- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:IPGP

Does AI Momentum and AMD-OpenAI Partnership Alter the Growth Story for IPG Photonics (IPGP)?

Reviewed by Sasha Jovanovic

- In recent days, renewed confidence in the artificial intelligence sector, following strong demand signals from Nvidia leadership and a major partnership between AMD and OpenAI, has strengthened sentiment for technology and semiconductor companies such as IPG Photonics.

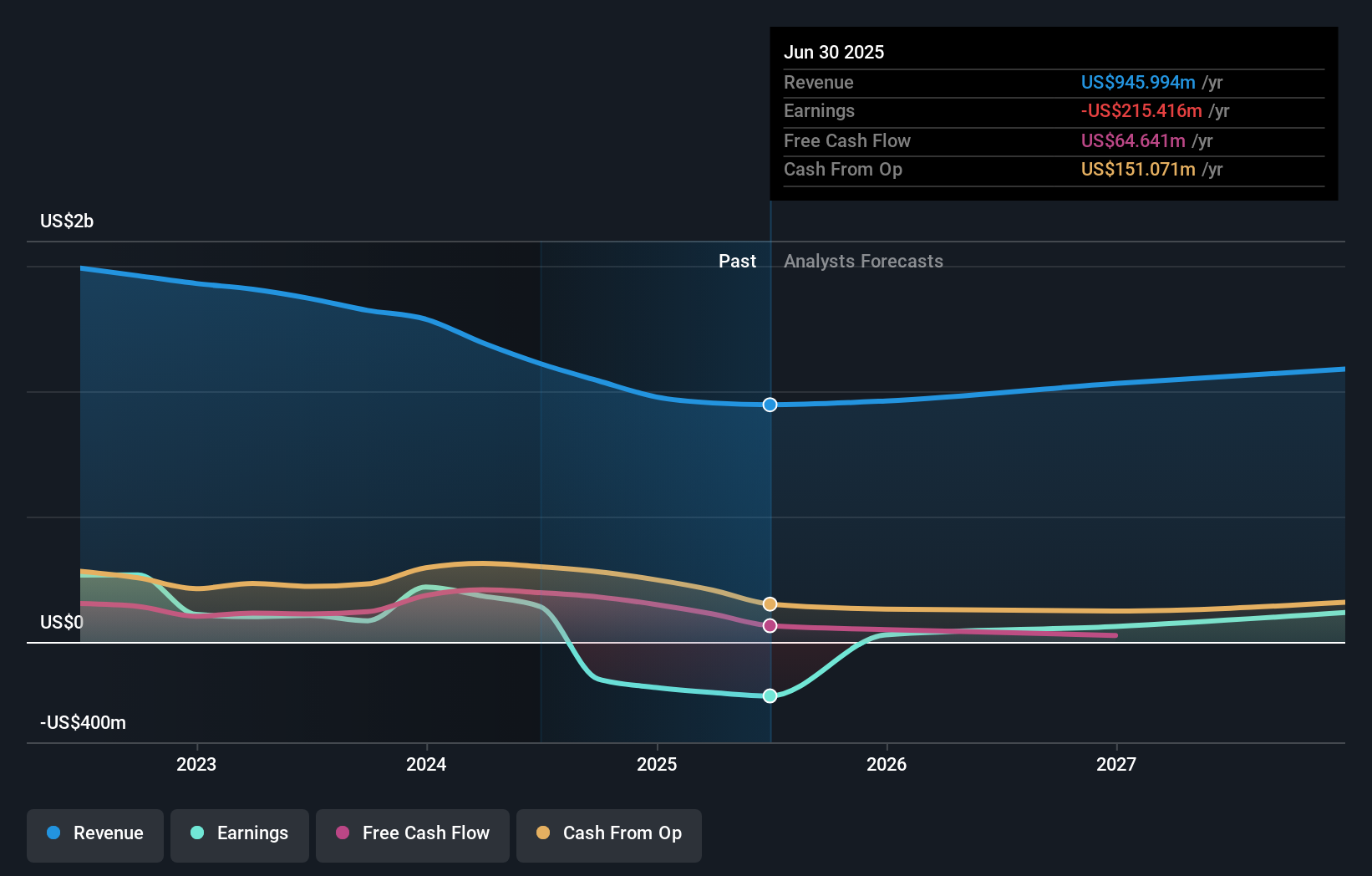

- This momentum comes as analysts highlight concerns about IPG Photonics' valuation relative to its industry peers, particularly given recent revenue declines and more modest growth forecasts compared to the broader sector.

- We'll look at how heightened optimism for AI-driven chip demand could influence IPG Photonics’ future growth outlook and investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

IPG Photonics Investment Narrative Recap

To be a shareholder in IPG Photonics, you need confidence that industrial automation, advanced manufacturing, and the accelerating adoption of AI will drive long-term demand for high-performance laser technology. While renewed market enthusiasm for AI, sparked by bullish comments from Nvidia and major chip partnerships, lifted sentiment for semiconductor and equipment stocks, the biggest near-term catalyst for IPG remains a sustained recovery in its core materials processing segment, while the steepest risk continues to be weak revenue trends and valuation concerns. This recent AI momentum does not fundamentally alter these key factors for IPG in the short term.

Among IPG's recent announcements, the launch of the CROSSBOW MINI 3 kW HEL System for defense applications stands out. Unveiled at the DSEI event in the UK, this product highlights the company’s ongoing push into non-industrial markets, but with core industrial applications still under pressure, innovation in these advanced segments serves more as a long-term diversification play than an immediate growth driver.

However, against renewed optimism, it’s important for investors to recognize that revenue in IPG’s materials processing business remains under pressure and...

Read the full narrative on IPG Photonics (it's free!)

IPG Photonics' narrative projects $1.2 billion in revenue and $133.9 million in earnings by 2028. This requires 8.1% yearly revenue growth and an earnings increase of $349.3 million from -$215.4 million today.

Uncover how IPG Photonics' forecasts yield a $82.83 fair value, a 3% upside to its current price.

Exploring Other Perspectives

You will find fair value estimates for IPG Photonics from the Simply Wall St Community ranging from as low as US$3.83 to as high as US$82.83, based on three unique perspectives. With sluggish core revenue and valuation anxiety among analysts, make sure to consider how your own growth and risk outlook stacks up against these varied views.

Explore 3 other fair value estimates on IPG Photonics - why the stock might be worth less than half the current price!

Build Your Own IPG Photonics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IPG Photonics research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free IPG Photonics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IPG Photonics' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IPGP

IPG Photonics

Develops, manufactures, and sells various high-performance fiber lasers, fiber amplifiers, and diode lasers used in materials processing, medical, and advanced applications worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion