- United States

- /

- Communications

- /

- NasdaqGS:HLIT

The Bull Case For Harmonic (HLIT) Could Change Following AI-Powered Streaming Tech Launch at IBC2025 - Learn Why

Reviewed by Simply Wall St

- Harmonic recently announced at IBC2025 that it will showcase a suite of innovations in video streaming and broadcast delivery, including hybrid cloud solutions, AI-driven workflows, advanced ad insertion, and new features for live sports streaming.

- An interesting insight is that Harmonic’s new product integrations and industry collaborations aim to automate ad monetization and enhance fan engagement, reinforcing its reputation as a leader in next-generation video solutions.

- We’ll explore how Harmonic’s focus on AI-powered ad monetization and hybrid streaming could impact its investment narrative and future growth.

Harmonic Investment Narrative Recap

To be a shareholder in Harmonic, you need to believe the company can capitalize on the digital transformation of broadcast and streaming, with ongoing innovation in AI-powered ad technology and hybrid cloud solutions as sizable future growth drivers. The latest IBC2025 announcements spotlight fresh momentum in Harmonic’s streaming segment, but do not materially shift the short-term catalysts or the primary risk around customer deployment delays for Unified DOCSIS 4.0 in the Broadband segment.

Among the recent news, the debut of Harmonic’s Software Spectrum X media server, which doubles UHD channel density, stands out for its direct relevance to the expanding live streaming market. This breakthrough supports Harmonic’s push for higher operational efficiency and improved video quality, factors that align closely with current catalysts such as SaaS expansion and demand for new monetization tools.

However, it’s important to recognize that, despite product advances, investors should be aware of the risk around potential disruptions if deployment delays persist or macro volatility affects Broadband orders…

Read the full narrative on Harmonic (it's free!)

Harmonic's outlook projects $722.8 million in revenue and $100.5 million in earnings by 2028. This assumes 1.6% annual revenue growth and a $47.3 million earnings increase from the current $53.2 million.

Uncover how Harmonic's forecasts yield a $10.93 fair value, a 21% upside to its current price.

Exploring Other Perspectives

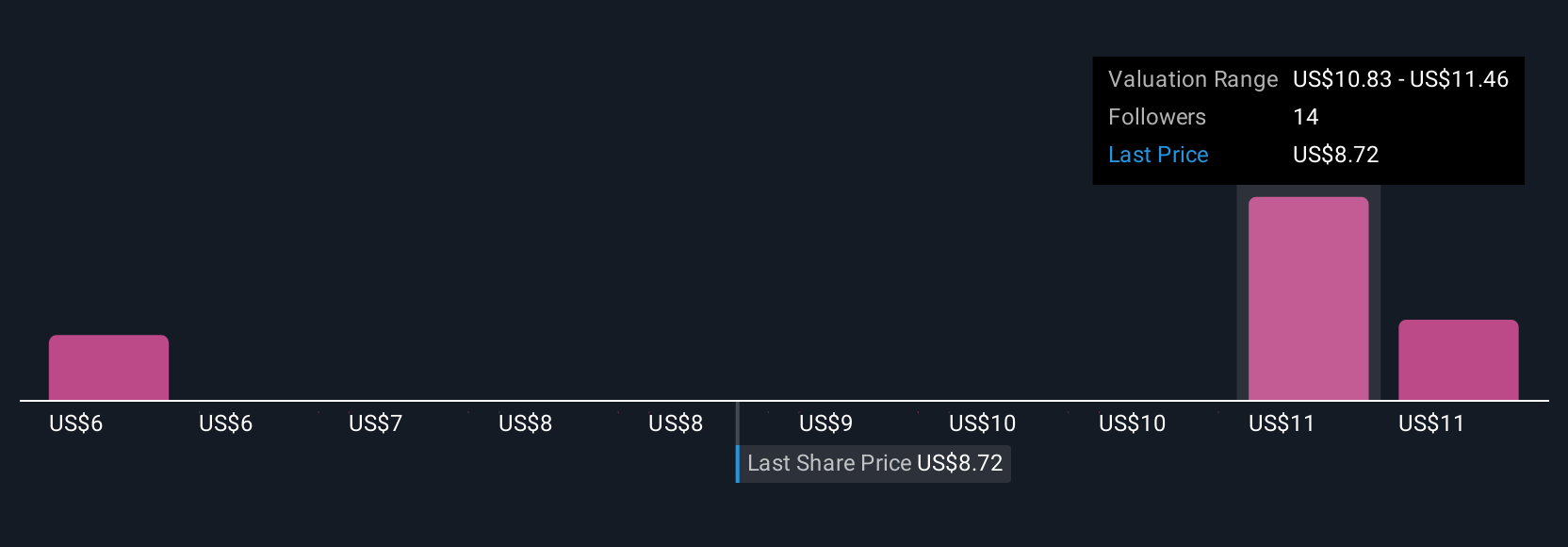

The Simply Wall St Community has provided three fair value estimates for Harmonic, ranging from US$10.93 to US$45.19. While opinions on valuation differ widely, ongoing delays in customer deployment of Unified DOCSIS 4.0 remain a key challenge to watch for overall business momentum.

Build Your Own Harmonic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmonic research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Harmonic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmonic's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmonic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLIT

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives