used in materials processing, medical, and advanced applications worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success